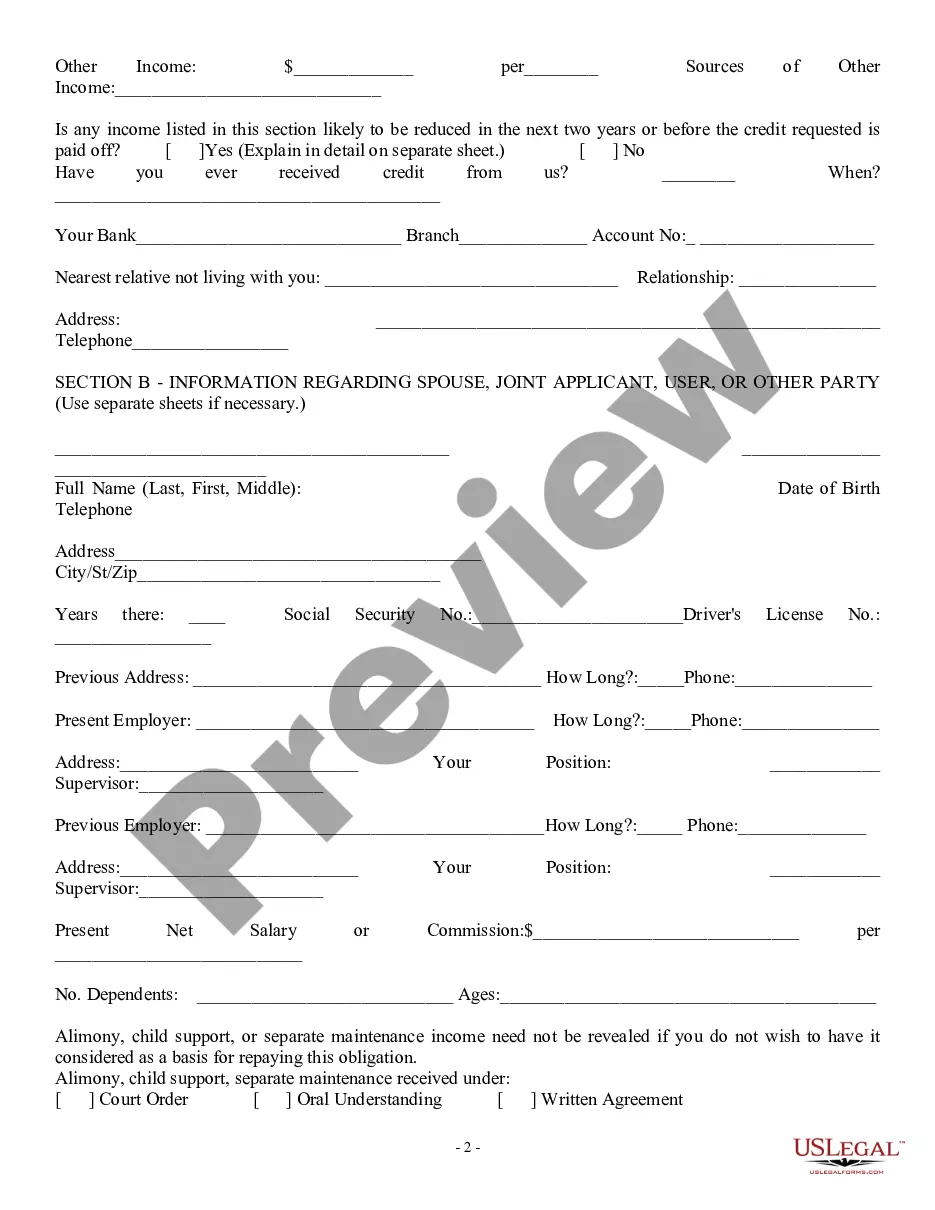

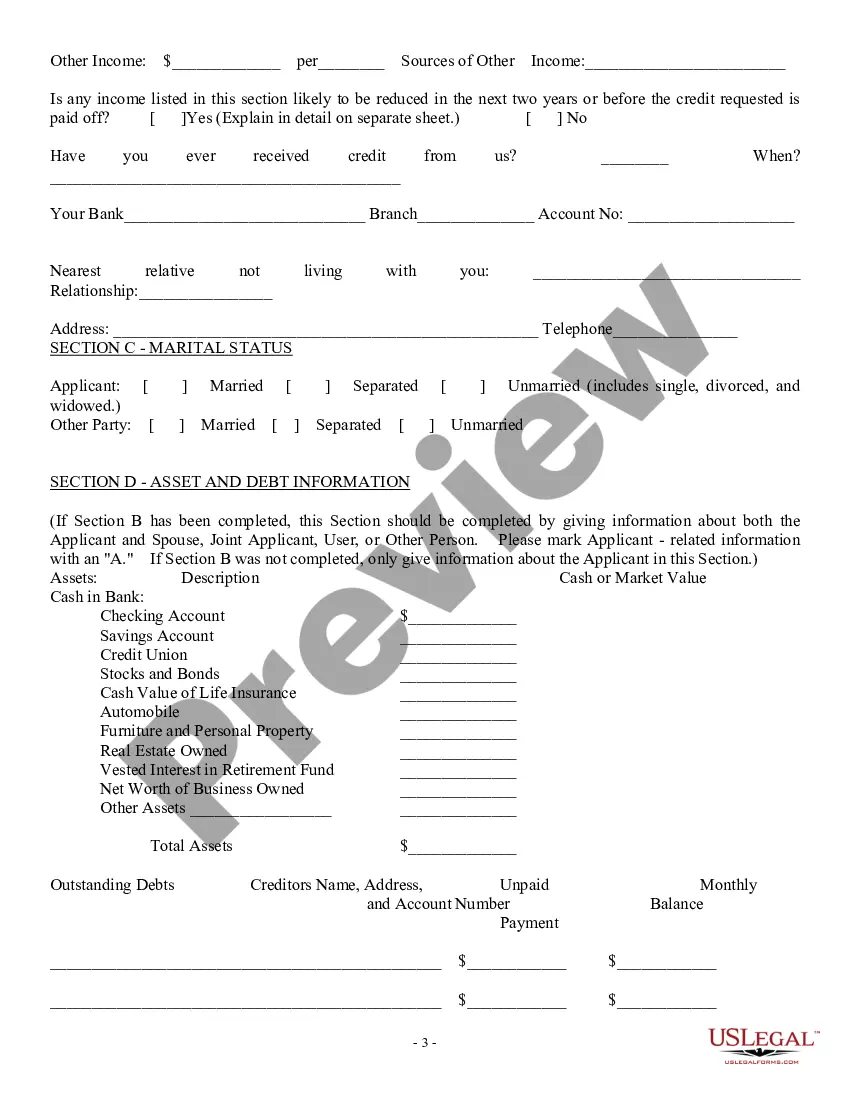

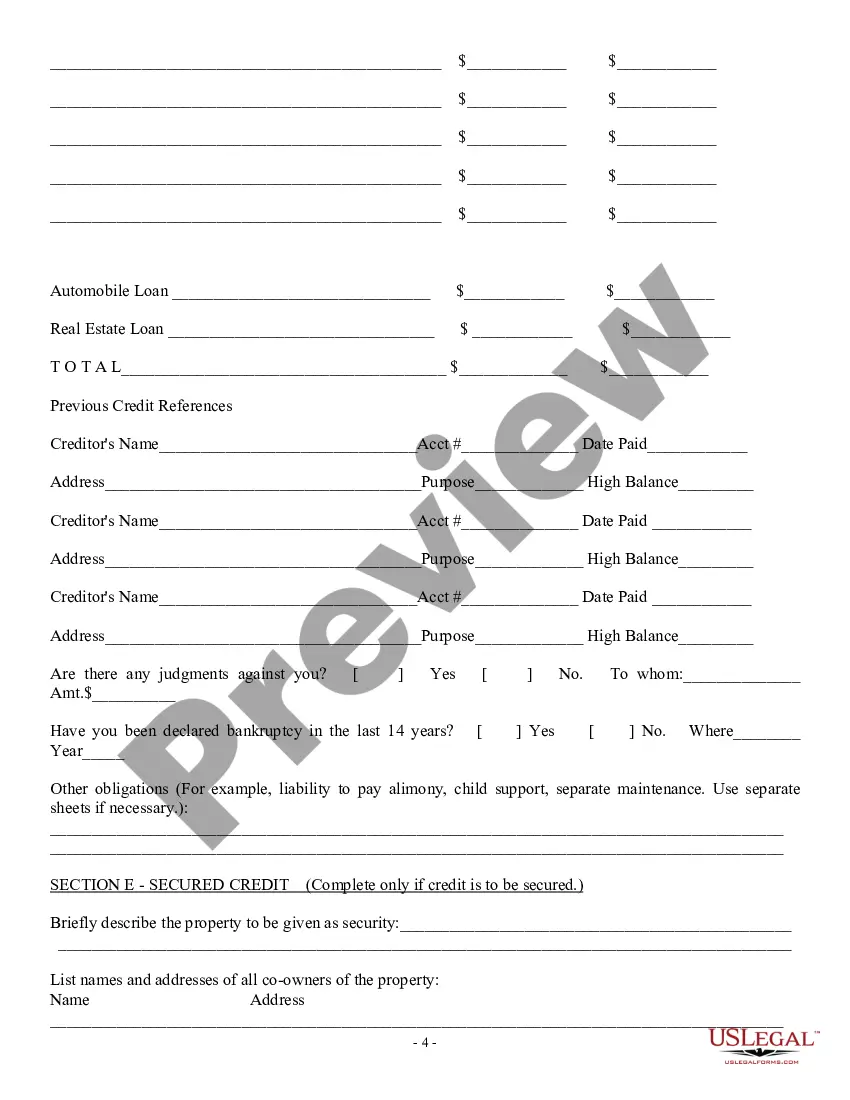

The Washington Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions governing a personal loan between a lender and a borrower in the state of Washington. This agreement is designed to protect the interests of both parties involved in the loan transaction. The Consumer Loan Application collects detailed information about the borrower, including their personal details, financial situation, employment history, and credit history. This information helps the lender assess the borrower's creditworthiness and determine whether they meet the eligibility criteria for the loan. The Personal Loan Agreement specifies the loan amount, interest rate, repayment terms, and any applicable fees or charges. It also provides a clear timeline for loan repayment, including the due dates for monthly installments or the full repayment of the loan. Additionally, the agreement may include provisions for late payment penalties, early repayment options, and the consequences of defaulting on the loan. Different types of Washington Consumer Loan Application — Personal Loan Agreements may exist based on factors such as the loan purpose or the financial institution offering the loan. Some common types include: 1. Secured Personal Loan Agreement: This type of agreement requires the borrower to provide collateral, such as a home or a car, which the lender can seize in the event of loan default. 2. Unsecured Personal Loan Agreement: Unlike secured loans, unsecured loans do not require collateral. Instead, lenders rely solely on the borrower's creditworthiness and ability to repay the loan. 3. Fixed-Rate Personal Loan Agreement: This agreement sets a fixed interest rate for the entire term of the loan. Borrowers are usually attracted to this type of loan because it provides certainty in budgeting their monthly payments. 4. Variable-Rate Personal Loan Agreement: In this type of agreement, the interest rate fluctuates based on market conditions. The monthly loan payments may change accordingly, making it important for the borrower to assess their ability to afford potential interest rate increases. 5. Debt Consolidation Personal Loan Agreement: This agreement is specifically tailored for borrowers who want to consolidate their existing debts into a single loan with more favorable terms, lower interest rates, and simplified repayment options. It is crucial for both lenders and borrowers to carefully review and understand the terms and conditions outlined in the Washington Consumer Loan Application — Personal Loan Agreement before signing it. Seeking legal advice or consulting a financial professional can be beneficial to ensure all legal obligations and rights are fully understood and protected.

Washington Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Washington Consumer Loan Application - Personal Loan Agreement?

If you wish to total, down load, or print out lawful papers web templates, use US Legal Forms, the biggest collection of lawful varieties, that can be found on the web. Utilize the site`s simple and easy convenient lookup to get the documents you will need. Numerous web templates for company and person uses are sorted by classes and says, or search phrases. Use US Legal Forms to get the Washington Consumer Loan Application - Personal Loan Agreement within a couple of mouse clicks.

When you are previously a US Legal Forms consumer, log in in your accounts and then click the Acquire option to have the Washington Consumer Loan Application - Personal Loan Agreement. You can also accessibility varieties you in the past downloaded inside the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for the right area/region.

- Step 2. Use the Preview choice to examine the form`s content material. Never neglect to read the outline.

- Step 3. When you are not satisfied with all the type, utilize the Research industry on top of the display to get other models in the lawful type design.

- Step 4. Upon having discovered the shape you will need, select the Acquire now option. Opt for the rates plan you prefer and add your credentials to sign up for the accounts.

- Step 5. Procedure the financial transaction. You may use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Select the format in the lawful type and down load it in your device.

- Step 7. Complete, change and print out or indication the Washington Consumer Loan Application - Personal Loan Agreement.

Each and every lawful papers design you get is the one you have for a long time. You have acces to every single type you downloaded inside your acccount. Go through the My Forms portion and pick a type to print out or down load again.

Be competitive and down load, and print out the Washington Consumer Loan Application - Personal Loan Agreement with US Legal Forms. There are thousands of professional and condition-particular varieties you can use for your personal company or person requires.

Form popularity

FAQ

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

(1) Consumer means an individual who obtains or has obtained a financial product or service from you that is to be used primarily for personal, family, or household purposes, or that individual's legal representative. (2) Examples in the case of a financial institution other than a credit union.

What is Consumer Credit? A consumer credit system allows consumers to borrow money or incur debt, and to defer repayment of that money over time. Having credit enables consumers to buy goods or assets without having to pay for them in cash at the time of purchase.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note) An amount borrowed (principal)

(1) No person may make secured or unsecured loans of money or things in action, or extend credit, or service or modify the terms or conditions of residential mortgage loans, or service or modify student education loans, without first obtaining and maintaining a license in ance with this chapter, except those ...

What is a Consumer Loan? A Consumer Loan is a loan that banks offer to customers to buy household goods and appliances and even personal devices. These include television sets, air-conditioners, home theatre systems, refrigerators, laptops, mobile phones, cameras and even modular kitchens.

Consumer mortgages are a type of loan from a bank or lender to help you finance the purchase of a home. Commercial real estate loans, on the other hand, lend business owners a sum of money to invest in their business.