The Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders is a legal document that outlines the rights and responsibilities of shareholders and management in a close corporation. A close corporation is a privately held company with a limited number of shareholders. This agreement is specifically designed for close corporations in the state of Washington and ensures that all shareholders have a clear understanding of their roles and expectations within the company. It helps establish a framework for decision-making, profit distribution, and the overall governance of the corporation. Keywords: Washington Agreement of Shareholders, Close Corporation, Management by Shareholders, legal document, rights, responsibilities, shareholders, management, close corporations, decision-making, profit distribution, governance. In Washington, there are different types of agreement structures related to the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders. These types include: 1. Shareholder Voting Agreement: This agreement outlines the voting rights and obligations of each shareholder in the close corporation. It establishes rules for decision-making processes within the company and ensures that all shareholders have a say in important matters. 2. Shareholder Buy-Sell Agreement: This agreement provides a mechanism for buying and selling shares among shareholders in the close corporation. It sets guidelines for the transfer of ownership and protects the interests of both buying and selling shareholders. 3. Shareholder Employment Agreement: This agreement stipulates the terms and conditions under which a shareholder may be employed by the close corporation. It covers aspects such as compensation, job duties, termination clauses, and ensures that the employment relationship is clearly defined and compliant with state laws. 4. Shareholder Rights Agreement: This agreement clarifies the rights and entitlements of each shareholder in the close corporation. It covers aspects such as voting rights, dividend distribution, and access to corporate information, ensuring that all shareholders are treated fairly and equally. In conclusion, the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders is a crucial legal document for close corporations in Washington. It helps establish the rules and expectations for shareholders and management, ensuring smooth operations and effective decision-making within the company. Different types of related agreements, such as Shareholder Voting Agreements, Shareholder Buy-Sell agreements, Shareholder Employment Agreements, and Shareholder Rights Agreements, further shape the relationships and responsibilities within the close corporation.

Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

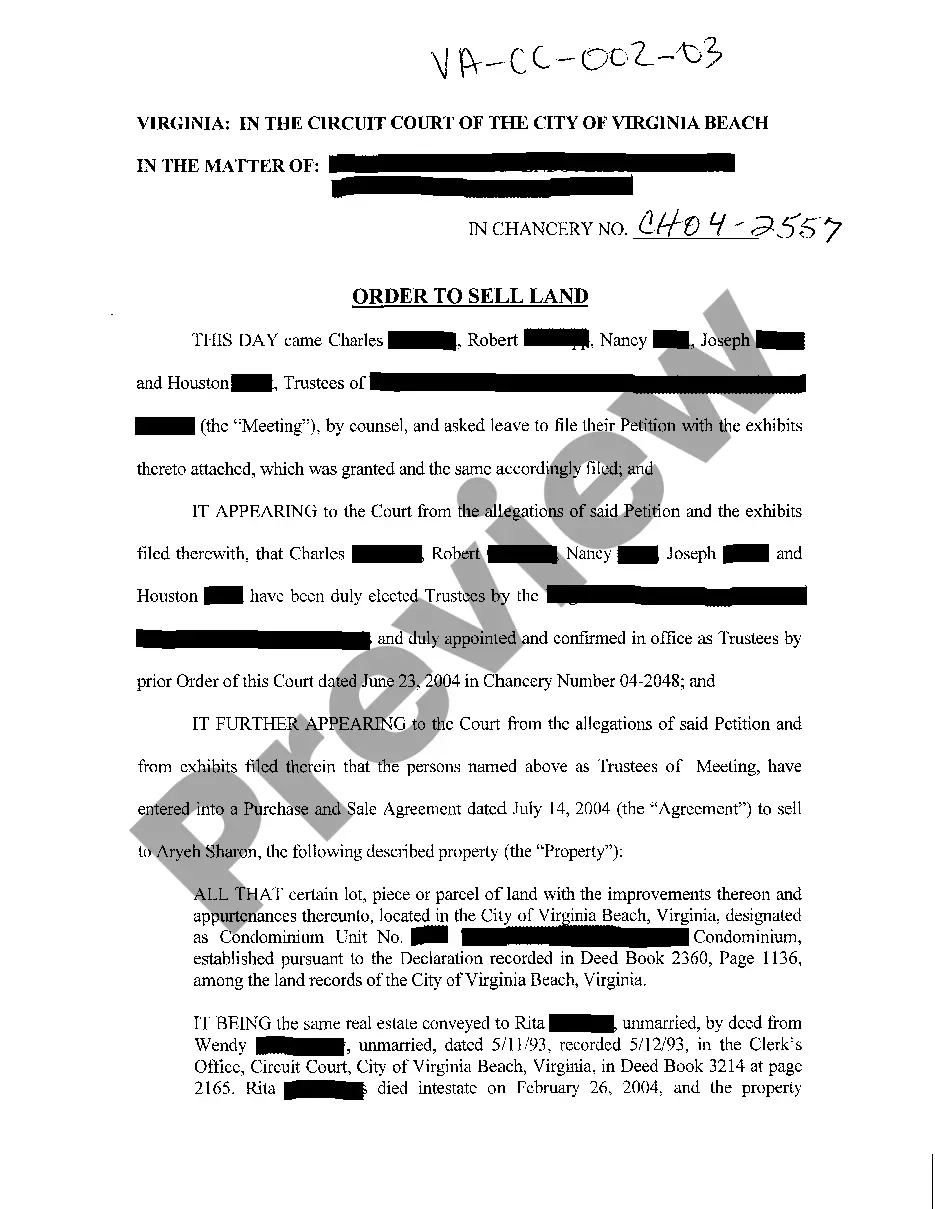

How to fill out Washington Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

If you want to comprehensive, obtain, or print authorized papers layouts, use US Legal Forms, the biggest assortment of authorized forms, which can be found on-line. Use the site`s simple and easy handy lookup to get the paperwork you require. Various layouts for business and person reasons are categorized by categories and states, or key phrases. Use US Legal Forms to get the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders in a few mouse clicks.

If you are already a US Legal Forms client, log in for your account and click the Down load button to get the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders. Also you can accessibility forms you earlier acquired inside the My Forms tab of your own account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for that appropriate area/region.

- Step 2. Take advantage of the Review solution to examine the form`s articles. Do not neglect to learn the outline.

- Step 3. If you are unhappy together with the form, make use of the Lookup discipline near the top of the monitor to discover other models of your authorized form web template.

- Step 4. Once you have identified the form you require, click the Get now button. Opt for the pricing strategy you choose and add your accreditations to sign up to have an account.

- Step 5. Process the deal. You can utilize your bank card or PayPal account to accomplish the deal.

- Step 6. Choose the structure of your authorized form and obtain it on the product.

- Step 7. Comprehensive, edit and print or sign the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders.

Each authorized papers web template you purchase is the one you have eternally. You may have acces to each and every form you acquired inside your acccount. Click on the My Forms area and decide on a form to print or obtain yet again.

Compete and obtain, and print the Washington Agreement of Shareholders of a Close Corporation with Management by Shareholders with US Legal Forms. There are thousands of professional and condition-certain forms you may use to your business or person demands.

Form popularity

FAQ

A general shareholder agreement is an agreement between two or more shareholders which sets out additional rights and protections for the shareholders, including voting rights, restrictions on the transfer of shares and protection for minority shareholders.

General and unanimous agreements are the two types of shareholders' agreements. The main contents of the agreement include sections related to the introduction of the parties, definition, business details, board of directors information, shareholders' undertaking, restrictions, termination clauses, etc.

A general shareholders agreement is treated as a commercial contract between the parties and is subject to a corporation's articles and by-laws, together with applicable statutes. They typically deal with a wide variety of issues and there is no statutory requirement for the content that they contain.

WHO SHOULD SIGN THE SHAREHOLDERS AGREEMENT? The shareholders agreement should be signed or executed by the company and each shareholder. Remember the legal requirements for a company and an individual to sign documents is different, so make sure that you review the execution blocks correctly and sign the right one!

Shareholders are not required to enter into a shareholders' agreement but, where there are 2 or more shareholders, it is good practice for the shareholders to put one in place.

Mistake 1: Not having a Shareholders Agreement in place. Mistake 2: Not outlining how transfer, ownership or dissolution of shares will be handled. Mistake 3: Not outlining what each party is responsible for. Mistake 4: Not outlining how voting will take place and how issues will be resolved.

A shareholders' agreement is a contract that regulates the relationship between the shareholders and the corporation. The agreement will detail what models or forms which the corporation should run and outline and the basic rights and obligations of the shareholders.

A shareholder agreement is an arrangement that defines the relationship between shareholders and the company. The agreement safeguards the rights and obligations of the majority and minority shareholders, and it ensures all shareholders are treated fairly.