No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Washington Rejection of Claim and Report of Experience with Debtor

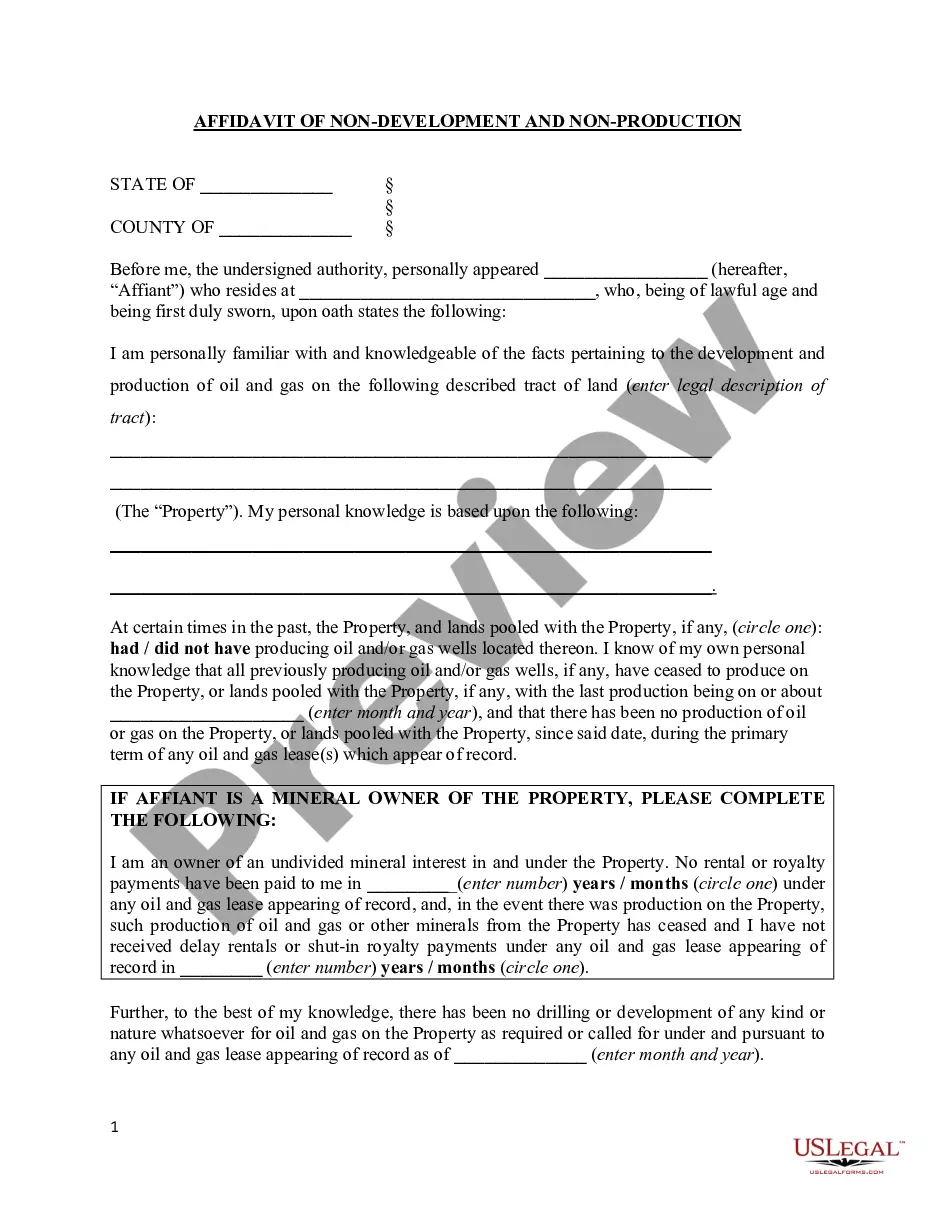

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

It is feasible to spend hours on the internet trying to locate the authentic document template that meets the state and federal requirements you will need.

US Legal Forms offers thousands of authentic templates that are reviewed by professionals.

You can effortlessly download or print the Washington Rejection of Claim and Report of Experience with Debtor from the platform.

First, ensure you have selected the correct document template for the area/city of your choice. Review the form description to verify you have selected the appropriate form. If available, utilize the Preview option to examine the document template as well. If you want to find another version of your template, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click on Buy now to proceed. Choose the payment plan you prefer, enter your details, and create your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the authentic form. Select the format of your document and download it to your device. Make changes to your document if necessary. You can fill out, edit, and sign and print the Washington Rejection of Claim and Report of Experience with Debtor. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest variety of authentic templates. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and select the Acquire option.

- Afterwards, you can fill out, modify, print, or sign the Washington Rejection of Claim and Report of Experience with Debtor.

- Every authentic document template you purchase belongs to you permanently.

- To obtain an additional copy of the purchased form, navigate to the My documents section and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

If a creditor fails to file a proof of claim, they may lose their right to participate in the bankruptcy proceedings. This can prevent them from recovering any debts owed to them, as they will not be recognized as a creditor in the Washington Rejection of Claim and Report of Experience with Debtor. It’s essential for creditors to understand the implications of missing this step. By utilizing Uslegalforms, creditors can ensure they meet all necessary requirements to protect their interests.

Typically, the creditor files the proof of claim in bankruptcy proceedings. This is essential for creditors to establish their rights to receive payment from the debtor's estate. In the Washington Rejection of Claim and Report of Experience with Debtor, accurate filing is essential to avoid complications later in the process. Resources from Uslegalforms can ensure that your proof of claim is filed correctly and on time.

Yes, a debtor can file a proof of claim under the Washington Rejection of Claim and Report of Experience with Debtor. This allows a debtor to assert that they have a specific claim against the bankruptcy estate. It's important for debtors to be aware of the deadlines and requirements associated with filing a proof of claim. Utilizing resources like Uslegalforms can simplify this process and help you navigate the complexities involved.

In the context of the Washington Rejection of Claim and Report of Experience with Debtor, any interested party can object to a proof of claim. This includes debtors, creditors, or trustees involved in the bankruptcy case. It's crucial for anyone wishing to object to follow the proper legal procedures to ensure their objection is heard. Understanding this process can greatly aid in making informed decisions regarding claims.

To put a claim against someone's estate, you should first ensure you have a valid basis for your claim, such as outstanding debts or contractual obligations. Afterward, prepare your claim in writing, directing it to the estate's personal representative or executor. For a smoother experience, visit the US Legal platform, where you can find helpful tools and resources related to the Washington Rejection of Claim and Report of Experience with Debtor.

Creditor claims against an estate in Washington state must typically be filed within four months from the date the personal representative mails notice of the probate proceedings. It’s essential to keep this timeframe in mind to ensure your claim is considered valid. Utilizing the US Legal platform can assist you in managing these deadlines and properly addressing any Washington Rejection of Claim and Report of Experience with Debtor.

An example of a claim against an estate might include an unpaid debt owed to a creditor, such as a medical bill or credit card debt. Claims can also arise from disputes over contract obligations or loans to the deceased. Understanding these examples is crucial for navigating the Washington Rejection of Claim and Report of Experience with Debtor, and using tools from US Legal can help in formalizing your claim.

To file a claim against an estate in Washington state, begin by gathering all necessary documentation to support your claim. Next, submit your written claim to the estate's personal representative within the designated time frame. In this process, the US Legal platform can assist you by providing resources and step-by-step guidance on how to effectively file your claim, particularly regarding the Washington Rejection of Claim and Report of Experience with Debtor.

Filing a claim against an estate in Washington state involves preparing a written claim and submitting it to the personal representative of the estate. It's important to include relevant details, such as the amount owed and the basis for the claim. You can also benefit from utilizing the US Legal platform to access templates that simplify the claim process, making it easier to navigate your rights regarding the Washington Rejection of Claim and Report of Experience with Debtor.