A guaranty is an undertaking on the part of one person (the guarantor) which binds the guarantor to performing the obligation of the debtor or obligor in the event of default by the debtor or obligor. The contract of guaranty may be absolute or it may be conditional. An absolute or unconditional guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A guaranty may be either continuing or restricted. The contract is restricted if it is limited to the guaranty of a single transaction or to a limited number of specific transactions and is not effective as to transactions other than those guaranteed. The contract is continuing if it contemplates a future course of dealing during an indefinite period, or if it is intended to cover a series of transactions or a succession of credits, or if its purpose is to give to the principal debtor a standing credit to be used by him or her from time to time.

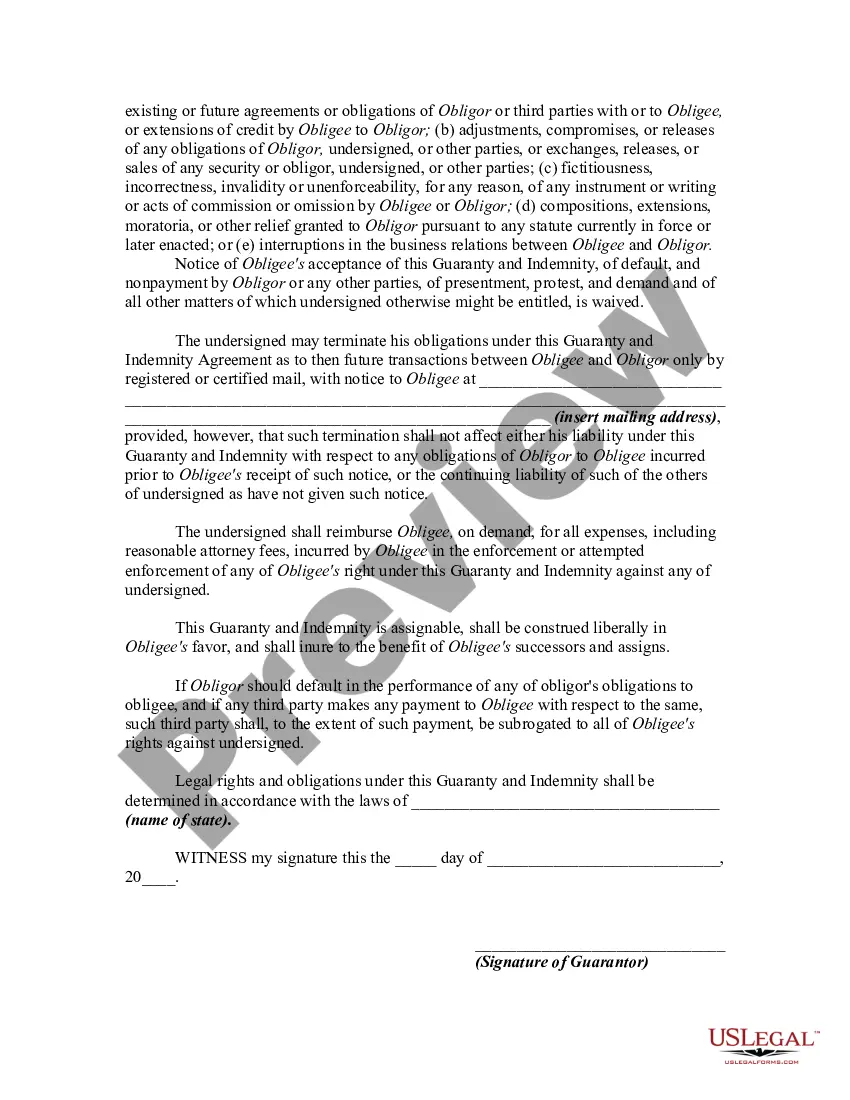

A Washington Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract that outlines the obligations of a guarantor to ensure repayment of a business's debts. This agreement is commonly used when a lender requires additional security for a loan or credit facility. In Washington state, there are several types of Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement that may be categorized based on their specific terms and conditions. Some common variations include: 1. General Guaranty: This is a broad form of guaranty where the guarantor agrees to guarantee all existing and future debts of the business, regardless of the specific type or amount. It provides the lender with maximum protection and holds the guarantor liable for any defaults. 2. Specific Guaranty: Unlike the general guaranty, this type limits the guarantor's liability to a particular debt or a defined set of debts of the business. It allows the guarantor to limit their exposure by specifying the extent of their responsibility. 3. Limited Guaranty: With a limited guaranty, the guarantor's liability is capped at a specific amount or limited to certain circumstances. This can be advantageous for the guarantor as it restricts their potential financial risk. 4. Continuing Guaranty: This type of guaranty remains in effect until it is terminated or revoked by the guarantor or the lender. It covers both existing and future obligations of the business, providing ongoing security to the lender. 5. Unconditional Guaranty: An unconditional guaranty implies that the guarantor accepts full responsibility for the business's debts without any conditions or exceptions. This type of agreement eliminates any uncertainties regarding the guarantor's obligation to repay the debts. 6. Indemnity Agreement: Alongside the guaranty, an indemnity agreement may be included to protect the guarantor from any losses, damages, or expenses incurred as a result of the guaranty obligation. It serves as an additional layer of security for the guarantor. In summary, a Washington Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding agreement that outlines the obligations of a guarantor to ensure repayment of a business's debts. This agreement can take various forms, such as general, specific, limited, continuing, or unconditional, depending on the specific terms and conditions agreed upon. Additionally, an indemnity agreement may be included to provide further protection to the guarantor.A Washington Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legal contract that outlines the obligations of a guarantor to ensure repayment of a business's debts. This agreement is commonly used when a lender requires additional security for a loan or credit facility. In Washington state, there are several types of Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement that may be categorized based on their specific terms and conditions. Some common variations include: 1. General Guaranty: This is a broad form of guaranty where the guarantor agrees to guarantee all existing and future debts of the business, regardless of the specific type or amount. It provides the lender with maximum protection and holds the guarantor liable for any defaults. 2. Specific Guaranty: Unlike the general guaranty, this type limits the guarantor's liability to a particular debt or a defined set of debts of the business. It allows the guarantor to limit their exposure by specifying the extent of their responsibility. 3. Limited Guaranty: With a limited guaranty, the guarantor's liability is capped at a specific amount or limited to certain circumstances. This can be advantageous for the guarantor as it restricts their potential financial risk. 4. Continuing Guaranty: This type of guaranty remains in effect until it is terminated or revoked by the guarantor or the lender. It covers both existing and future obligations of the business, providing ongoing security to the lender. 5. Unconditional Guaranty: An unconditional guaranty implies that the guarantor accepts full responsibility for the business's debts without any conditions or exceptions. This type of agreement eliminates any uncertainties regarding the guarantor's obligation to repay the debts. 6. Indemnity Agreement: Alongside the guaranty, an indemnity agreement may be included to protect the guarantor from any losses, damages, or expenses incurred as a result of the guaranty obligation. It serves as an additional layer of security for the guarantor. In summary, a Washington Continuing and Unconditional Guaranty of Business Indebtedness Including an Indemnity Agreement is a legally binding agreement that outlines the obligations of a guarantor to ensure repayment of a business's debts. This agreement can take various forms, such as general, specific, limited, continuing, or unconditional, depending on the specific terms and conditions agreed upon. Additionally, an indemnity agreement may be included to provide further protection to the guarantor.