A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

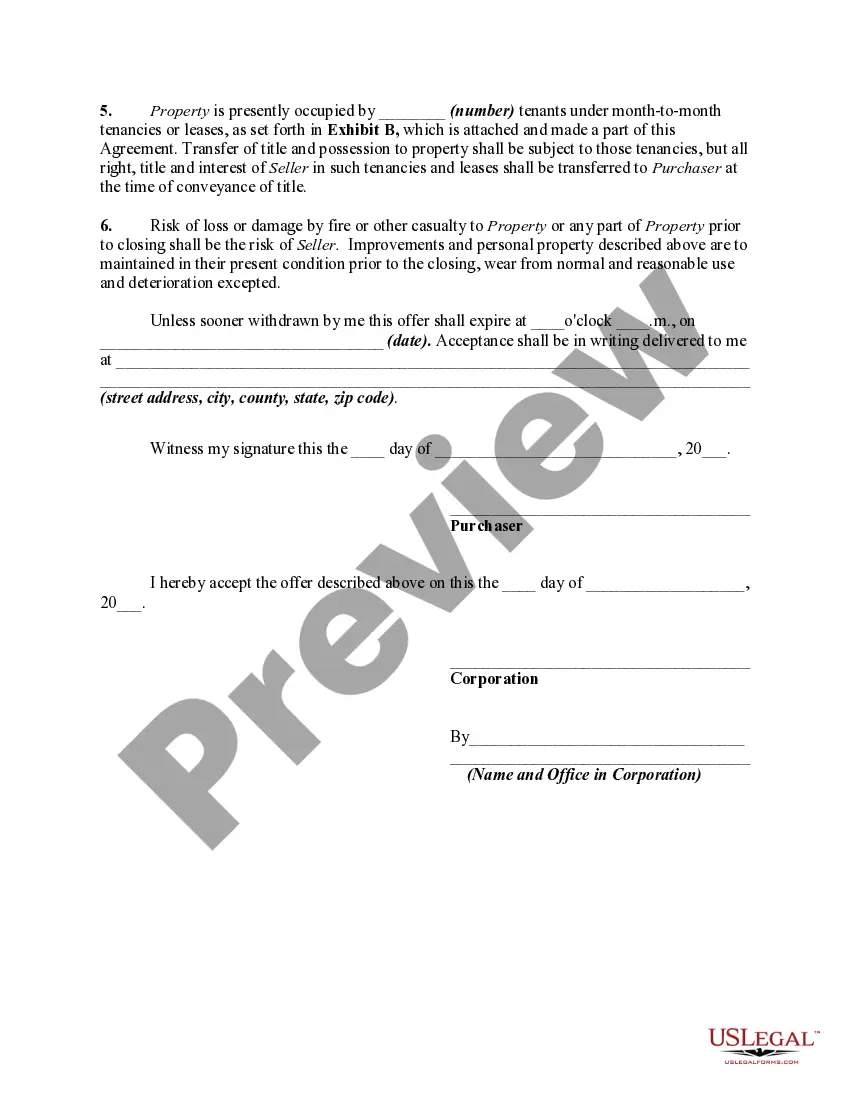

Washington Offer to Purchase Commercial Property is a legal document used in the state of Washington when an individual or entity wants to make an offer to purchase a commercial property. It outlines the terms and conditions under which the buyer is willing to acquire the property. This detailed description will cover the key aspects of a Washington Offer to Purchase Commercial Property and its various types. 1. Purpose and Parties Involved: A Washington Offer to Purchase Commercial Property serves as a formal proposal made by the buyer (also known as the offer or) to the property owner or seller (also known as the offeree). The purpose is to express the buyer's intent to purchase a specific commercial property and initiate the negotiation process. 2. Property Description and Terms: The offer should include a comprehensive description of the commercial property, including its address, legal description, and any additional details that help identify the property. Additionally, it is essential to outline the proposed purchase price, the desired payment terms (such as cash, financing, or combination), and the buyer's preferred timeline for closing the deal. 3. Contingencies and Due Diligence: Washington Offers to Purchase Commercial Property often include contingency clauses that protect the buyer's interests during the transaction. Common contingencies may involve securing financing, conducting property inspections, environmental assessments, reviewing necessary permits, or obtaining specific zoning approvals. These clauses allow the buyer to withdraw from the offer without penalties if any contingency is not met satisfactorily. 4. Earnest Money Deposit: To demonstrate the buyer's seriousness and commitment to proceeding with the purchase, a Washington Offer to Purchase Commercial Property typically includes an earnest money provision. This provision requires the buyer to deposit a specific amount of money into an escrow account within a specified timeframe. The funds, held in escrow, act as security and can be applied towards the purchase price upon closing. 5. Disclosure Requirements: Washington state has various disclosure requirements when it comes to commercial property transactions. Buyers are entitled to receive specific disclosures, such as the condition of the property, any known defects or hazards, environmental information, and other relevant disclosures that affect the commercial property. Types of Washington Offer to Purchase Commercial Property: 1. Standard Offer to Purchase: This is the most common type of offer used in commercial real estate transactions. It covers the general terms and conditions for purchasing a commercial property. 2. Conditional Offer to Purchase: This type of offer is used when the buyer wants to make the offer contingent upon specific conditions being met, such as receiving a loan approval or completing a satisfactory due diligence period. 3. All-Cash Offer: An all-cash offer means that the buyer intends to purchase the property without any financing requirements. The buyer must provide proof of sufficient funds to complete the transaction. In conclusion, a Washington Offer to Purchase Commercial Property is a legally binding document used for initiating the purchase process. It includes property details, purchase terms, contingencies, and disclosure requirements. Understanding the different types allows potential buyers to tailor their offers to their specific needs and circumstances.Washington Offer to Purchase Commercial Property is a legal document used in the state of Washington when an individual or entity wants to make an offer to purchase a commercial property. It outlines the terms and conditions under which the buyer is willing to acquire the property. This detailed description will cover the key aspects of a Washington Offer to Purchase Commercial Property and its various types. 1. Purpose and Parties Involved: A Washington Offer to Purchase Commercial Property serves as a formal proposal made by the buyer (also known as the offer or) to the property owner or seller (also known as the offeree). The purpose is to express the buyer's intent to purchase a specific commercial property and initiate the negotiation process. 2. Property Description and Terms: The offer should include a comprehensive description of the commercial property, including its address, legal description, and any additional details that help identify the property. Additionally, it is essential to outline the proposed purchase price, the desired payment terms (such as cash, financing, or combination), and the buyer's preferred timeline for closing the deal. 3. Contingencies and Due Diligence: Washington Offers to Purchase Commercial Property often include contingency clauses that protect the buyer's interests during the transaction. Common contingencies may involve securing financing, conducting property inspections, environmental assessments, reviewing necessary permits, or obtaining specific zoning approvals. These clauses allow the buyer to withdraw from the offer without penalties if any contingency is not met satisfactorily. 4. Earnest Money Deposit: To demonstrate the buyer's seriousness and commitment to proceeding with the purchase, a Washington Offer to Purchase Commercial Property typically includes an earnest money provision. This provision requires the buyer to deposit a specific amount of money into an escrow account within a specified timeframe. The funds, held in escrow, act as security and can be applied towards the purchase price upon closing. 5. Disclosure Requirements: Washington state has various disclosure requirements when it comes to commercial property transactions. Buyers are entitled to receive specific disclosures, such as the condition of the property, any known defects or hazards, environmental information, and other relevant disclosures that affect the commercial property. Types of Washington Offer to Purchase Commercial Property: 1. Standard Offer to Purchase: This is the most common type of offer used in commercial real estate transactions. It covers the general terms and conditions for purchasing a commercial property. 2. Conditional Offer to Purchase: This type of offer is used when the buyer wants to make the offer contingent upon specific conditions being met, such as receiving a loan approval or completing a satisfactory due diligence period. 3. All-Cash Offer: An all-cash offer means that the buyer intends to purchase the property without any financing requirements. The buyer must provide proof of sufficient funds to complete the transaction. In conclusion, a Washington Offer to Purchase Commercial Property is a legally binding document used for initiating the purchase process. It includes property details, purchase terms, contingencies, and disclosure requirements. Understanding the different types allows potential buyers to tailor their offers to their specific needs and circumstances.