Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation is a legal document that outlines the rights and obligations of shareholders in the event of a significant change within a closely held corporation. It helps regulate the transfer of shares and provides a framework for resolving disputes among shareholders. This agreement is pivotal in maintaining the stability and continuity of the corporation's operations. In the state of Washington, there are several types of Buy-Sell Agreements that shareholders of closely held corporations can consider: 1. Cross-Purchase Agreement: This type of agreement allows each shareholder to purchase the shares of a departing shareholder. In this scenario, individual shareholders become buyers, ensuring a smooth transition of ownership within the corporation. 2. Redemption Agreement: A Redemption Agreement states that the corporation itself will redeem the shares of a departing shareholder. The corporation becomes the buyer, providing funds to the departing shareholder in exchange for their shares. This method is often pursued when the shareholders desire simplicity and ease of execution. 3. Hybrid Agreement: As the name suggests, this type of agreement combines elements of both Cross-Purchase and Redemption Agreements. It allows for flexibility and customization based on the specific circumstances of the closely held corporation and its shareholders. 4. Wait-and-See Agreement: This agreement offers flexibility in determining which type of Buy-Sell Agreement — Cross-Purchase or Redemption – will be executed when a triggering event occurs. The shareholders can decide at that time which method is most appropriate based on their needs and the corporation's financial situation. A Washington Buy-Sell Agreement typically includes the following key provisions: — Triggering Events: This section outlines the events that can initiate the buy-sell process, such as the death, disability, retirement, or resignation of a shareholder. It may also include divorce, bankruptcy, or other circumstances that may necessitate a transfer of shares. — Purchase Price and Valuation Method: This provision specifies how the purchase price of the shares will be determined, whether through a fixed price, formula, appraisal, or another agreed-upon method. It helps prevent disputes and ensures fairness in the valuation process. — Funding Mechanism: This section explains the method by which the buying shareholders will finance the purchase, such as through insurance policies or internal financing arrangements. It ensures that sufficient funds are available to execute the buy-sell transaction efficiently. — Right of First Refusal: This provision grants existing shareholders the first opportunity to purchase the shares being offered for sale by a departing shareholder. It helps maintain control and continuity within the closely held corporation. — Terms and Conditions: The agreement will also include additional terms and conditions, such as non-compete clauses, restrictions on share transfers, dispute resolution mechanisms, and confidentiality provisions. These clauses safeguard the corporation's interests and protect the shareholders' rights. In conclusion, a Washington Buy-Sell Agreement between Shareholders of Closely Held Corporations is a vital document that safeguards the interests of shareholders and ensures a smooth transfer of shares in various triggering events. Cross-Purchase, Redemption, Hybrid, and Wait-and-See Agreements are the different types of buy-sell agreements to consider, each offering its own advantages and flexibility. By addressing key provisions like triggering events, purchase price and valuation, funding mechanisms, right of first refusal, and additional terms and conditions, this agreement helps maintain stability and protects the interests of all parties involved.

Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

How to fill out Washington Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

If you want to comprehensive, obtain, or produce lawful file themes, use US Legal Forms, the greatest variety of lawful types, which can be found on the Internet. Utilize the site`s easy and convenient research to obtain the paperwork you will need. Various themes for business and personal uses are categorized by groups and states, or key phrases. Use US Legal Forms to obtain the Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation in a couple of clicks.

Should you be presently a US Legal Forms customer, log in to your bank account and click on the Obtain button to obtain the Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation. You can also access types you earlier downloaded within the My Forms tab of your respective bank account.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your proper city/nation.

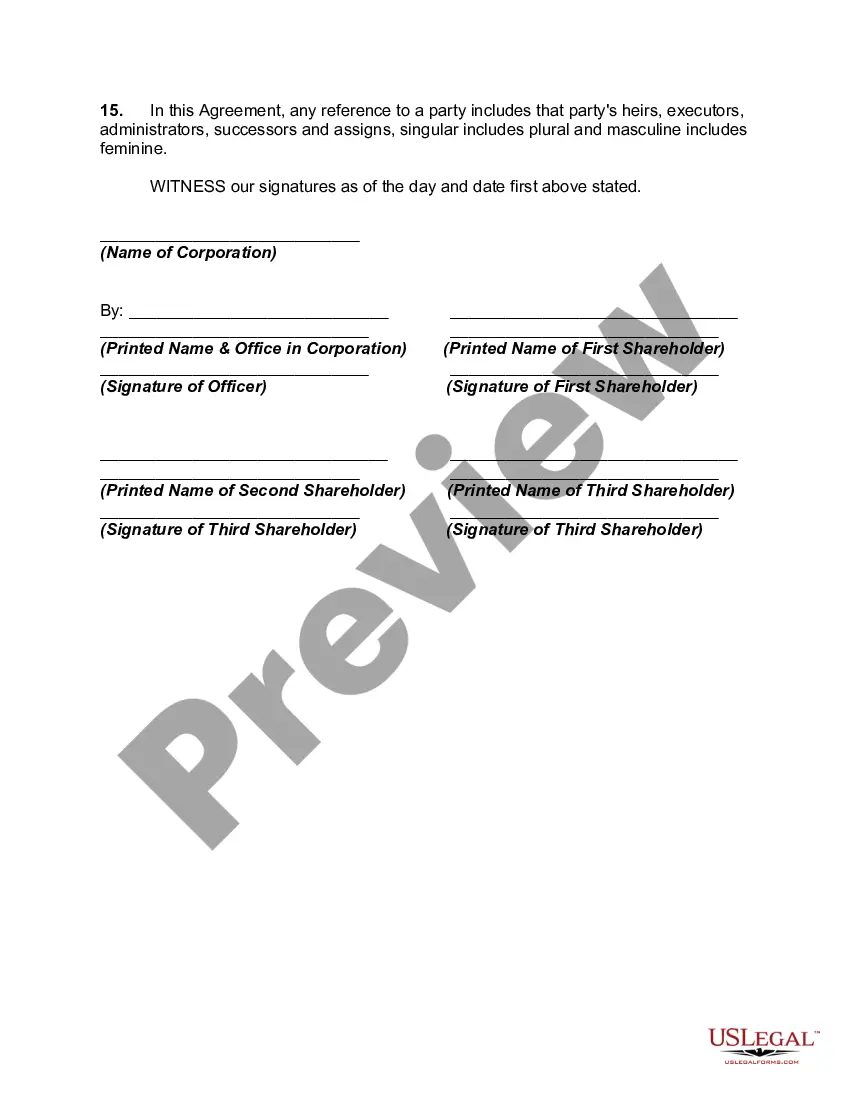

- Step 2. Utilize the Preview solution to look through the form`s content. Do not neglect to read the outline.

- Step 3. Should you be unsatisfied with the kind, utilize the Lookup field at the top of the display screen to discover other variations of the lawful kind design.

- Step 4. Upon having discovered the form you will need, select the Get now button. Pick the prices plan you favor and put your references to sign up for the bank account.

- Step 5. Method the deal. You should use your bank card or PayPal bank account to complete the deal.

- Step 6. Select the file format of the lawful kind and obtain it in your product.

- Step 7. Total, revise and produce or indicator the Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation.

Each and every lawful file design you buy is your own property forever. You have acces to every single kind you downloaded with your acccount. Select the My Forms section and decide on a kind to produce or obtain once again.

Be competitive and obtain, and produce the Washington Buy-Sell Agreement between Shareholders of Closely Held Corporation with US Legal Forms. There are thousands of expert and state-specific types you can use to your business or personal demands.