Washington Simple Promissory Note for Vehicle Purchase

Description

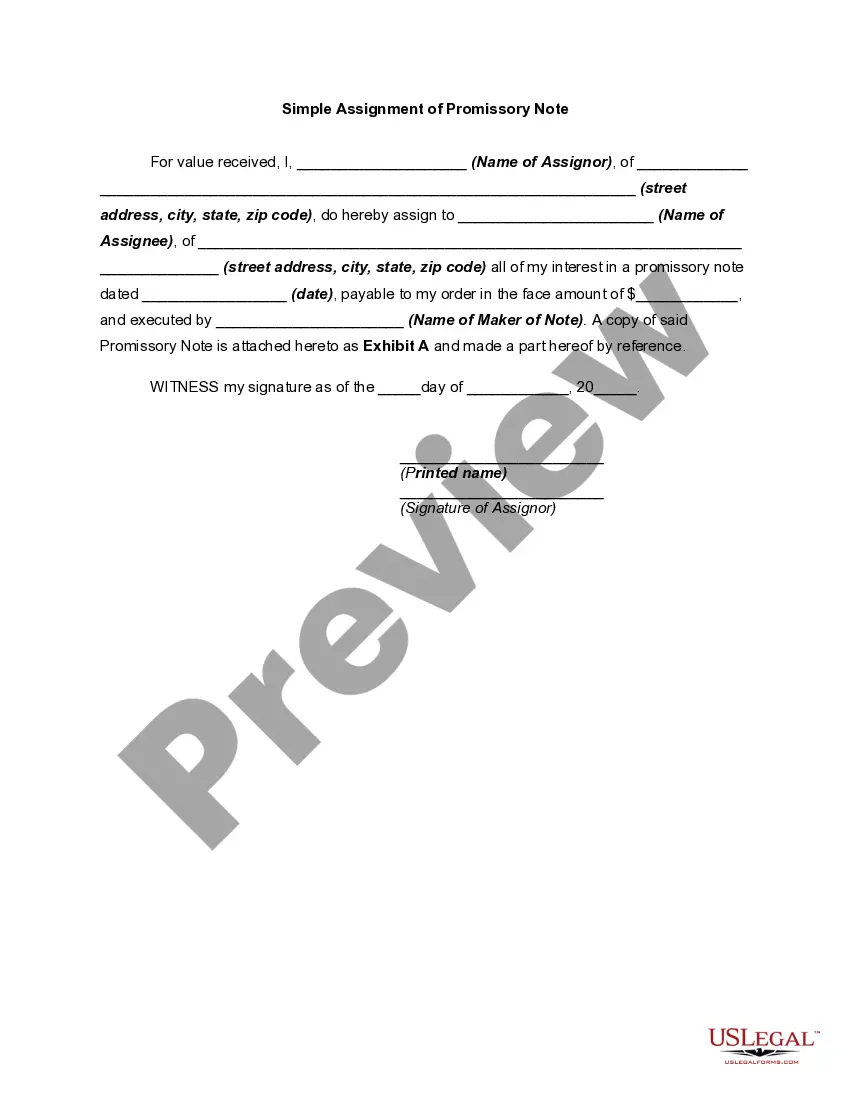

How to fill out Simple Promissory Note For Vehicle Purchase?

You can dedicate numerous hours online trying to locate the legal document template that meets the state and federal requirements that you need.

US Legal Forms offers thousands of legal forms that are vetted by experts.

You can easily download or print the Washington Simple Promissory Note for Vehicle Purchase from the service.

If you wish to find another variant of the form, utilize the Search field to discover the template that suits your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Afterwards, you can fill out, modify, print, or sign the Washington Simple Promissory Note for Vehicle Purchase.

- Each legal document template you obtain is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward guidelines outlined below.

- First, ensure that you have selected the correct document template for your chosen state/city.

- Check the form description to confirm you have selected the appropriate document.

- If available, use the Review button to view the document template as well.

Form popularity

FAQ

To fill out a promissory demand note, start by including the names of the borrower and lender at the top of the document. Clearly state the amount being borrowed, the interest rate if applicable, and the repayment terms. It’s essential to write down the date the note is created and any conditions under which the lender can demand repayment. Finally, both parties should sign the document to make it legally binding.

A Washington promissory note does not need to be notarized. To execute the note, the borrower should sign and date it. If there is a co-signer, the co-signer should also sign and date the document.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

Promissory notes are usually documented and enter the public record shortly after settlement. The trustee (or lender) holds the promissory note until the debt is repaid. Once the borrower has satisfied the note's terms, the trustee will record a deed of reconveyance or stamp the recorded promissory note as paid.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like or .

Promissory Notes. Homeowners usually think of their mortgage as an obligation to repay the money they borrowed to buy their residence. But actually, it's a promissory note they also sign, as part of the financing process, that represents that promise to pay back the loan, along with the repayment terms.