In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Washington Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

You can spend hours online attempting to locate the official document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are examined by experts.

You can effortlessly obtain or print the Washington Security Agreement with Farm Products as Collateral from the service.

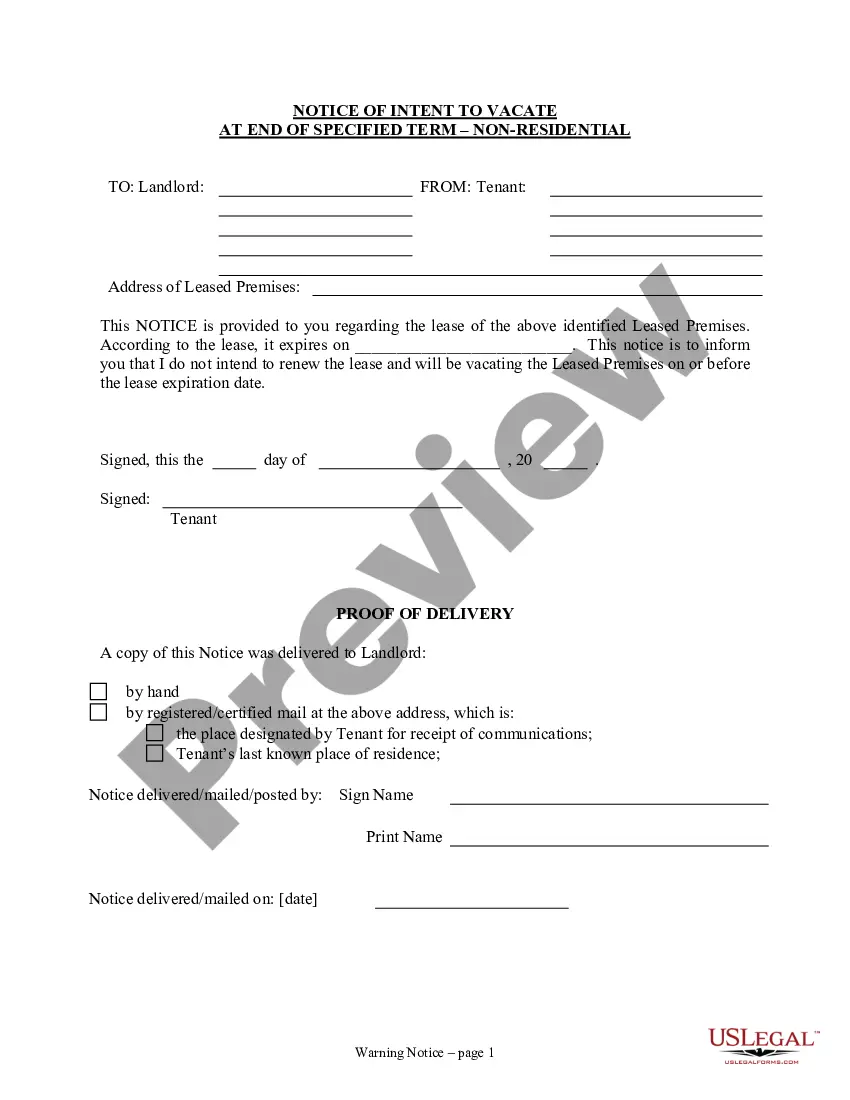

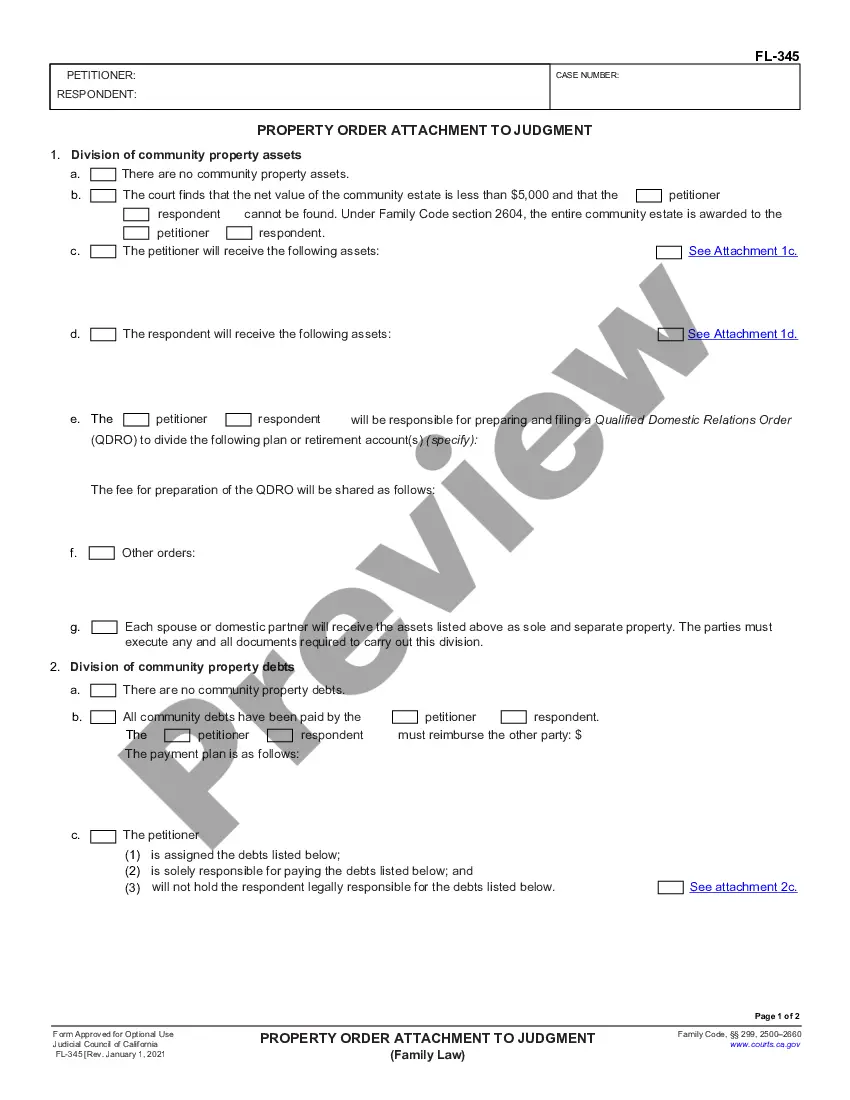

If available, use the Preview option to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can complete, alter, print, or sign the Washington Security Agreement with Farm Products as Collateral.

- Every legal document format you purchase is yours permanently.

- To get another copy of any purchased document, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the area/city of your choice.

- Review the document description to ensure you have chosen the right form.

Form popularity

FAQ

The financing statement of a security agreement serves as a public record that indicates the lender's interest in the collateral. In a Washington Security Agreement with Farm Products as Collateral, this document is essential for protecting the lender's rights against claims from other creditors. It is typically filed with a state agency to ensure that third parties are aware of the lender's claim.

The primary purpose of a security agreement is to protect the lender's interests by establishing their rights to specific collateral, including farm products. This legal framework provides clarity on the terms of repayment and what happens if the borrower defaults. Overall, it creates a mutual understanding between parties, promoting trust in the financial transaction.

A security agreement is a broader legal document that establishes a lender's rights over specified collateral, while a pledge agreement specifically relates to the transfer of possession of collateral to the lender. When a Washington Security Agreement with Farm Products as Collateral is involved, it may also include provisions that relate to a pledge, especially if possession is required for perfection.

A financing statement is a legal form that a lender files to publicly declare their security interest in a borrower's collateral. This document contains essential information identifying the parties involved, as well as details about the collateral, such as farm products in a Washington Security Agreement. It acts as a notice to others that the lender has a claim, protecting their interests.

Perfecting a pledge involves giving possession of the pledged property to the lender or a third party acting on their behalf. This action establishes the lender’s legal claim over the collateral, which could include farm products under a Washington Security Agreement. It is crucial to complete proper documentation and, if necessary, register it to avoid any future disputes over rights.

To perfect a security interest in a contract, you must follow the steps outlined in the Uniform Commercial Code (UCC). Typically, this involves creating a valid security agreement and registering a financing statement with the appropriate authority. This process is critical when you have a Washington Security Agreement with Farm Products as Collateral because perfection ensures that your interest is legally recognized against third parties.

A security agreement outlines the terms under which a borrower grants a lender a security interest in collateral, such as farm products. In contrast, a financing statement is a public document that notifies third parties of the lender's security interest. When dealing with a Washington Security Agreement with Farm Products as Collateral, it is essential to understand that the security agreement provides the details, while the financing statement serves as notice.

A security agreement must include details such as the identities of the parties involved, a description of the collateral, and the terms of the agreement. In the scenario of a Washington Security Agreement with Farm Products as Collateral, it is crucial to precisely identify the farm products used as collateral. Including these components helps ensure that the agreement is enforceable and clear to all parties.

A pledge agreement involves the borrower giving possession of collateral to the lender until the debt is settled, while a security agreement allows the borrower to retain possession of the collateral. In the context of a Washington Security Agreement with Farm Products as Collateral, the farmer maintains control over their products but grants the lender a legal interest in them. Understanding this distinction helps farmers make informed decisions about securing financing.

The primary purpose of a security agreement is to define the rights and responsibilities of both the borrower and lender regarding collateral. By creating a Washington Security Agreement with Farm Products as Collateral, both parties gain clarity on how the collateral will be managed and what happens in case of default. This legal structure fosters trust and reduces risks for both farmers and financial institutions.