Washington Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Washington Nonresidential Simple Lease in mere seconds.

If you already have an account, Log In and download the Washington Nonresidential Simple Lease from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Complete, adjust, and print and sign the downloaded Washington Nonresidential Simple Lease.

Every template you added to your account has no expiration time and belongs to you permanently. Therefore, if you wish to download or print an additional copy, just navigate to the My documents section and click on the form you desire. Access the Washington Nonresidential Simple Lease with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to view the form's content. Check the description to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the page to locate the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Next, choose your preferred payment plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the payment.

- Select the format and download the form to your device.

Form popularity

FAQ

In Washington State, a lease does not have to be notarized to be legally binding. However, certain situations may benefit from notarization for additional protection. When using a Washington Nonresidential Simple Lease, consider consulting with legal advisors or using platforms like uslegalforms to find the right documents and ensure compliance with state laws.

Yes, you can add someone to your apartment, however, you must follow your lease's guidelines. Your Washington Nonresidential Simple Lease may require you to seek permission from your landlord before making any changes. Keeping open communication with your landlord is key to ensuring a smooth transition.

To add a resident to your lease, start by reviewing the terms of your Washington Nonresidential Simple Lease to understand the process. You will likely need to submit a request to your landlord and provide information about the new tenant. Always ensure that the lease agreement reflects these changes to keep everything official and avoid misunderstandings.

Yes, someone can live with you without being on the lease, but this situation can be risky. Landlords may have restrictions against unauthorized occupants as outlined in your Washington Nonresidential Simple Lease. It is advisable to inform your landlord about any additional occupants to avoid potential issues.

Yes, you can add someone to an existing lease, but it typically requires the landlord's approval. To successfully add a tenant, review your Washington Nonresidential Simple Lease terms and follow the proper procedures. It is essential to provide all necessary documentation to your landlord or property manager to facilitate the addition.

When completing a rental application without rental history, be honest and provide all relevant information about your current situation. You can emphasize your financial stability, employment history, and any references who can vouch for your reliability. Additionally, consider attaching a cover letter that explains your position and highlights your strengths as a prospective tenant. Utilizing a Washington Nonresidential Simple Lease can help streamline your leasing process and ease concerns for landlords.

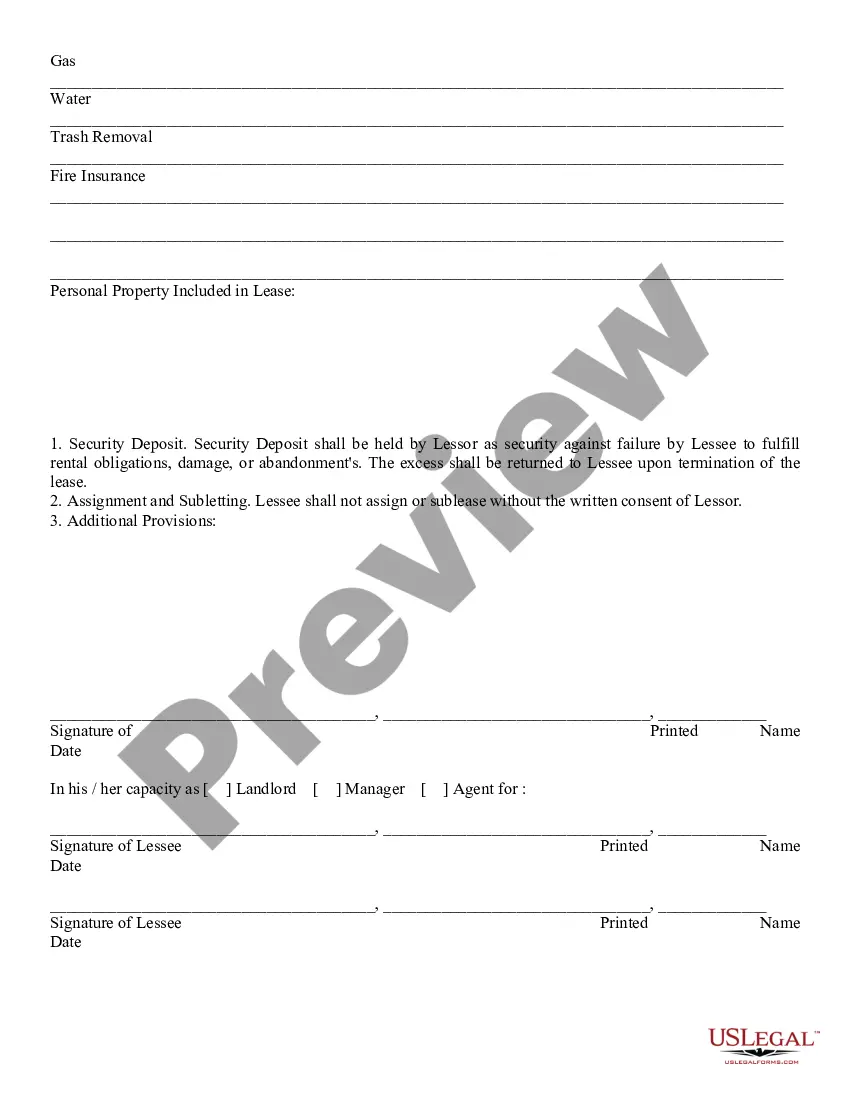

To fill out the residential lease inventory and condition form for a Washington Nonresidential Simple Lease, start by carefully reviewing the entire document. Next, examine the property and note any existing damages or issues in the designated sections. It's important to be thorough and accurate, as this form protects both you and the landlord. Finally, both parties should sign the form to confirm agreement on the property's condition.

A simple lease, like the Washington Nonresidential Simple Lease, is characterized by its straightforward structure and easy-to-understand terms. This type of lease typically covers the essentials, including rent, property use, and duration, making it accessible for both landlords and tenants. Its design prioritizes clarity, which is beneficial for anyone entering a lease agreement.

The lowest lease term often depends on the agreement between the landlord and tenant, but it can be as short as one month in some situations. In a Washington Nonresidential Simple Lease, short-term leases can provide flexibility, especially for businesses testing new locations. Always review your lease terms carefully to confirm the specified duration.

A nonresidential lease refers to an agreement where the tenant rents property for business or commercial purposes, rather than residential use. The Washington Nonresidential Simple Lease is one example that outlines straightforward terms between landlords and tenants. Such agreements focus on the operation of a business on the property, ensuring that both parties know their responsibilities.