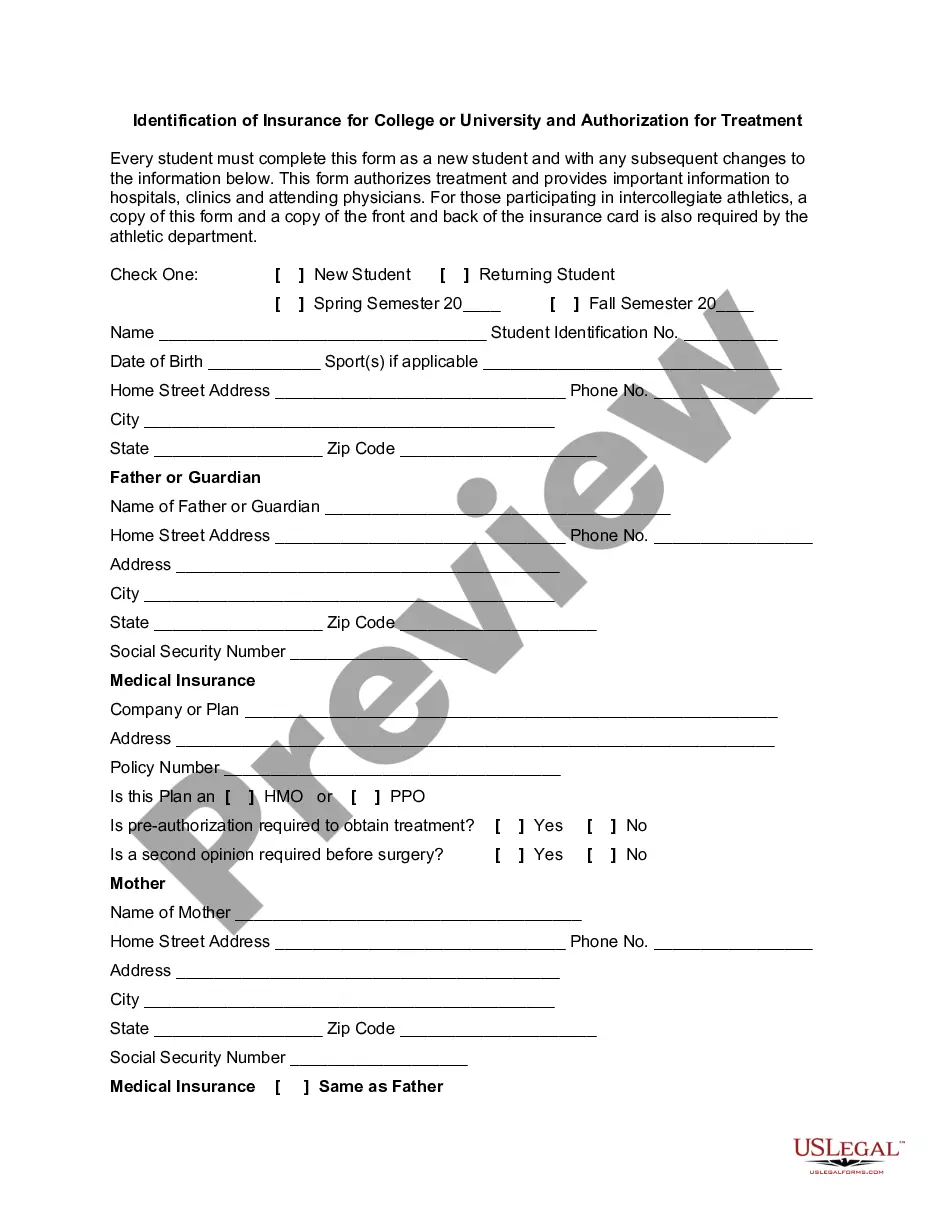

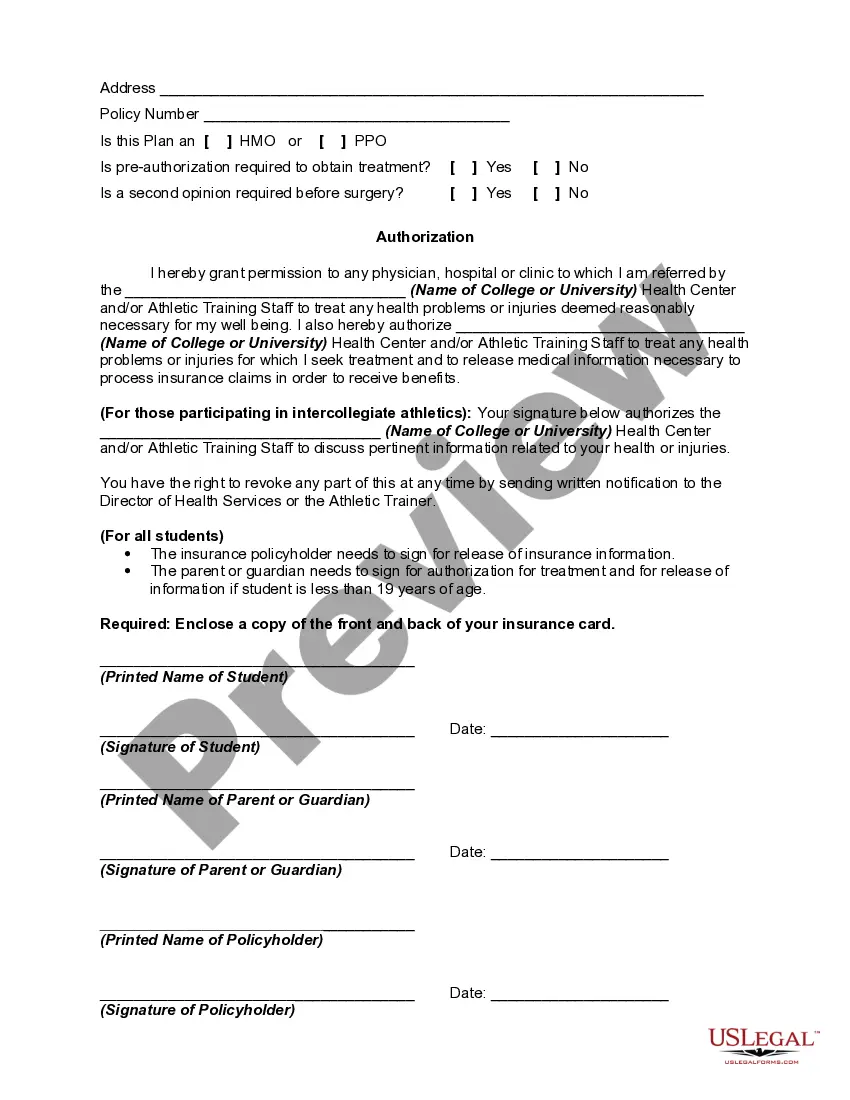

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Washington Identification of Insurance for College or University and Authorization is a crucial document that outlines the insurance coverage requirements for educational institutions in the state of Washington. This document ensures that colleges and universities meet the necessary insurance standards to protect students, faculty, and staff in case of emergencies or unforeseen events. There are several types of Washington Identification of Insurance for College or University and Authorization that are commonly required: 1. General Liability Insurance: This type of insurance provides coverage for bodily injury, property damage, and personal injury claims that may arise on the college or university premises. It protects the institution from potential lawsuits and covers medical expenses or legal fees related to accidents or incidents. 2. Worker's Compensation Insurance: This insurance is essential for colleges and universities as it provides coverage for employees who may sustain work-related injuries or illnesses. It covers medical expenses, rehabilitation, and lost wages for injured or sick workers. 3. Property Insurance: This type of insurance protects the college or university's buildings, facilities, and equipment in case of damage or loss due to fire, theft, vandalism, or natural disasters. It ensures that the institution can quickly recover and continue operating in the aftermath of such events. 4. Professional Liability Insurance: Also known as Errors and Omissions Insurance, this coverage is specifically tailored for colleges and universities that provide professional services such as educational advice and counseling. It offers protection against lawsuits claiming negligence, errors, or omissions in the performance of these services. 5. Cyber Liability Insurance: With colleges and universities relying heavily on technology, this insurance is becoming increasingly important. It provides coverage for data breaches, cyber-attacks, hacking incidents, and other cyber-related risks that may compromise sensitive student or institution information. The Washington Identification of Insurance for College or University and Authorization mandates that educational institutions must obtain and maintain adequate coverage for these types of insurances. The coverage amounts and specific requirements may vary depending on the size of the institution, the number of students enrolled, and other factors. Overall, having the appropriate insurance coverage is crucial for colleges and universities in Washington to ensure the safety and well-being of their students, faculty, and staff, as well as to protect the institution itself from potential financial hardships arising from unforeseen events.The Washington Identification of Insurance for College or University and Authorization is a crucial document that outlines the insurance coverage requirements for educational institutions in the state of Washington. This document ensures that colleges and universities meet the necessary insurance standards to protect students, faculty, and staff in case of emergencies or unforeseen events. There are several types of Washington Identification of Insurance for College or University and Authorization that are commonly required: 1. General Liability Insurance: This type of insurance provides coverage for bodily injury, property damage, and personal injury claims that may arise on the college or university premises. It protects the institution from potential lawsuits and covers medical expenses or legal fees related to accidents or incidents. 2. Worker's Compensation Insurance: This insurance is essential for colleges and universities as it provides coverage for employees who may sustain work-related injuries or illnesses. It covers medical expenses, rehabilitation, and lost wages for injured or sick workers. 3. Property Insurance: This type of insurance protects the college or university's buildings, facilities, and equipment in case of damage or loss due to fire, theft, vandalism, or natural disasters. It ensures that the institution can quickly recover and continue operating in the aftermath of such events. 4. Professional Liability Insurance: Also known as Errors and Omissions Insurance, this coverage is specifically tailored for colleges and universities that provide professional services such as educational advice and counseling. It offers protection against lawsuits claiming negligence, errors, or omissions in the performance of these services. 5. Cyber Liability Insurance: With colleges and universities relying heavily on technology, this insurance is becoming increasingly important. It provides coverage for data breaches, cyber-attacks, hacking incidents, and other cyber-related risks that may compromise sensitive student or institution information. The Washington Identification of Insurance for College or University and Authorization mandates that educational institutions must obtain and maintain adequate coverage for these types of insurances. The coverage amounts and specific requirements may vary depending on the size of the institution, the number of students enrolled, and other factors. Overall, having the appropriate insurance coverage is crucial for colleges and universities in Washington to ensure the safety and well-being of their students, faculty, and staff, as well as to protect the institution itself from potential financial hardships arising from unforeseen events.