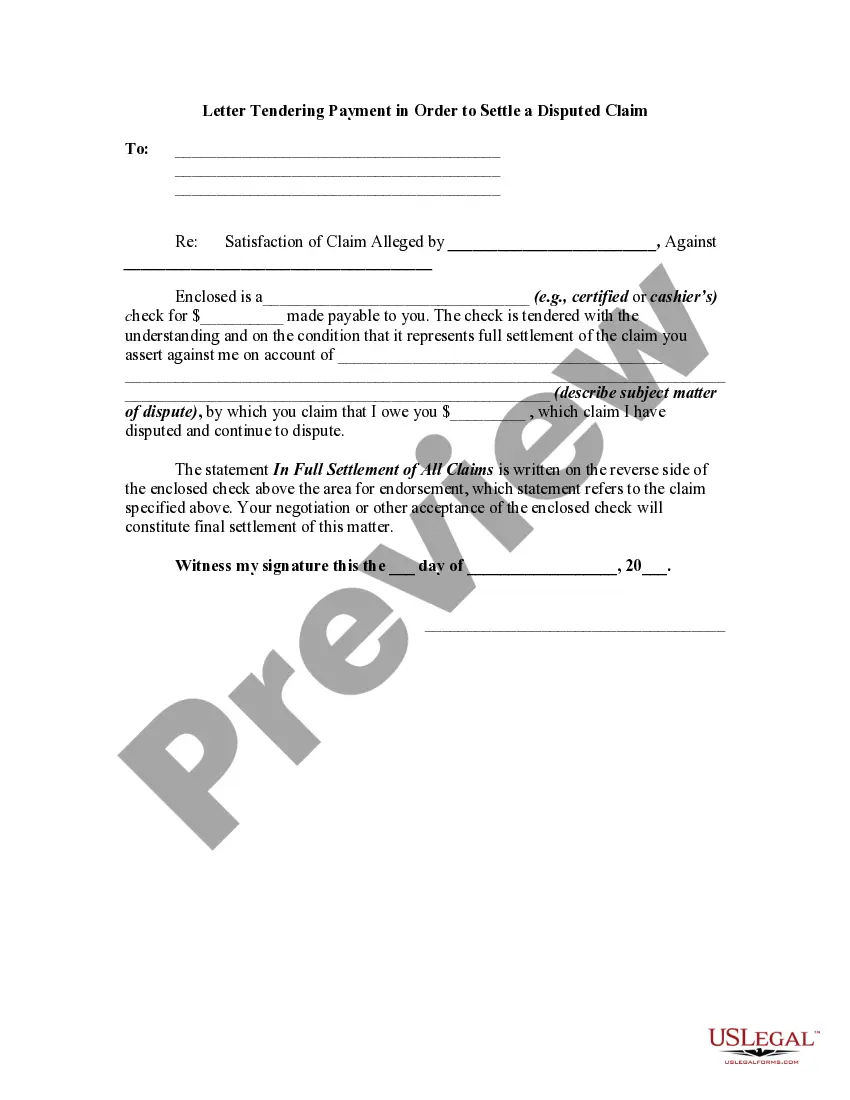

A contract is usually discharged by performance of the terms of the agreement. However, the parties may agree to a different performance. This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged. The following form is a sample of a letter accompanying a check tendered in settlement of a claim that is in dispute.

Washington Settlement Offer Letter from a Business Regarding a Disputed Account

Description

How to fill out Settlement Offer Letter From A Business Regarding A Disputed Account?

It is feasible to spend hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of valid forms that have been vetted by experts.

You can easily download or print the Washington Settlement Offer Letter from a Business Regarding a Disputed Account through our services.

To find another version of the form, use the Lookup field to locate the format that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Washington Settlement Offer Letter from a Business Regarding a Disputed Account.

- Every valid document template you purchase is yours for life.

- To obtain an additional copy of a purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document format for the county/city of your choice.

- Review the form description to confirm you have chosen the correct form.

- If available, use the Preview option to view the document template as well.

Form popularity

FAQ

A letter of demand can be very successful in resolving disputes, particularly when it concerns a Washington Settlement Offer Letter from a Business Regarding a Disputed Account. Its success often depends on how well it is written and the strength of the claims presented. A well-crafted demand letter that outlines your case and requests a specific settlement can motivate the business to negotiate, leading to a favorable outcome.

To file a complaint against a business in Washington state, you can start by submitting a formal complaint to the Washington Attorney General’s Office. Provide all pertinent details of the situation, including your Washington Settlement Offer Letter from a Business Regarding a Disputed Account. Make sure to keep copies of everything you send and follow up to ensure your complaint is being processed.

A strong demand letter is crucial to negotiating a satisfactory resolution to a Washington Settlement Offer Letter from a Business Regarding a Disputed Account. Be concise, yet detailed in your account of the situation, and specify what you want from the business. Use factual language and emphasize the consequences of inaction, as this can compel the recipient to take your request seriously.

When drafting a letter to request a settlement regarding a Washington Settlement Offer Letter from a Business Regarding a Disputed Account, start with your contact information and the business’s details. Clearly outline the reasons for your dispute and the settlement you propose. Include any supporting documents that validate your claims, as this can strengthen your request and prompt a positive response.

To write an effective demand letter related to a Washington Settlement Offer Letter from a Business Regarding a Disputed Account, begin with a clear statement of your request. Include the specific amount you seek, the circumstances of the dispute, and any relevant documentation. Ensure that you maintain a respectful tone, while being direct about your expectations. This approach helps in persuading the business to consider your position seriously.

In a demand letter, it is crucial to avoid threatening language or ultimatums, as these can escalate tensions. For a Washington Settlement Offer Letter from a Business Regarding a Disputed Account, focus on presenting your case factually and respectfully. By maintaining a professional tone, you increase the chances of reaching a settlement amicably.

An effective claim letter should be direct and organized. When composing a Washington Settlement Offer Letter from a Business Regarding a Disputed Account, identify the claim efficiently, include necessary documentation, and articulate your expectations clearly. This approach ensures that the recipient understands your position and the resolution you seek.

To write a claim settlement letter, start with a friendly greeting and state the purpose clearly. Use the Washington Settlement Offer Letter from a Business Regarding a Disputed Account format to outline the details, including the claim amount and reasons for the settlement. Make sure to request a timely response to facilitate the resolution process.

A good debt settlement letter should begin with your intention to settle the debt, followed by an explanation of your financial situation. In the case of a Washington Settlement Offer Letter from a Business Regarding a Disputed Account, ensure you propose a specific settlement amount that you can afford. Closing with a polite request for a response encourages communication.

To write a letter for a settlement amount, start by clearly stating the subject in the header. Use the Washington Settlement Offer Letter from a Business Regarding a Disputed Account as a reference, include your contact information, and define the settlement terms specifically. Clearly outline your reasons for the settlement offer, and express your willingness to negotiate further if necessary.