Washington Consignment Agreement in the Form of a Receipt

Description

How to fill out Consignment Agreement In The Form Of A Receipt?

If you aim to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are available online.

Employ the site's user-friendly and efficient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and provide your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Washington Consignment Agreement in the Form of a Receipt with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Washington Consignment Agreement in the Form of a Receipt.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the template for the correct city/state.

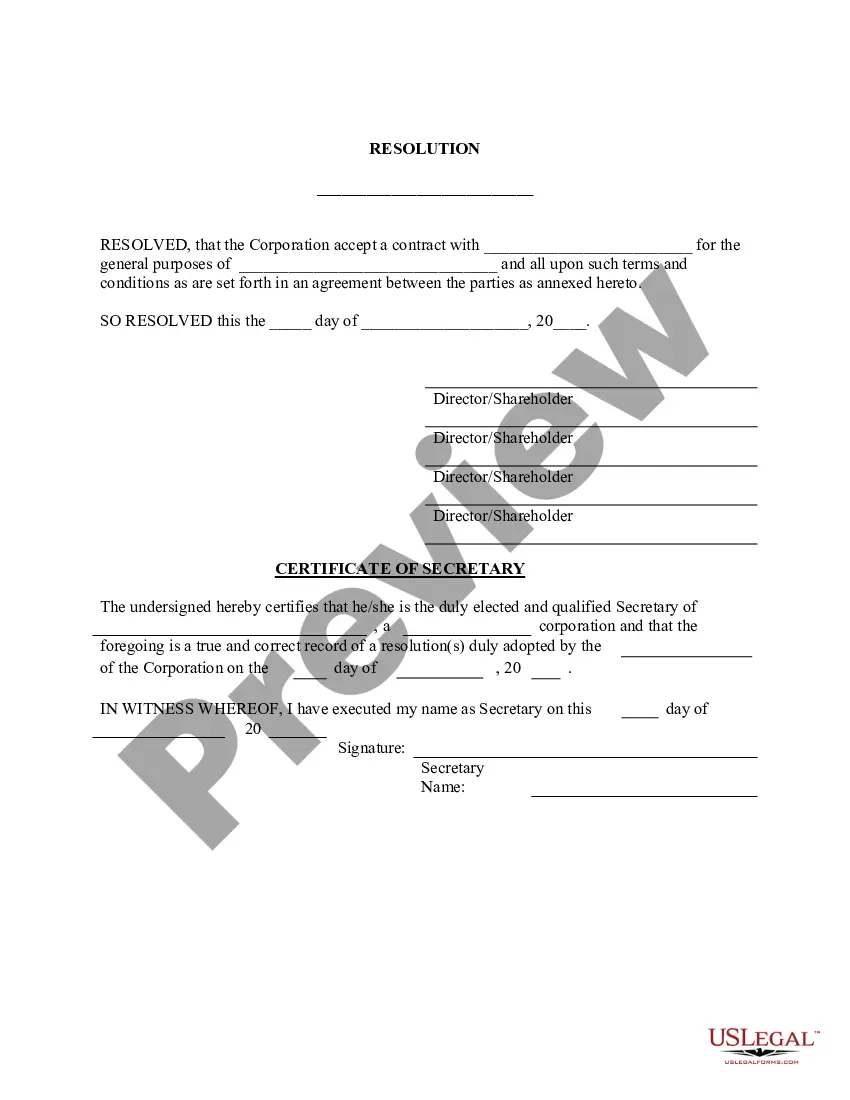

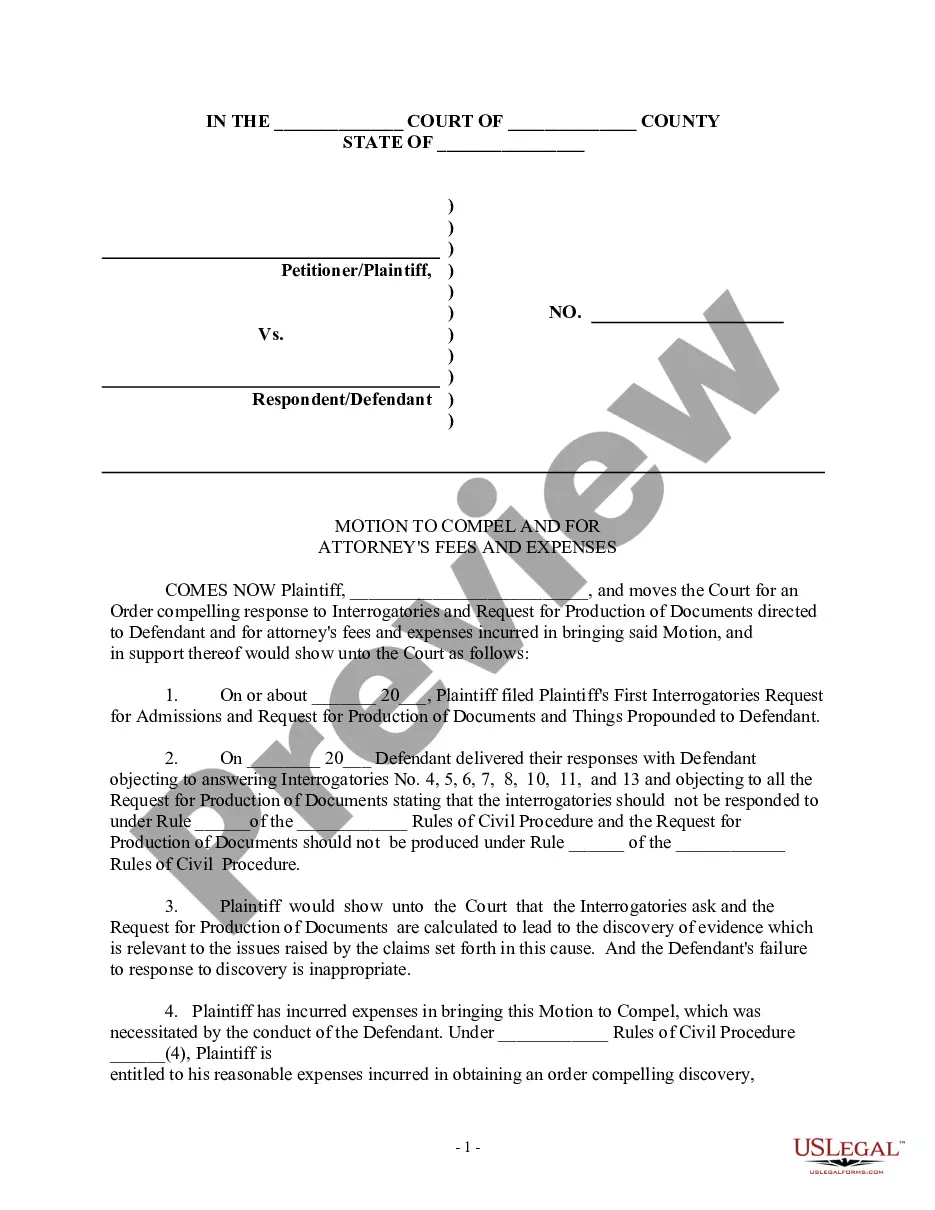

- Step 2. Use the Review option to check the content of the template. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other templates of the legal form format.

Form popularity

FAQ

Creating a consignment invoice is straightforward. Begin by listing your business information, followed by the purchaser's details, items sold, their quantities, and sale prices. Incorporating guidelines from your Washington Consignment Agreement in the Form of a Receipt can enhance the accuracy of your invoicing process. This preparation helps maintain transparency, ensuring that both seller and buyer understand the financial exchange clearly.

To write a consignment agreement, start by detailing the names of the parties involved, the description of the goods, and the payment and commission structure. Incorporate terms that specify ownership and liability to establish clear expectations. A well-structured Washington Consignment Agreement in the Form of a Receipt safeguards the interests of both the seller and buyer, ensuring a smooth transaction process.

A typical consignment arrangement often includes a consignor supplying products to a consignee, who then sells the items on behalf of the consignor. The consignor receives payment only after the sale, allowing for minimal upfront risk. Creating a Washington Consignment Agreement in the Form of a Receipt helps formalize this process, providing clarity and protecting both parties.

A comprehensive consignment agreement should include details such as the description of the goods, the duration of the consignment, and the agreed commission. It should also outline the responsibilities of both the consignor and consignee. Utilizing a Washington Consignment Agreement in the Form of a Receipt can help you cover all necessary points, ensuring both parties understand their rights and obligations.

The standard for consignment involves an agreement where one party provides goods to another for sale, while maintaining ownership until a sale occurs. This arrangement protects both parties by clearly outlining responsibilities and conditions. Typically, a Washington Consignment Agreement in the Form of a Receipt serves to document these terms and ensure transparency in the transaction.

To set up a consignment agreement, start by clearly defining the terms, responsibilities, and percentage split in a written document. Using a Washington Consignment Agreement in the Form of a Receipt can streamline this process, ensuring all important details are covered. Once both parties agree, sign the document and keep records of all transactions.

Typically, the seller or consignor maintains accounting records for consignment sales, but both parties should be involved. A Washington Consignment Agreement in the Form of a Receipt outlines the responsibilities clearly. Good communication between you and your consignor is essential for accuracy and transparency.

Yes, consignment sales must be reported to the IRS, as they generate income for your business. Using a Washington Consignment Agreement in the Form of a Receipt provides a clear record of these transactions, which can simplify your reporting. It's important to keep accurate records to ensure compliance.

A fair percentage for consignment typically ranges from 25% to 60%, depending on the product and market conditions. Consider the value you provide versus your seller's costs when setting this percentage. A Washington Consignment Agreement in the Form of a Receipt can formalize your agreement, ensuring both parties understand the terms.

To account for consignment sales using a Washington Consignment Agreement in the Form of a Receipt, you should track the inventory held on consignment separately from regular sales. When items sold on consignment are sold, record the sale and update your inventory to reflect the items sold. This clear record keeping helps in monitoring performance and financial reporting.