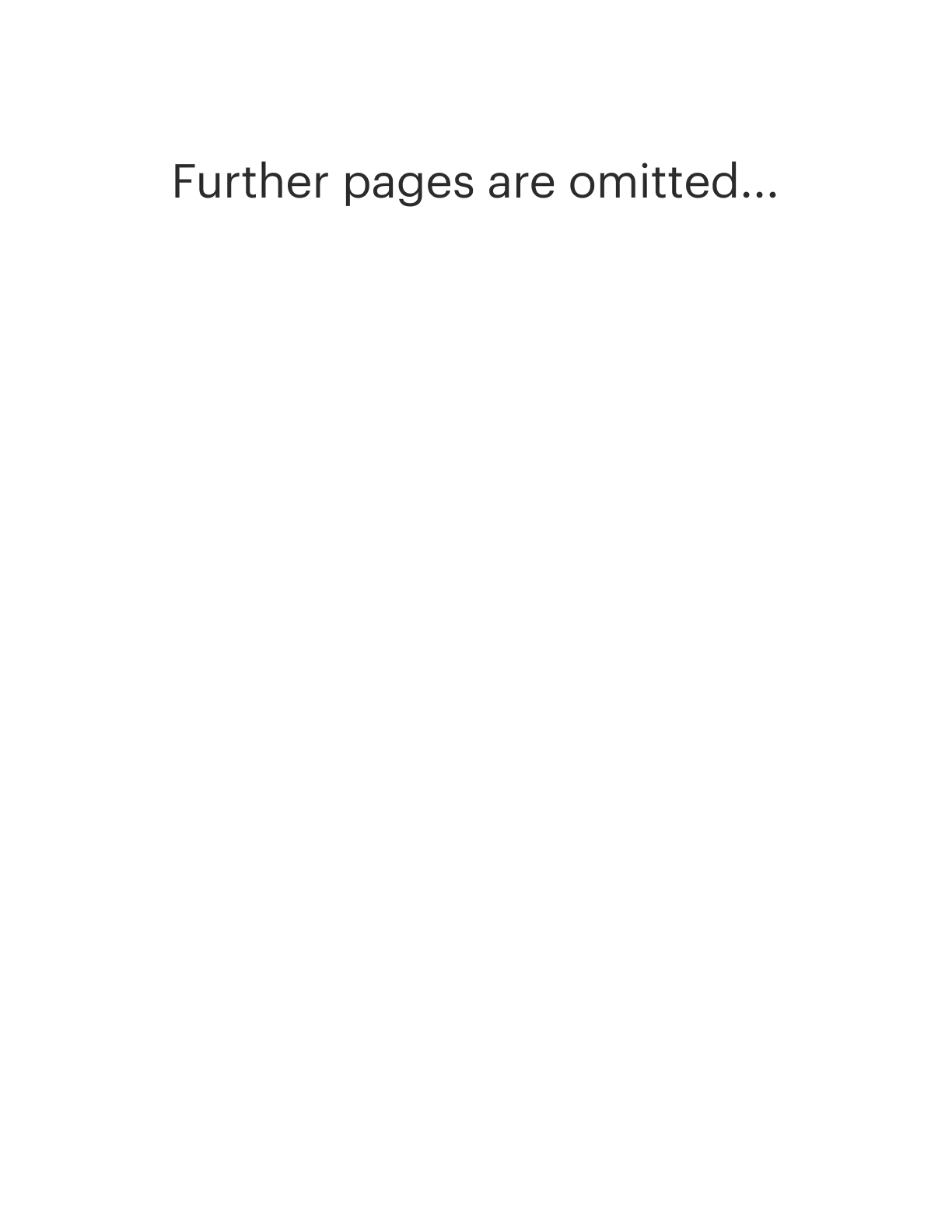

Washington Triple Net Lease for Commercial Real Estate

Description

How to fill out Triple Net Lease For Commercial Real Estate?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a vast array of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most current versions of forms such as the Washington Triple Net Lease for Commercial Real Estate within minutes.

If you already have an account, Log In and obtain the Washington Triple Net Lease for Commercial Real Estate from the US Legal Forms repository. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Washington Triple Net Lease for Commercial Real Estate.

Every template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Washington Triple Net Lease for Commercial Real Estate with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that address your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are simple steps to help you get started.

- Ensure that you have selected the correct form for your location/region. Click on the Preview button to review the form's details. Check the form description to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Purchase now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- Complete the payment. Use your Visa or Mastercard or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

A Washington Triple Net Lease for Commercial Real Estate typically includes obligations for property taxes, insurance, and maintenance expenses. The lease will also outline the base rent and any additional costs that the tenant assumes. Furthermore, terms relating to lease duration, renewal options, and property maintenance standards are often included. Having a well-defined lease ensures both parties are aligned in their responsibilities.

In Washington, commercial leases do not necessarily require notarization. However, having the lease notarized can provide additional legal protection, ensuring that both parties' signatures are verified. It's advisable to consult a legal professional when drafting or signing a Washington Triple Net Lease for Commercial Real Estate to ensure all local laws are followed.

Structuring a triple net lease requires clarity on obligations and costs. Designate the tenant as responsible for property taxes, insurance, and maintenance costs, while the landlord typically retains responsibility for structural repairs. Make sure to include terms related to rent adjustments and renewal options for the tenant. This clarity fosters a solid relationship between both parties.

To calculate a triple net lease in Washington, you need to factor in the base rent along with the tenant's share of property expenses. Start by estimating the total annual costs of taxes, insurance, and maintenance. Divide this sum by the total rentable square footage to obtain a per-square-foot figure. Finally, add this amount to the base rent for a comprehensive monthly payment.

To structure a Washington Triple Net Lease for Commercial Real Estate, begin by defining responsibilities between the landlord and tenant. The lease should clearly outline who pays for property taxes, insurance, and maintenance costs. Include terms for rent adjustments and any additional fees. By organizing these details upfront, you create a transparent agreement that benefits both parties.

Getting approved for a NNN lease, such as a Washington Triple Net Lease for Commercial Real Estate, involves showing strong financials and a stable business plan. Provide detailed documentation of your financial health to demonstrate your capacity to manage ongoing expenses associated with the lease. Utilizing resources like USLegalForms can also help simplify the documentation process and improve your chances of approval.

The downside of a Washington Triple Net Lease for Commercial Real Estate includes the increased financial responsibility on the tenant. Tenants must budget not only for rent, but also for variable expenses like property taxes and maintenance costs. It's essential to carefully evaluate these factors and consider potential fluctuations in expenses before committing.

Many commercial leases, especially in Washington, are structured as triple net leases. This arrangement shifts the responsibility for property expenses like taxes, maintenance, and insurance to the tenant. Understanding the implications of a triple net lease can help you make informed decisions when leasing commercial space.

To qualify for a Washington Triple Net Lease for Commercial Real Estate, you need to meet specific financial criteria and have a solid business plan. Landlords look for tenants who can reliably cover rent and property expenses such as taxes, insurance, and maintenance. Preparing a clear presentation of your business's financial outlook can significantly increase your chances.

Finding a Washington Triple Net Lease for Commercial Real Estate can be straightforward if you focus on the right strategies. Start by searching online listings, connecting with local real estate agents, or exploring commercial property databases. Engaging a knowledgeable real estate professional can help you uncover properties that meet your specific needs.