As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Washington Report of Independent Accountants after Audit of Financial Statements

Description

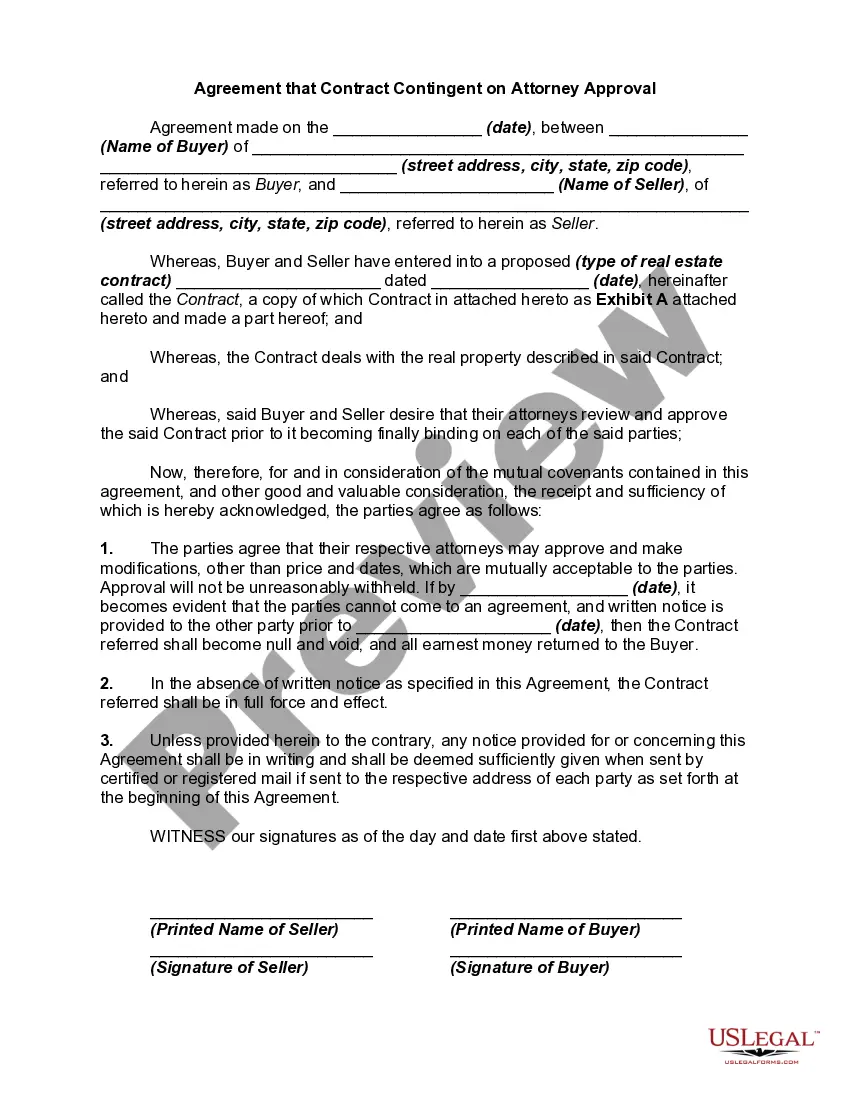

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

Are you currently in a situation where you require documents for either business or personal reasons every single day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging. US Legal Forms offers thousands of form templates, such as the Washington Report of Independent Accountants following the Audit of Financial Statements, which can be tailored to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterward, you can download the Washington Report of Independent Accountants following the Audit of Financial Statements template.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Washington Report of Independent Accountants following the Audit of Financial Statements at any time, if needed. Simply click on the desired form to download or print the document.

Use US Legal Forms, the largest repository of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you have the appropriate form, click Buy now.

- Choose the payment plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a preferred document format and download your copy.

Form popularity

FAQ

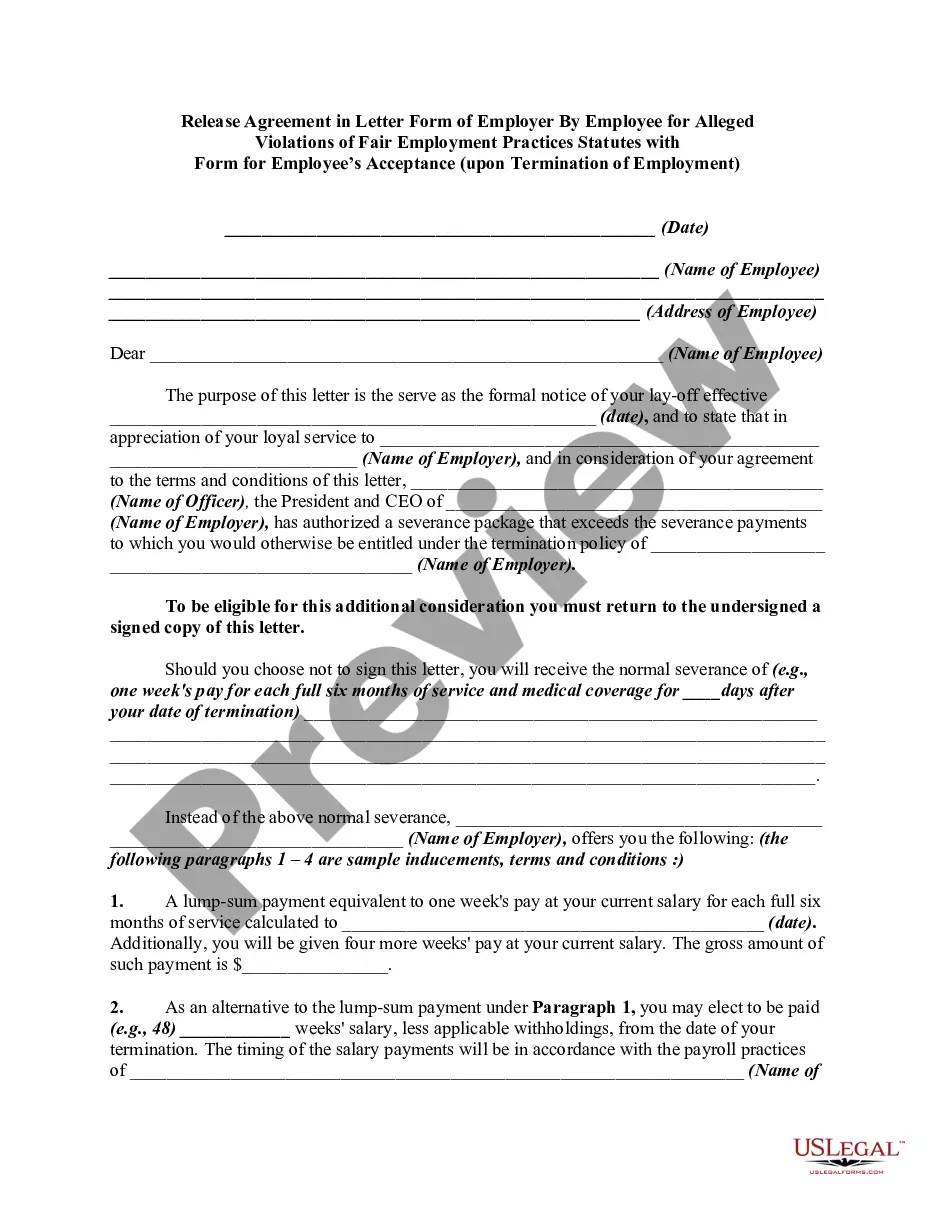

Filing audited financial statements is often a requirement for various stakeholders, including investors and regulatory bodies. When you receive a Washington Report of Independent Accountants after Audit of Financial Statements, it provides an assurance of your financial health and compliance. This report can be essential for firms seeking loans, attracting investors, or fulfilling state regulations. Using uslegalforms, you can easily navigate the process of preparing and filing your audited financial statements.

A single audit report combines the audit of financial statements and the compliance audit of federal programs into one comprehensive review. This report aims to provide a clear overview of how effectively the organization uses federal funds while ensuring accountability and transparency. Ultimately, it aligns with the principles outlined in the Washington Report of Independent Accountants after Audit of Financial Statements.

A Single Audit report in Washington is conducted on certain organizations that receive federal funds, assessing their compliance with federal regulations and financial requirements. This report ensures that these entities manage their federal awards properly and demonstrates accountability to taxpayers. The findings are part of the Washington Report of Independent Accountants after Audit of Financial Statements, essential for federal oversight.

You can typically find an independent auditor's report on the official website of the organization being audited, especially for public companies and nonprofits. Additionally, various regulatory bodies and financial databases may also provide access to these reports. Utilizing platforms like uslegalforms can simplify your search for the Washington Report of Independent Accountants after Audit of Financial Statements, providing necessary documentation and templates.

Yes, audited financial statements are generally considered public information, especially if the organization is publicly traded or a nonprofit entity. This transparency ensures that stakeholders, including investors and the public, can access and evaluate the financial health of an organization. The Washington Report of Independent Accountants after Audit of Financial Statements provides essential insights into an entity's fiscal responsibilities.

A single audit focuses on organizations that receive federal funding, emphasizing compliance with federal regulations, financial integrity, and performance accountability. In contrast, a regular audit evaluates the overall financial statements without the specialized compliance elements. Understanding these differences is key in comprehending the Washington Report of Independent Accountants after Audit of Financial Statements and its implications for fund management.

The audit report serves to provide an objective assessment of an organization's financial statements, ensuring accuracy and compliance with relevant accounting standards. Essentially, it represents the Washington Report of Independent Accountants after Audit of Financial Statements, allowing stakeholders to trust the financial data presented. This report is vital for building credibility with investors, regulators, and other interested parties.

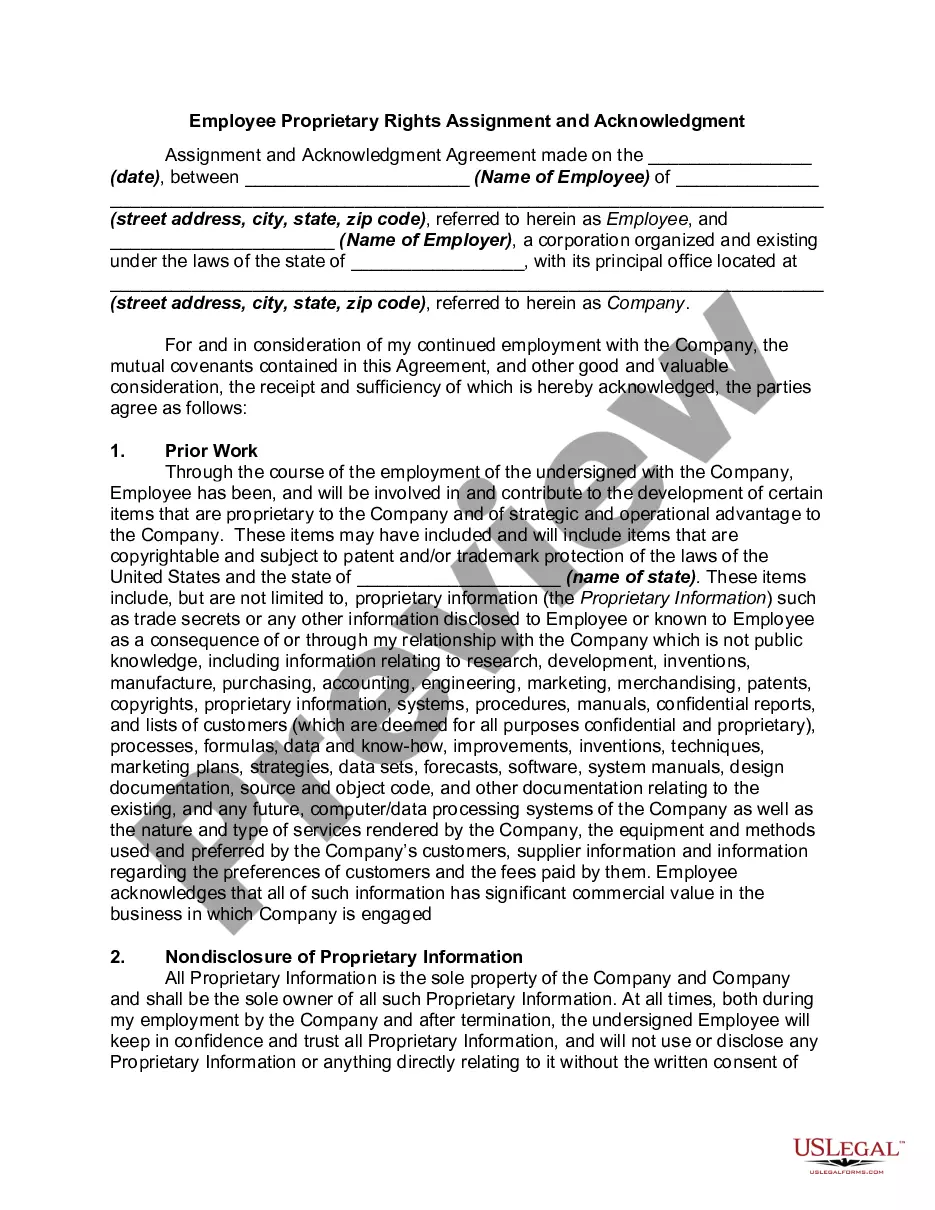

The responsibility for auditing financial statements typically lies with independent auditors, often CPAs who work independently from the organization being audited. This separation is vital for maintaining objectivity and impartiality in the audit process. By choosing to engage qualified auditors familiar with the Washington Report of Independent Accountants after Audit of Financial Statements, organizations can ensure high-quality review and accountability in their financial practices.

An independent accountant's review report is a document that summarizes an accountant's findings after examining a client's financial statements. This report indicates whether the financial statements meet the required standards and often includes observations and recommendations for improvements. Understanding the Washington Report of Independent Accountants after Audit of Financial Statements can be crucial for businesses looking to enhance financial transparency and accountability.

Yes, an accountant can conduct an audit, provided they have the appropriate certification. Specifically, a licensed CPA is typically required to complete audits due to their expertise in handling financial statements. By engaging an accountant familiar with the Washington Report of Independent Accountants after Audit of Financial Statements, a business can ensure that they receive accurate insights into their financial health.