Wedding consultants help people to plan weddings. Wedding consultants give advice on outfits for the bride and her attendants. They suggest colors, fabrics, and styles for dresses. They help choose suits for the groom and other male members of the wedding party. They also help the bride select her wardrobe for the honeymoon. Sometimes they help with fittings for these clothes. Wedding consultants may help prepare a budget for the wedding and assist the bride and groom as they pick out silver, china, glassware, linens, and other items for their new home. Consultants often keep a gift registry, which is a list of the couple's choices and purchases. The registry helps people choose a gift that the couple will like and that someone else has not already bought them.

Wedding consultants also help to make many of the plans for the wedding itself. For this they need to know about the customs of different religious or ethnic groups. They give advice on the etiquette, or proper manners, for the wedding. They sometimes help to choose, order, address, and mail the invitations. They may suggest and order flower arrangements and other decorations to use. They may hire musicians, photographers, caterers, and bakers. They may also organize the transportation for the wedding party and make travel and lodging arrangements for the bride and groom or for guests. Often they help the members of the wedding party with what they are wearing. Wedding consultants may also attend rehearsals and the wedding itself. Sometimes they send information about the wedding to newspapers.

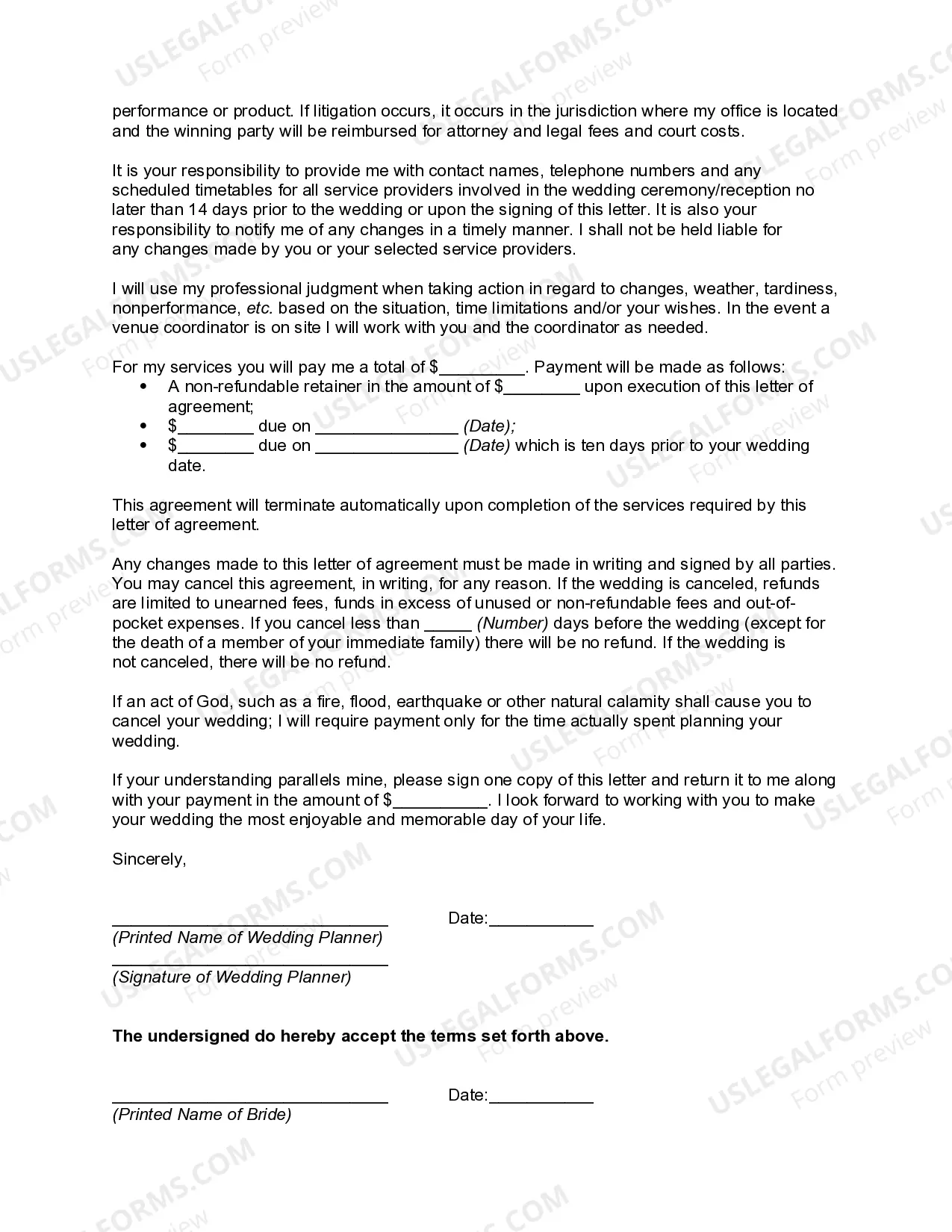

The Washington Letter Agreement with a Wedding Consultant, Planner, or Coordinator who is self-employed is a legal document that outlines the terms and conditions of the professional relationship between the parties involved. This agreement serves as a binding contract, which ensures that both the consultant and the client are on the same page regarding the services to be provided, compensation, and other essential aspects of the engagement. Keywords: Washington Letter Agreement, wedding consultant, wedding planner, wedding coordinator, self-employed, detailed description, types. 1. Basic Washington Letter Agreement with Wedding Consultant, Planner, or Coordinator — Self-Employed: This type of agreement is suitable for all self-employed wedding professionals who offer services as consultants, planners, or coordinators. It contains general terms and conditions that apply to most wedding projects. 2. Customized Washington Letter Agreement with Wedding Consultant, Planner, or Coordinator — Self-Employed: Sometimes, clients may have specific requirements or unusual circumstances that warrant a more tailored agreement. This type of agreement allows for customization to meet the unique needs of the client. 3. Comprehensive Washington Letter Agreement with Wedding Consultant, Planner, or Coordinator — Self-Employed: For complex wedding events or projects that require detailed planning and coordination, a comprehensive agreement ensures that all aspects of the engagement are thoroughly defined. This type of agreement may include additional clauses covering areas such as vendor management, wedding day logistics, and emergency backup plans. 4. Wedding Consultant Services Agreement for Washington Couples: This variant of the agreement is designed specifically for clients seeking assistance from a wedding consultant. It outlines the consultant's responsibilities in terms of vendor research, budget management, timeline creation, and overall guidance throughout the planning process. 5. Wedding Planner Services Agreement for Washington Couples: Intended for clients who require full-service wedding planning, this agreement specifies the planner's duties related to venue selection, contract negotiation, coordination of vendors, design conceptualization, and on-site management. 6. Wedding Coordinator Services Agreement for Washington Couples: Couples who have completed most of the wedding planning themselves but need professional assistance in executing their vision may opt for this agreement. It outlines the coordinator's responsibilities on the wedding day, including timeline implementation, vendor coordination, and managing unforeseen circumstances. In all types of Washington Letter Agreements with Wedding Consultants, Planners, or Coordinators who are self-employed, key clauses usually include the scope of services, compensation structure, payment schedules, cancellation policy, and any additional terms both parties deem necessary for a successful working relationship.