An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

It is easy to download or print the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust from the service.

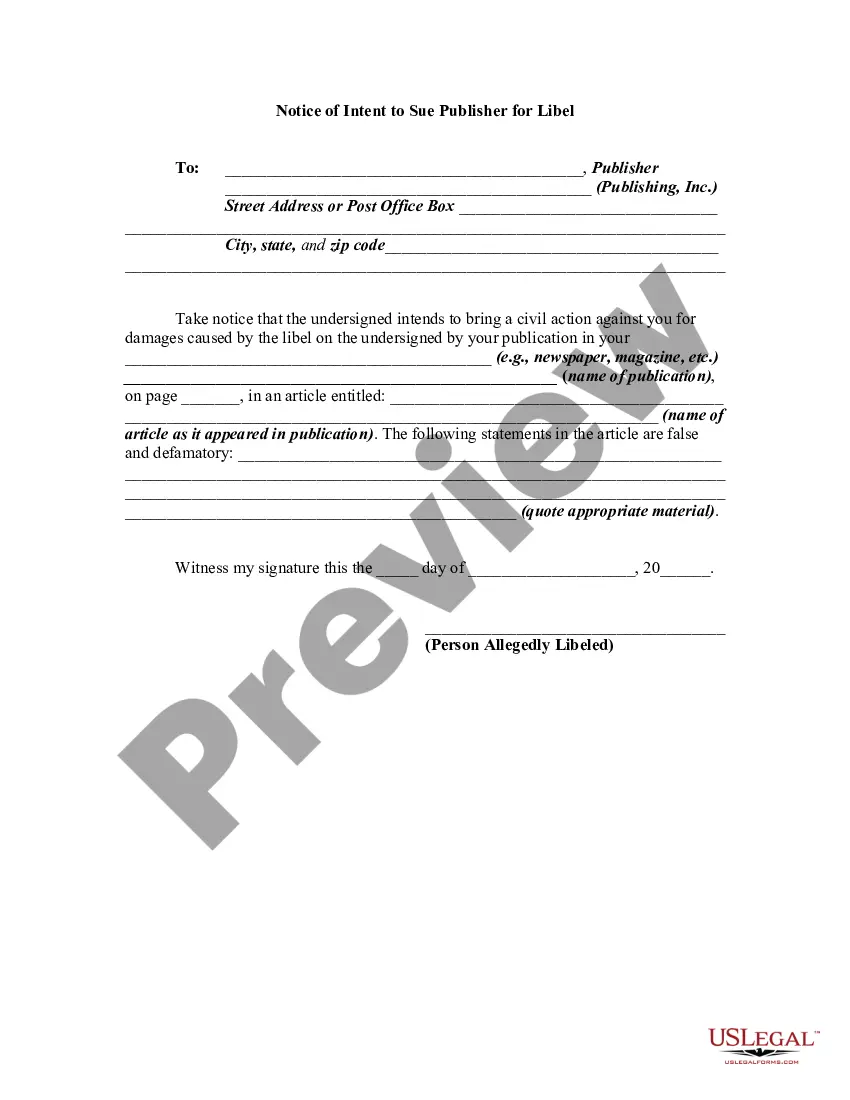

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust.

- Every legal document template you purchase is yours for an extended period.

- To get an additional copy of a purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your specific state/city.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Several states, including Washington, do not tax trust income, making them attractive options for trust establishment. This provides beneficiaries with more financial freedom and allows for strategic investments. Understanding the implications of a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust can help you maximize benefits. If you are considering state options for your trust, uslegalforms is a great resource to find the information you need.

Setting up a trust in Washington state provides several advantages, including asset protection and streamlined estate planning. A Washington Assignment by Beneficiary of a Percentage of the Income of a Trust can help beneficiaries access trust income efficiently. Furthermore, Washington's lack of estate tax creates an appealing environment for individuals looking to preserve their wealth for future generations. Utilizing services from uslegalforms can simplify the process and ensure compliance with state laws.

Washington state does not impose an income tax on individuals, which includes income generated from trusts. This means that if you engage in a Washington Assignment by Beneficiary of a Percentage of the Income of a Trust, you can potentially benefit from tax savings. The absence of state income tax allows for greater flexibility and planning in managing trust assets. It is advisable to consult a financial advisor to understand how this impacts your specific trust situation.

One common mistake parents make is failing to clearly define the terms of the trust, including the distribution of income to beneficiaries. When setting up a trust fund, parents should consider the implications of the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust to avoid misunderstandings. Clarity in the trust document can prevent disputes among heirs and ensure that the intended financial support reaches the right hands. Engaging services such as USLegalForms can provide guidance in creating a comprehensive and effective trust.

Allocating trust income involves distributing earnings generated by the trust according to the terms set by the trust creator. Typically, the trust document specifies how income should be divided among beneficiaries. It's crucial to understand the guidelines surrounding the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust to ensure compliance and fairness among all parties involved. Utilizing resources like USLegalForms can help streamline this process and clarify any legal requirements.

Beneficiary income of a trust refers to the earnings distributed to beneficiaries, which can be in the form of interest, dividends, or capital gains. This income depends on the terms set in the trust and can be affected by provisions like the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust. Understanding how this income is calculated and distributed is essential for both trustees and beneficiaries, and platforms like USLegalForms can assist with necessary documentation.

Yes, income received from a trust is generally taxable to the beneficiary. The taxation applies to distributions made from the trust, including amounts specified under the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust. It's vital to report this income on your tax return, as failing to do so can lead to penalties. Consulting with a tax professional can provide additional guidance.

A beneficiary is an individual or entity entitled to receive assets from a trust, while an income beneficiary specifically receives income generated from the trust's assets. Understanding these terms is crucial, especially when navigating the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust. Knowing your role can clarify your rights and expectations, leading to smoother transactions and distributions.

Distributing trust income to beneficiaries typically requires following the guidelines outlined in the trust document. You would determine how much income each beneficiary is entitled to receive, potentially utilizing the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust for clarity. Utilizing a structured approach helps to prevent disputes, and services like USLegalForms can provide valuable resources for effective distribution.

Allocating trust income to beneficiaries involves reviewing the trust document to understand specific terms regarding distributions. In general, income can be allocated according to the percentages specified within the trust, like the Washington Assignment by Beneficiary of a Percentage of the Income of a Trust. Consulting with a legal professional or using platforms like USLegalForms can simplify this process and ensure compliance with legal requirements.