Washington Community Property Disclaimer

Description

How to fill out Community Property Disclaimer?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide variety of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, categorized by types, states, or keywords.

You can access the latest versions of forms like the Washington Community Property Disclaimer in just minutes.

If the form does not meet your needs, utilize the Search field at the top of the screen to find an alternative.

If you are satisfied with the form, confirm your choice by selecting the Purchase now button. Then, pick the payment plan you prefer and provide your details to register for an account.

- If you already hold a subscription, Log In to retrieve the Washington Community Property Disclaimer from your US Legal Forms library.

- The Download button will be available on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the appropriate form for your locality/region.

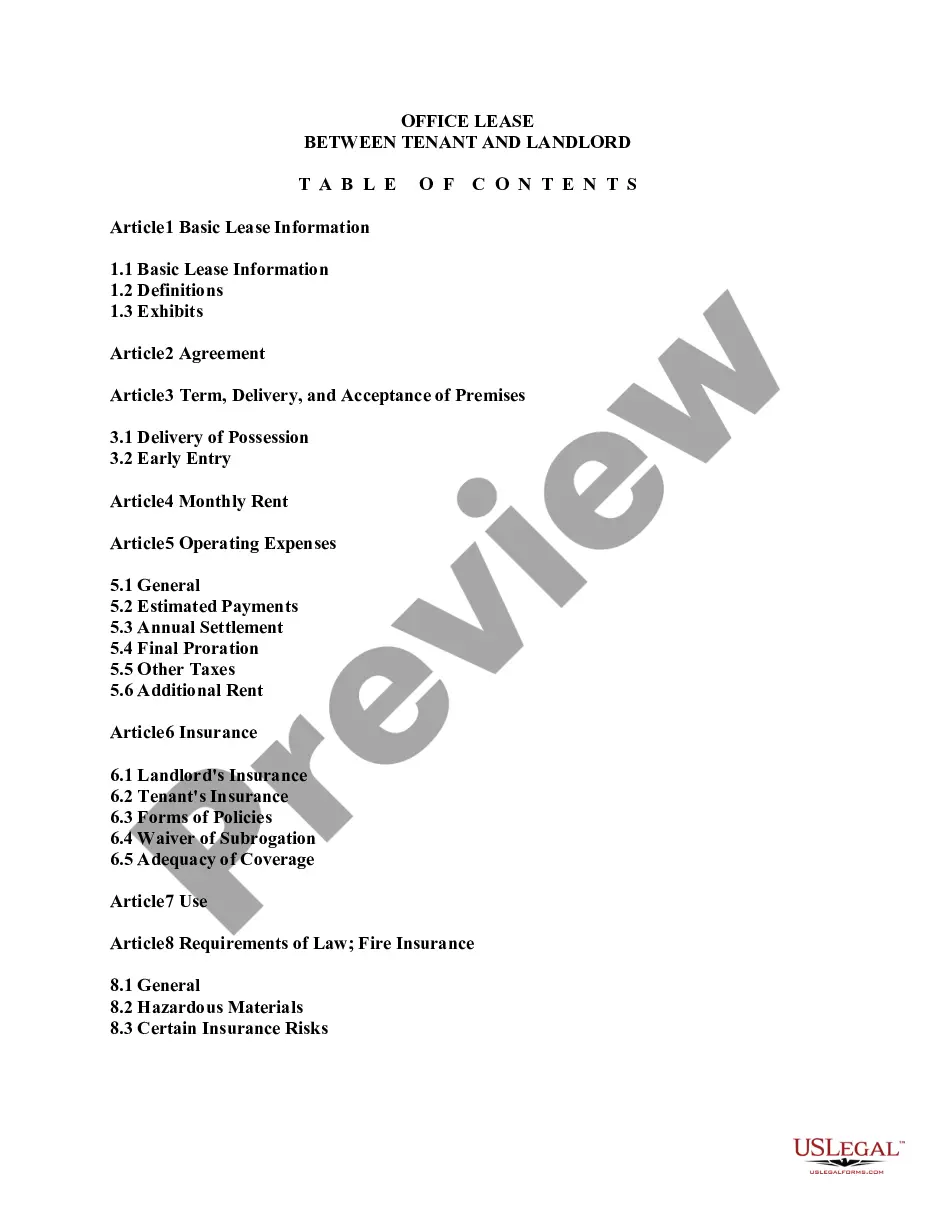

- Click the Review button to examine the form's details. Verify the form information to ensure you have chosen the correct one.

Form popularity

FAQ

One downside of a disclaimer trust is that once an individual disclaims property, they lose any claim to it, which may create unintended consequences. Additionally, establishing a Washington Community Property Disclaimer can involve complex legal requirements, potentially leading to confusion and added costs. Moreover, a disclaimer trust may not be suitable for everyone, as it can limit control over the distribution of assets. It is essential to assess your unique financial situation, and platforms like US Legal Forms can simplify the process of creating and managing these trusts.

The purpose of a disclaimer trust is to allow a spouse to refuse certain property or assets, thereby directing them into a trust that benefits their heirs. In the context of a Washington Community Property Disclaimer, this mechanism can help manage assets and minimize potential taxes. By utilizing a disclaimer trust, individuals can create flexible estate planning strategies that adapt to their financial situation. Furthermore, it enables beneficiaries to retain control over the distribution of inherited assets.

If you are married but living separately in different states, you will need to determine your primary residence for tax purposes. Maintain clarity on which state’s laws apply, especially regarding community property. The Washington Community Property Disclaimer can clarify your asset distribution, ensuring fair tax treatment and compliance. Consulting a tax advisor is advisable to navigate this intricate situation.

To file married filing separately (MFS) in a community property state like Washington, calculate your share of community income accurately. Each spouse must file their own return that reflects half of the total community income. The Washington Community Property Disclaimer helps establish and clarify ownership and tax obligations. Consider seeking advice from a tax professional to navigate these complexities effectively.

In California, the community property form may differ from Washington's approach due to varying state laws. However, it's important to clearly delineate ownership on your tax forms. Using the Washington Community Property Disclaimer can provide a similar protective measure, ensuring that you report your income accurately while honoring your financial rights. Always check specific state requirements as they can vary.

Yes, a spouse can disclaim community property in Washington. This process allows one spouse to refuse their interest in community assets, often for tax or inheritance planning purposes. Utilizing the Washington Community Property Disclaimer can help clarify this refusal and ensure it is legally recognized. This is particularly useful in complex financial situations, protecting the interests of both spouses.

In community property states like Washington, when filing married filing separately, you must report half of your combined community income. You will need to accurately calculate your individual income, deductions, and any tax credits. The Washington Community Property Disclaimer is essential here, as it provides clarity on shared ownership and the right way to allocate responsibilities. Always consult a tax professional to ensure compliance.

To file married separately in Washington, you will both need to complete separate tax returns. Each spouse must report their own income, deductions, and credits. Make sure to use the Washington Community Property Disclaimer to clarify any shared property and ensure proper tax treatment. This method can simplify the management of finances, especially in cases of separation or divorce.

A disclaimer trust is an estate planning tool that allows beneficiaries to refuse inheritances, redirecting those assets into a trust for future management. This option can provide financial advantages, such as protecting assets from creditors. In Washington State, this strategy complements the Washington Community Property Disclaimer, offering flexibility in estate management. Consulting with professionals can help clarify the benefits and nuances of a disclaimer trust.

Yes, there are specific forms available for disclaiming an inheritance in Washington State. These forms outline the necessary information to create a valid Washington Community Property Disclaimer. US Legal Forms offers ready-to-use templates that cater to your needs, ensuring you complete the documentation accurately and efficiently.