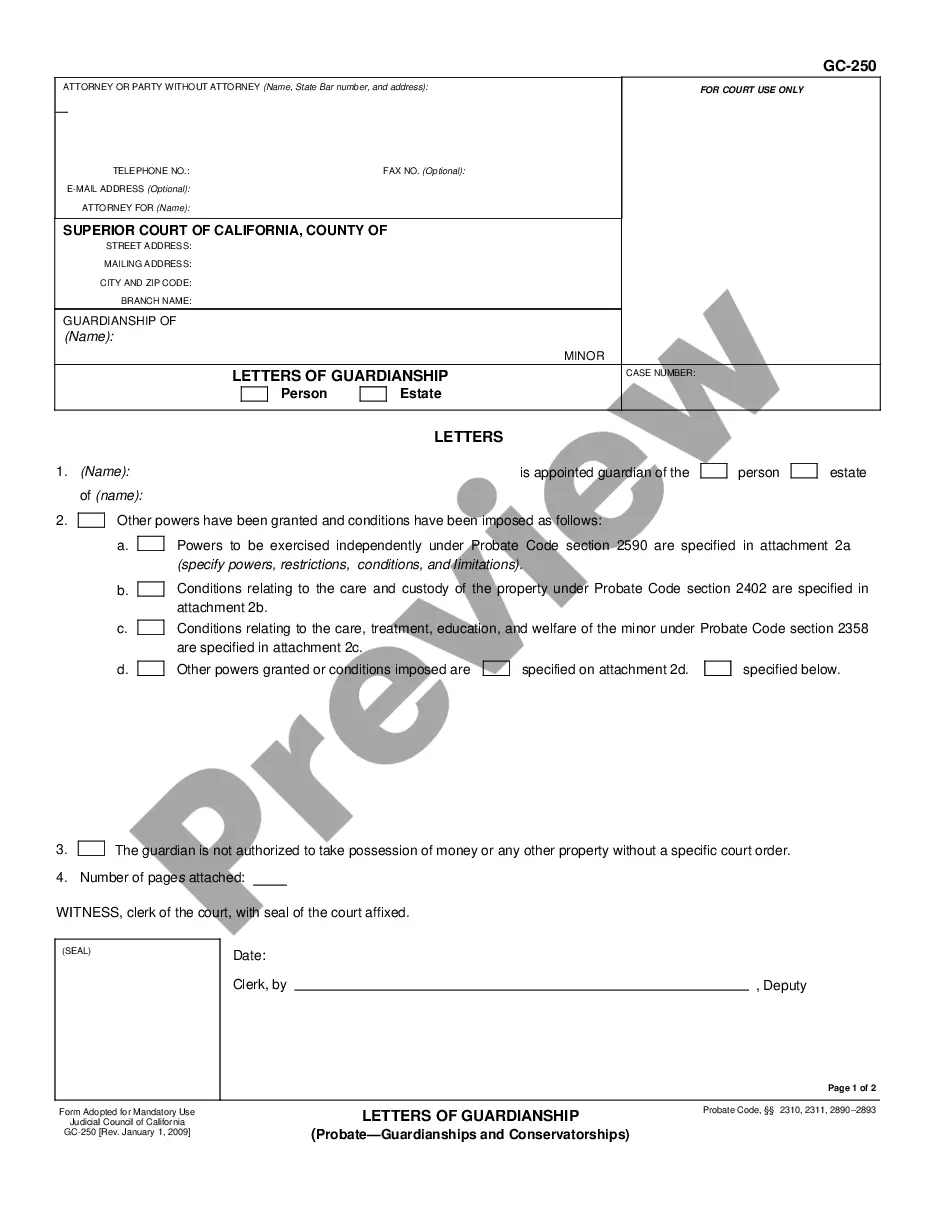

Keywords: Washington, escrow instructions, residential sale, types, detailed description: Washington Escrow Instructions for Residential Sale are legal documents that outline the terms and conditions of a real estate transaction involving the sale of a residential property in the state of Washington. These instructions serve as a guide for all parties involved, including the buyer, seller, real estate agents, and escrow officer, to ensure a smooth and successful transaction. There are different types of Washington Escrow Instructions for Residential Sale, depending on the specific requirements and conditions of the transaction. Some common types include: 1. Standard Escrow Instructions: These are the most common and widely used type of escrow instructions for residential sales in Washington. They cover the basic terms of the transaction, including the purchase price, earnest money deposit, and conditions for the release of funds. 2. FHA/VA Escrow Instructions: These instructions are specifically designed for transactions involving Federal Housing Administration (FHA) or Veterans Affairs (VA) loans. They include additional provisions and requirements mandated by these government-backed loan programs. 3. Short Sale Escrow Instructions: In a short sale transaction, the seller's lender agrees to accept less than the total amount owed on the mortgage. Escrow instructions for short sales outline the specific terms and conditions related to the lender's approval process, including the timeline for approval and release of funds. 4. New Construction Escrow Instructions: For new construction residential sales, a different set of escrow instructions may be used. These instructions often include provisions related to the completion of the construction, inspections, and warranty transfers. Regardless of the specific type of Washington Escrow Instructions for Residential Sale, these documents typically cover essential aspects such as the identification of the parties involved, property description, purchase price, earnest money deposit, financing terms, closing date, title insurance, prorations, and any additional terms or contingencies. It is imperative for all parties involved to carefully review and understand the escrow instructions to ensure compliance and prevent any potential conflicts or misunderstandings during the transaction. Escrow officers play a crucial role in the process, as they act as neutral third parties responsible for processing and disbursing funds according to the instructions. In conclusion, Washington Escrow Instructions for Residential Sale provide a detailed roadmap for successful real estate transactions in the state. Understanding the different types of escrow instructions and their specific requirements is essential for all parties involved to navigate the process smoothly and protect their interests.

Washington Escrow Instructions for Residential Sale

Description

How to fill out Escrow Instructions For Residential Sale?

You might spend time online seeking the correct legal document format that satisfies the state and federal requirements you need.

US Legal Forms offers a vast selection of legal templates that have been reviewed by professionals.

You can download or print the Washington Escrow Instructions for Residential Sale from our service.

If available, utilize the Preview function to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and then click on the Download button.

- After that, you can fill out, edit, print, or sign the Washington Escrow Instructions for Residential Sale.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another copy of any purchased form, go to the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

- Firstly, ensure that you have selected the correct document format for the region/city you choose.

- Check the document description to confirm you have selected the right form.

Form popularity

FAQ

Washington Escrow Instructions for Residential Sale include essential details that guide the escrow process. Typically, these instructions outline the roles and responsibilities of all parties involved, the conditions for escrow release, and the distribution of funds. Additionally, they specify necessary documents, timelines, and any contingencies that must be met. Understanding these components can help ensure a smooth transaction process and protect your interests.

Commonly, the sales contract and any necessary addendums serve as instructions for escrow. These documents provide specific details about the transaction, including payment terms and contingencies. Utilizing comprehensive Washington Escrow Instructions for Residential Sale can help all involved parties understand their responsibilities and timelines.

Sale escrow instructions are guidelines that outline the responsibilities of all parties involved in a real estate transaction. These instructions ensure that funds and property are properly handled during the sale. Specifically, Washington Escrow Instructions for Residential Sale detail how to manage the closing process and protect both buyer and seller interests.

When you sell your house, the escrow process involves several critical steps to ensure a successful transaction. The funds from the sale will be placed in escrow, and they will be released to the seller once all obligations are satisfied, such as inspections and title transfers. By adhering to Washington Escrow Instructions for Residential Sale, you can ensure that all parties understand their obligations, making the sale smoother and more efficient.

Escrow instructions are written guidelines that define the terms and conditions for the handling of an escrow account during a real estate transaction. These instructions specify how funds will be managed, what requirements must be met for the transaction to close, and the roles of each party involved. In the context of Washington Escrow Instructions for Residential Sale, clear instructions help ensure a smooth transaction and protect everyone’s interests.

The standard document serving as the escrow instruction in Washington is the escrow agreement itself. This document outlines the steps the escrow agent will follow to fulfill the transaction. It is vital that both parties review this agreement to ensure accuracy before signing.

Escrow instructions are usually prepared by the escrow agent, but the content often stems from the buyer and seller's agreement. In Washington, utilizing a platform like UsLegalForms can simplify this process, providing templates and guidance for crafting precise escrow instructions. This ensures adherence to state laws and smooth transactions.

Typically, escrow instructions are provided by both the buyer and seller in a Washington real estate transaction. When they agree on the terms of sale, they establish how to proceed with the escrow process. This collaborative effort ensures everyone is informed about the transaction details.

In the context of Quizlet, the term can refer to the general understanding of escrow instructions as laid out in typical legal documents. However, in a Washington Escrow Instructions for Residential Sale context, it specifically involves the escrow agreement that governs real estate transactions. Understanding this helps clarify the process for users.

Changes to Washington Escrow Instructions for Residential Sale can generally be made by mutual agreement of both the buyer and seller. Any modifications must be documented in writing to ensure clarity and prevent disputes. It's crucial to communicate these changes effectively to the escrow agent.