Companies who seek venture capital are willing to exchange equity in the company in return for money to grow or expand the business. Those who provide venture capital generally seek a greater degree of control in the company affairs and quicker return on their investment than standard investors.

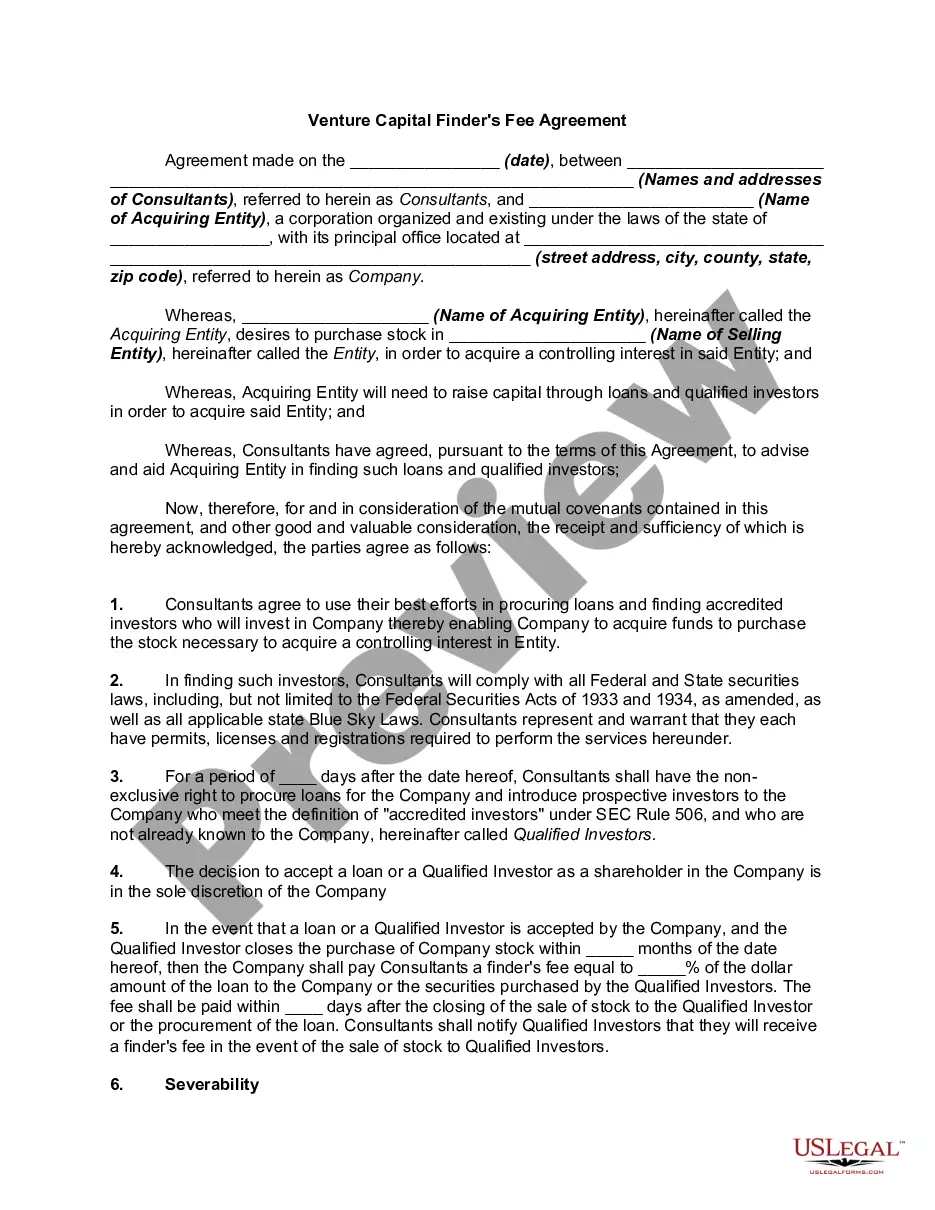

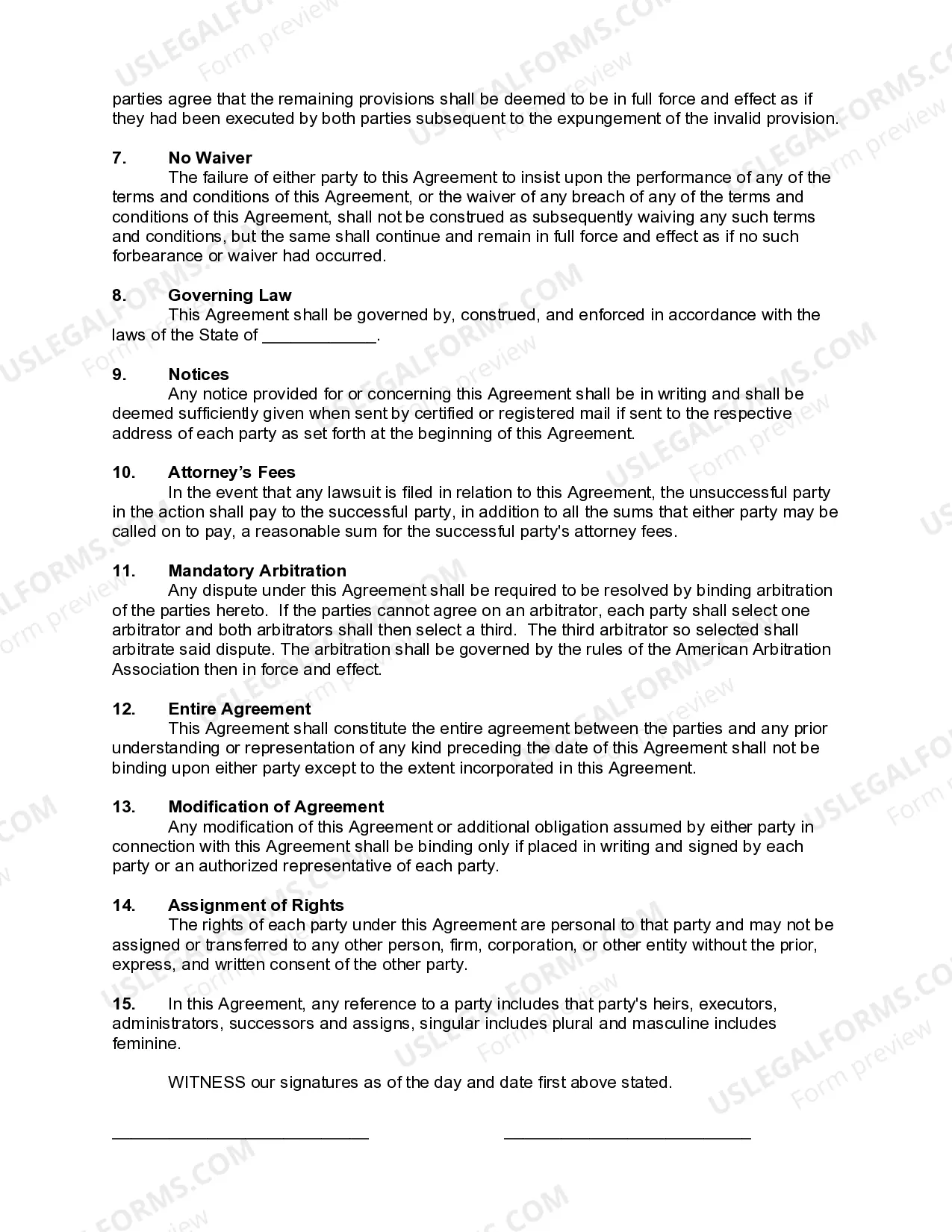

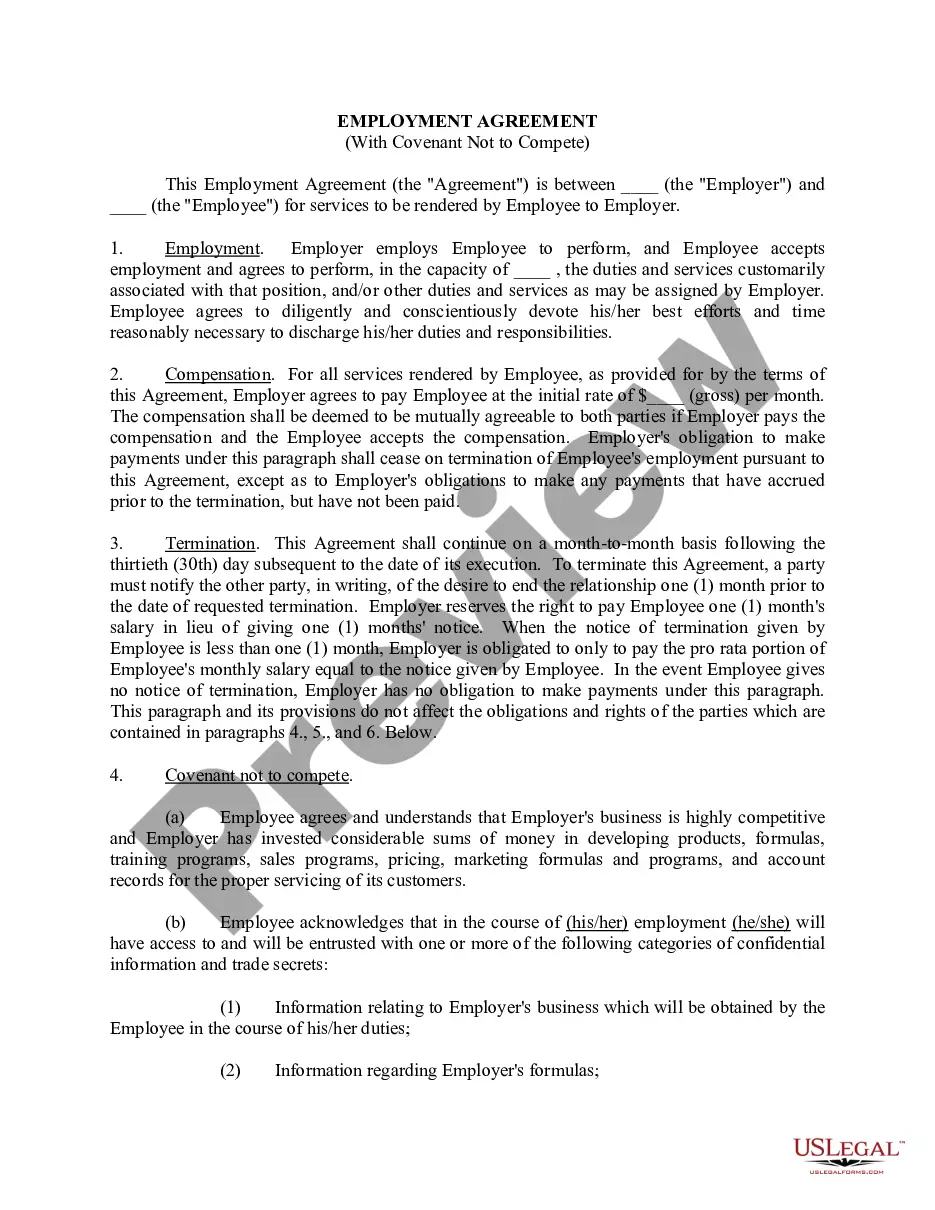

A Washington Venture Capital Finder's Fee Agreement is a document outlining the terms and conditions for compensating individuals or firms who assist in finding potential investment opportunities for venture capital firms in the state of Washington. This agreement serves as a legal contract, ensuring that both parties fully understand their obligations and rights regarding the finder's fees. The main objective of a Washington Venture Capital Finder's Fee Agreement is to establish a fair and mutually beneficial arrangement between the venture capital firm and the finder. It typically includes various key elements such as: 1. Parties involved: The agreement clearly identifies the parties involved, namely the venture capital firm (referred to as the Principal) and the finder (referred to as the Agent). 2. Services provided: The agreement outlines the specific services the Agent will provide in order to identify potential investment opportunities on behalf of the Principal. These services may include research, due diligence, networking, and connection facilitation. 3. Fee structure: The agreement defines the finder's fee structure, specifying the percentage or amount of compensation the Agent will receive if a successful investment is made based on their referral. The fee is usually calculated as a percentage of the investment amount or a fixed amount agreed upon by both parties. 4. Exclusivity: It is common for agreements to include a clause addressing exclusivity, stating whether the Agent has the exclusive right to provide investment opportunities to the Principal for a specified period or if they can work with multiple venture capital firms simultaneously. 5. Confidentiality and non-disclosure: To protect the Principal's proprietary information, the agreement often incorporates confidentiality clauses, emphasizing that the Agent must keep all information shared during the engagement confidential. 6. Term and termination: The agreement specifies the duration of the engagement between the Principal and the Agent, as well as the conditions under which either party can terminate the agreement. Termination clauses commonly include the option for immediate termination and outline procedures for providing notice. Though there may not be distinct types of Washington Venture Capital Finder's Fee Agreement, variations can exist based on customizations desired by the Principal or Agent. These variations might include specific clauses related to geographical restrictions, target industries, preferred company stages (startup, growth, etc.), or investment criteria, among others. In conclusion, a Washington Venture Capital Finder's Fee Agreement is a crucial legal document that outlines the terms and conditions for compensating individuals or firms who assist in sourcing potential investment opportunities for venture capital firms in Washington. Its purpose is to create a clear and fair arrangement between parties involved while protecting proprietary information.