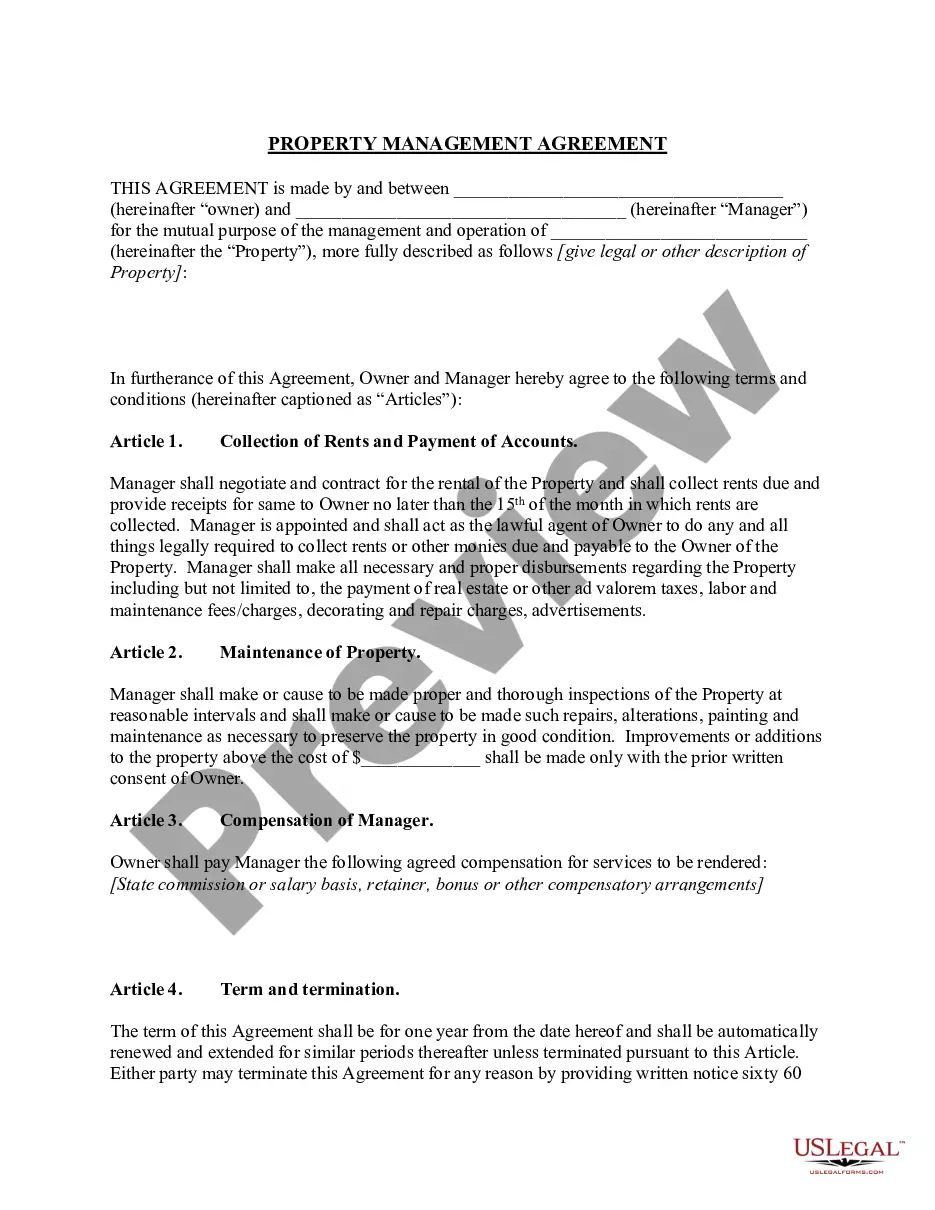

Washington Simple Promissory Note for Personal Loan is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Washington. This promissory note serves as evidence of the loan transaction and helps protect the rights and interests of both parties involved. The note includes important details such as the principal amount borrowed, the interest rate charged, repayment terms, and any collateral requirements, if applicable. A Washington Simple Promissory Note for Personal Loan follows the specific regulations and requirements set forth by Washington state laws. It is designed to ensure transparency and fairness in personal lending transactions while maintaining the enforceability of the agreement. This document provides a clear understanding and agreement between the lender and borrower, helping to minimize potential conflicts or misunderstandings. In Washington state, there are different types of promissory notes available for personal loans, such as: 1. Fixed-Rate Promissory Note: It involves a fixed interest rate that remains constant throughout the loan term. This type of note provides stability to both parties, as the borrower knows exactly what they need to pay each repayment period, and the lender is assured of a steady return on investment. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, an adjustable-rate note includes provisions for changing interest rates based on specific factors, such as fluctuations in the financial market. These notes often come with a lower initial interest rate but may increase or decrease over time depending on certain predetermined conditions. 3. Secured Promissory Note: This type of note includes a collateral requirement to secure the loan. Collateral can be any valuable asset owned by the borrower, such as a property, vehicle, or valuable possession. By agreeing to a secured promissory note, borrowers offer collateral as a form of security, ensuring that the lender has a means to recover their investment in case of default. 4. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. Instead, this type of note trusts the borrower's creditworthiness and personal reputation to guarantee repayment. As a result, unsecured loans may carry higher interest rates since they pose a greater risk to the lender. It is crucial to consult with legal professionals or seek guidance from financial advisors when drafting or signing a Washington Simple Promissory Note for Personal Loan. This ensures compliance with state laws and helps protect the rights and interests of both the lender and borrower involved in the transaction.

Washington Simple Promissory Note for Personal Loan

Description

How to fill out Washington Simple Promissory Note For Personal Loan?

Are you within a placement where you require documents for sometimes company or person functions virtually every day? There are plenty of legal document themes available on the net, but finding kinds you can trust isn`t straightforward. US Legal Forms delivers a huge number of kind themes, just like the Washington Simple Promissory Note for Personal Loan, which are composed in order to meet state and federal requirements.

When you are currently informed about US Legal Forms web site and possess an account, basically log in. Next, you can download the Washington Simple Promissory Note for Personal Loan template.

Unless you come with an account and wish to begin to use US Legal Forms, follow these steps:

- Find the kind you require and make sure it is for your appropriate city/state.

- Make use of the Review button to examine the shape.

- See the information to actually have chosen the proper kind.

- If the kind isn`t what you`re trying to find, utilize the Look for area to find the kind that meets your requirements and requirements.

- When you find the appropriate kind, just click Purchase now.

- Choose the rates prepare you desire, submit the necessary info to produce your account, and purchase the transaction using your PayPal or charge card.

- Pick a practical data file format and download your duplicate.

Get each of the document themes you have purchased in the My Forms menu. You may get a further duplicate of Washington Simple Promissory Note for Personal Loan any time, if needed. Just go through the necessary kind to download or print the document template.

Use US Legal Forms, the most comprehensive assortment of legal kinds, in order to save time and steer clear of mistakes. The service delivers expertly manufactured legal document themes that you can use for a selection of functions. Create an account on US Legal Forms and commence creating your daily life a little easier.