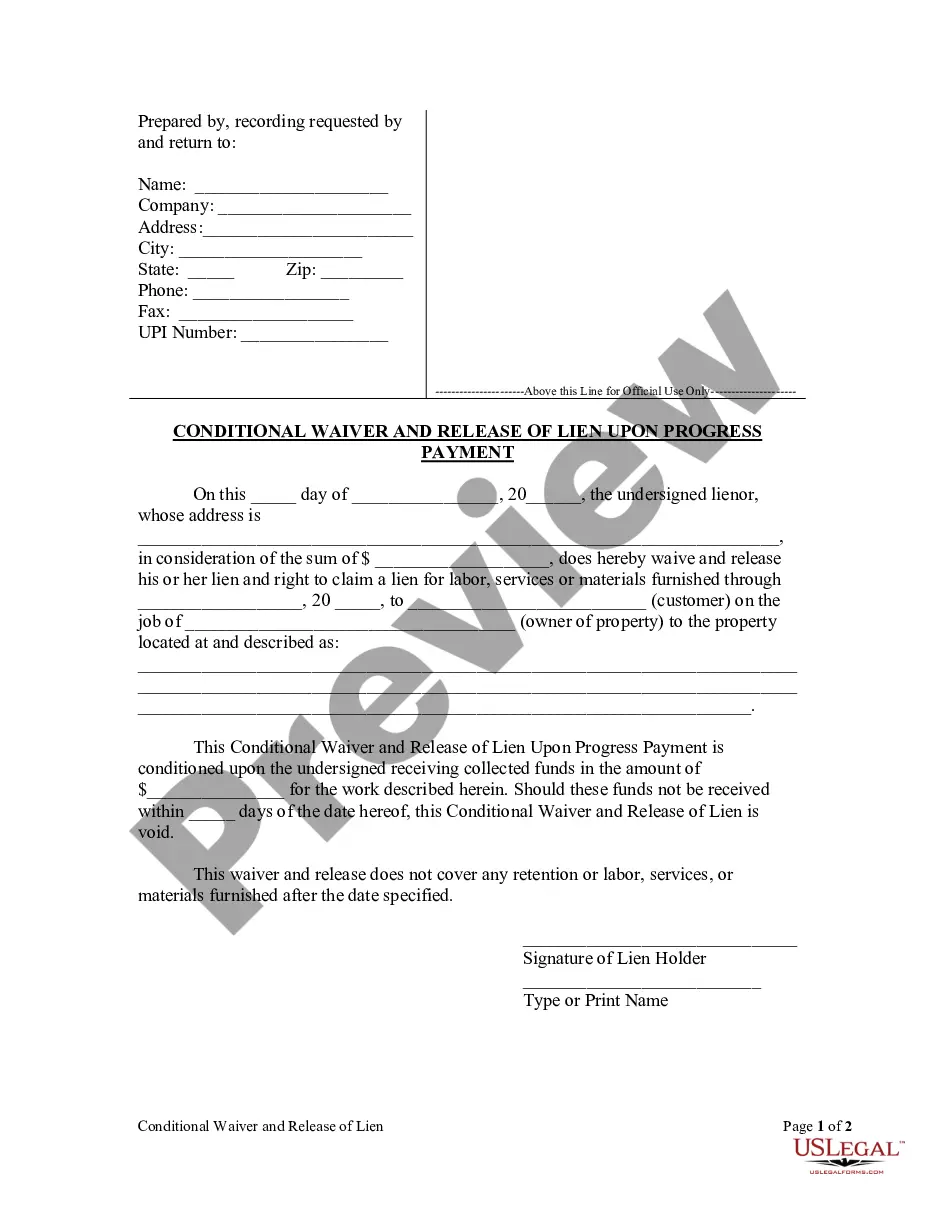

In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

Selecting the appropriate official documents template can be challenging.

Naturally, there are numerous templates accessible online, but how can you acquire the official document you require.

Visit the US Legal Forms website.

First, ensure that you have selected the correct template for your city/state. You can preview the template using the Review button and read the summary to confirm it is suitable for you.

- The service provides thousands of templates, such as the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease, which can be utilized for business and personal purposes.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to download the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Owed to Lessor from Lessee under Lease.

- Use your account to search for the official documents you have previously ordered.

- Visit the My documents section of your account to download an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Notary laws in Washington State stipulate that notaries public serve as impartial witnesses to the signing of documents. Notaries are responsible for verifying the identity of the signers and ensuring documents are signed voluntarily. While these laws may not apply directly to the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, understanding them can enhance the validity of important documents.

When a lease expires in Washington State, the tenant must vacate the property unless they have arranged a renewal with the landlord. If no renewal is made, the tenant is expected to leave by the designated move-out date. It’s crucial to understand how the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease affects tenancy during this transition.

In Washington State, leases do not automatically renew unless a specific clause in the lease states otherwise. Instead, tenants and landlords must discuss renewal terms prior to expiration. It is helpful to review the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease to understand any implications regarding lease renewal.

Leases in Washington State generally do not need to be notarized to be enforceable. However, some landlords may prefer notarization for added protection and clarity. The Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease can provide a sense of security regarding lease obligations without requiring notarization.

In Washington State, a will does not need to be notarized to be valid, but doing so can provide extra security. A notary can help prevent future disputes regarding the will's authenticity. While this topic may not directly relate to the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, it's important to understand all legal documentation.

In Washington State, landlords must provide at least 20 days' notice before the end of the lease if they do not intend to renew it. This requirement ensures that tenants have sufficient time to make alternate housing arrangements. Understanding this provision is essential, especially concerning the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

The new renters law in Washington State includes several significant changes aimed at protecting tenant rights. Among these changes, it restricts landlords from imposing certain fees and caps rent increases. This law reinforces the Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, helping both parties understand their financial commitments.

A standard residential lease agreement in Washington State outlines the terms and conditions for renting a property. It includes details such as the duration of the lease, the rent amount, payment dates, and responsibilities of both the landlord and the tenant. The Washington Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease often serves as a safeguard for landlords, ensuring that tenants fulfill their obligations.