A Washington Simple Promissory Note for Tuition Fee is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender for the purpose of paying tuition fees. This note serves as proof of the loan agreement and ensures that both parties are aware of their obligations and responsibilities. The Washington Simple Promissory Note for Tuition Fee includes essential information such as the names and contact details of the borrower and lender, the loan amount, the repayment schedule, and any applicable interest rates. It also includes clauses regarding late payment penalties, prepayment options, and any additional fees or charges that may be incurred during the repayment period. There are several types of Washington Simple Promissory Notes for Tuition Fee that cater to different needs and situations. Some common variations include: 1. Fixed Interest Rate Promissory Note: This type of note establishes a fixed interest rate for the loan, meaning that the interest rate remains constant throughout the repayment period. This provides stability and predictability for both parties. 2. Variable Interest Rate Promissory Note: In contrast to the fixed interest rate note, a variable interest rate promissory note allows the interest rate to fluctuate based on market conditions or other predetermined factors. This type of note may offer the benefit of lower interest rates initially, but borrowers should be prepared for potential interest rate increases. 3. Parent or Guardian Co-Signed Promissory Note: In situations where the borrower is a minor or lacks established credit history, a parent or guardian may be required to co-sign the promissory note. This provides an additional layer of security for the lender, as the co-signer becomes equally responsible for the repayment of the loan. 4. Secured Promissory Note: In certain cases, the lender may require the borrower to provide collateral as security for the loan. This could be in the form of real estate, a vehicle, or any other valuable asset. Should the borrower default on the loan, the lender has the right to seize the collateral to recover the owed amount. It is important for both the borrower and lender to carefully review and understand the terms and conditions of the Washington Simple Promissory Note for Tuition Fee before signing. Seeking legal advice or consulting a qualified professional can help ensure that the note accurately reflects the intentions and expectations of both parties and comply with Washington state laws.

Washington Simple Promissory Note for Tutition Fee

Description

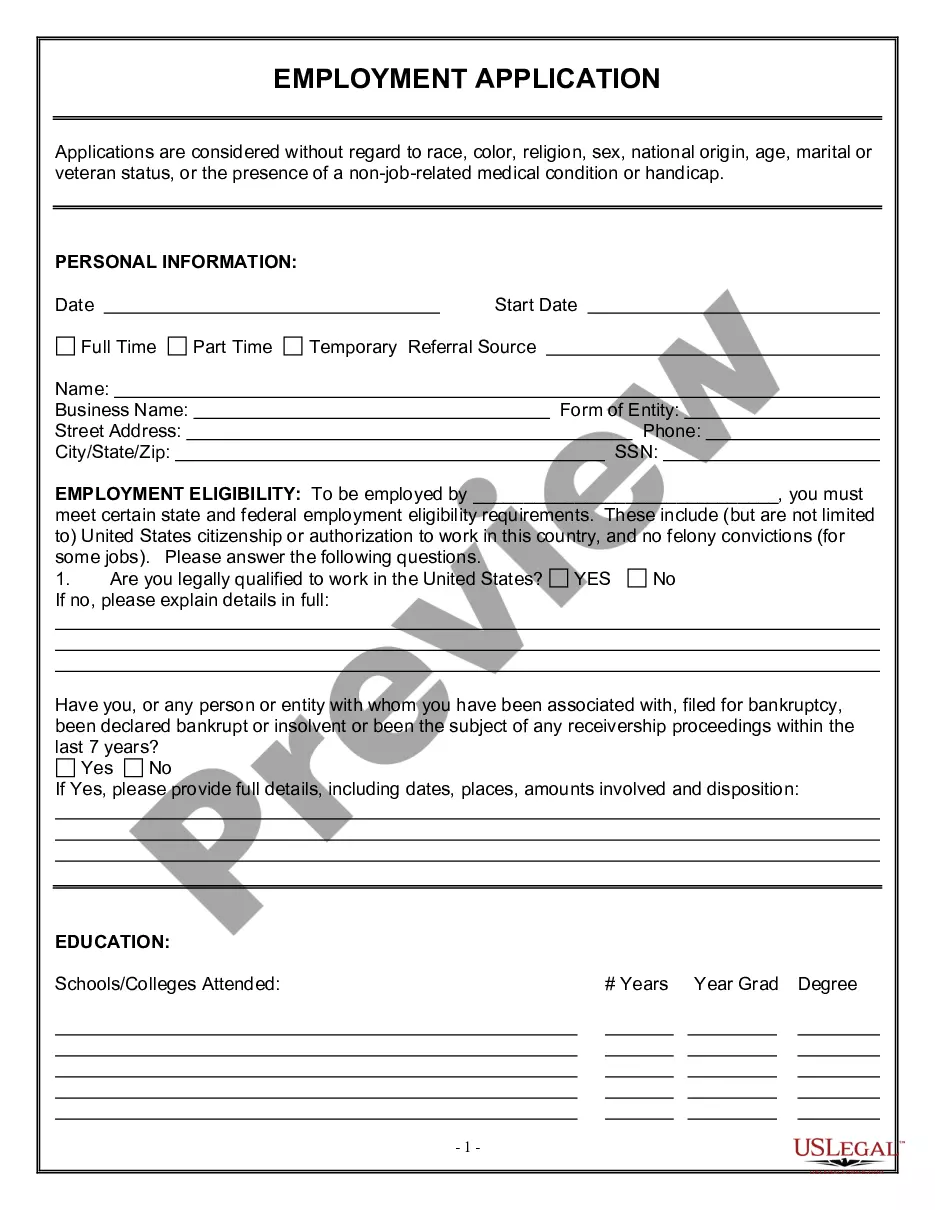

How to fill out Washington Simple Promissory Note For Tutition Fee?

US Legal Forms - one of the biggest libraries of authorized kinds in the United States - provides an array of authorized file templates it is possible to download or print out. Using the website, you may get a huge number of kinds for business and individual functions, categorized by categories, suggests, or keywords.You will discover the newest versions of kinds like the Washington Simple Promissory Note for Tutition Fee in seconds.

If you have a monthly subscription, log in and download Washington Simple Promissory Note for Tutition Fee through the US Legal Forms local library. The Download switch can look on every single form you view. You have access to all in the past saved kinds from the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, allow me to share simple guidelines to obtain started off:

- Make sure you have selected the correct form for the city/area. Go through the Preview switch to review the form`s content. Look at the form outline to actually have chosen the right form.

- If the form doesn`t suit your specifications, utilize the Look for field near the top of the monitor to get the one which does.

- When you are satisfied with the shape, confirm your choice by clicking the Acquire now switch. Then, choose the prices prepare you favor and supply your qualifications to register for an bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to complete the purchase.

- Find the formatting and download the shape on your system.

- Make adjustments. Load, modify and print out and sign the saved Washington Simple Promissory Note for Tutition Fee.

Each format you added to your account does not have an expiration particular date which is yours for a long time. So, in order to download or print out another duplicate, just proceed to the My Forms area and then click around the form you require.

Obtain access to the Washington Simple Promissory Note for Tutition Fee with US Legal Forms, probably the most considerable local library of authorized file templates. Use a huge number of expert and status-certain templates that meet your business or individual needs and specifications.