Washington Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

Are you presently in a situation where you require documents for either professional or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but locating reliable ones is challenging.

US Legal Forms provides thousands of form templates, including the Washington Revocable Trust for Minors, designed to comply with state and federal regulations.

Once you find the correct form, click on Buy now.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Washington Revocable Trust for Minors template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

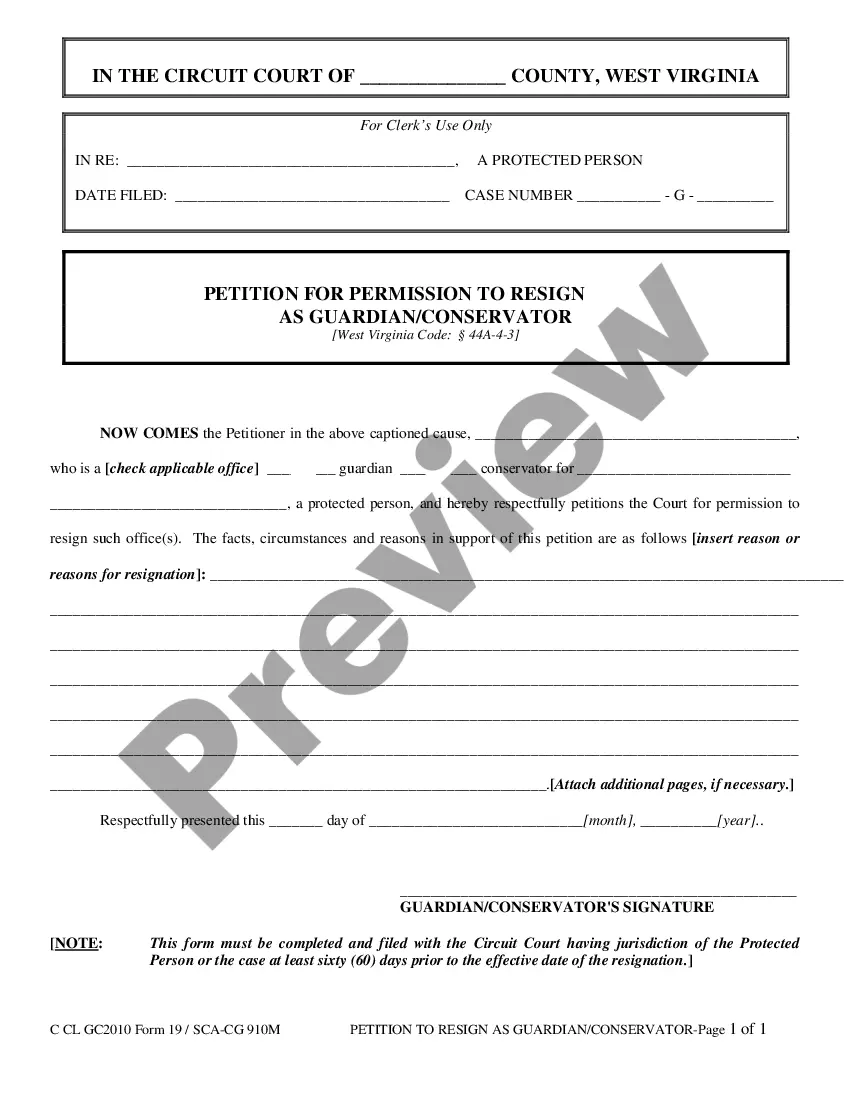

- Utilize the Preview option to review the document.

- Check the description to confirm that you have selected the appropriate form.

- If the form does not match your requirements, use the Search field to find the form that fits your needs.

Form popularity

FAQ

A simple trust is one that distributes all of its income to beneficiaries without accumulating it for future use. This type of trust can be beneficial in the context of a Washington Revocable Trust for Minors, where immediate access to funds is necessary for a minor's expenditures. Unlike complex trusts, simple trusts allow for straightforward management and tax reporting. Understanding these distinctions helps in making informed estate planning decisions.

A minor trust is a legal structure designed to hold and manage assets on behalf of a minor until they reach a certain age. This type of trust provides financial security and ease of management, ensuring funds are used for the minor's benefit. The Washington Revocable Trust for Minors allows for flexible management according to parents' wishes. Establishing such a trust guards against mismanagement as the child matures.

A child trust fund is an account designed to hold assets for a minor until they reach adulthood. This form of account can be part of a Washington Revocable Trust for Minors, ensuring the child's financial future is protected and accessible when needed. Parents can contribute funds, and the trust manages these assets responsibly. This creates a secure financial environment for your child's growth.

Setting up a Washington Revocable Trust for Minors involves several steps, starting with drafting a trust document that outlines your wishes. You will need to identify beneficiaries, choose a trustee, and specify how funds will be managed. Additionally, funding the trust with assets ensures it serves its purpose. Using platforms like USLegalForms can simplify this process and provide legal guidance.

A trust is a legal arrangement where one party holds property for the benefit of another. The Washington Revocable Trust for Minors allows parents to manage their child's assets until they reach maturity. This type of trust provides flexibility, as it can be altered or revoked by the grantor. Understanding categories of trusts helps you choose the right option for your family's needs.

One of the biggest mistakes parents make is failing to clearly define the terms of the trust in a Washington Revocable Trust for Minors. Without specific guidelines on distribution and management, a trust may not achieve its intended purpose. Parents should also consider updating the trust as circumstances change to ensure it continues to meet their child's needs.

The best age to set up a trust is as soon as you have assets to protect for your child, regardless of their current age. Establishing a Washington Revocable Trust for Minors can help secure your child's financial future early on. Additionally, this proactive approach allows you to dictate how those assets will be managed until your child reaches a responsible age.

In Washington state, a trust often provides more benefits than a will, especially when it comes to a Washington Revocable Trust for Minors. Unlike a will, a trust can help avoid the probate process, ensuring that assets are distributed quickly and privately. Additionally, a trust allows for ongoing management of assets, which can be particularly beneficial for minor children.

The Washington Revocable Trust for Minors is an excellent option for parents looking to secure their child's future. It allows for both asset protection and control over how and when funds are distributed. This type of trust can be customized to meet the family's specific needs, making it a practical choice for many families.

The best type of trust for a child is often a Washington Revocable Trust for Minors. This trust allows parents to remain flexible in their estate planning and make adjustments as needed. It also provides a structured way to manage the child's assets, ensuring they are used for the child's benefit until they are mature enough to handle finances independently.