Washington Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

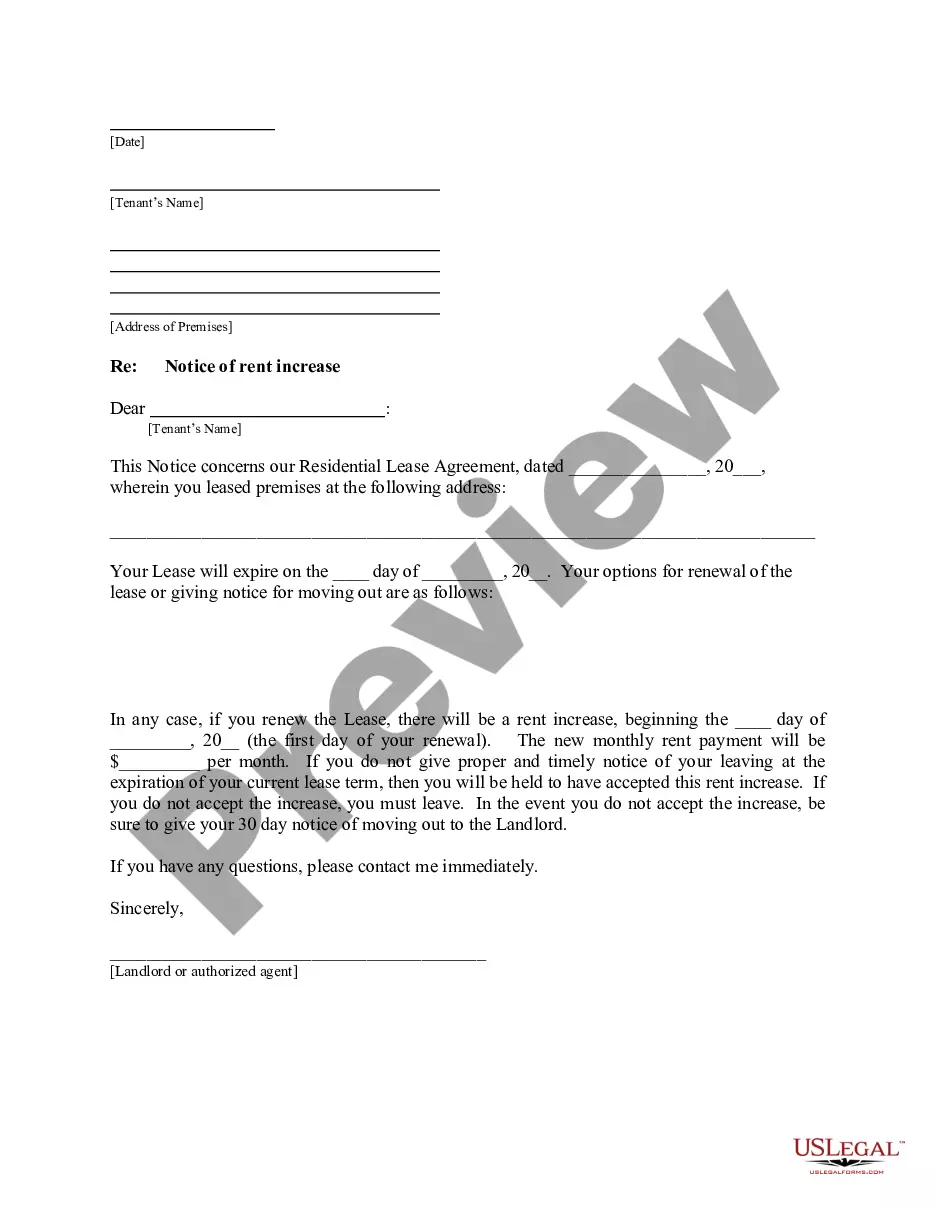

How to fill out Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

It is possible to invest several hours on the Internet attempting to find the authorized papers format which fits the state and federal demands you want. US Legal Forms supplies a large number of authorized forms which can be evaluated by experts. You can actually download or print the Washington Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure from our support.

If you have a US Legal Forms accounts, you are able to log in and click on the Acquire button. After that, you are able to complete, edit, print, or sign the Washington Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure. Every single authorized papers format you buy is yours for a long time. To get an additional version of any bought form, proceed to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms website for the first time, stick to the easy guidelines beneath:

- Initially, make certain you have chosen the proper papers format to the county/town of your liking. See the form explanation to ensure you have picked out the appropriate form. If readily available, take advantage of the Review button to appear through the papers format as well.

- If you wish to locate an additional variation of your form, take advantage of the Lookup area to discover the format that suits you and demands.

- Upon having identified the format you desire, click Get now to carry on.

- Find the pricing prepare you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You should use your credit card or PayPal accounts to pay for the authorized form.

- Find the file format of your papers and download it in your gadget.

- Make changes in your papers if necessary. It is possible to complete, edit and sign and print Washington Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

Acquire and print a large number of papers web templates using the US Legal Forms Internet site, which offers the greatest selection of authorized forms. Use specialist and express-distinct web templates to tackle your small business or specific needs.

Form popularity

FAQ

Ask the Creditor to Take the Debt Back If you want to negotiate directly with the creditor, ask the collection agency for the phone number of the collections department of the original creditor. Then call the creditor and ask if you can negotiate on the debt directly with the creditor.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

A "power of sale provision" is a clause in the loan contract. In this clause, the borrower pre-authorizes the property's sale through a nonjudicial foreclosure process after a default. The sale proceeds pay off all or part of the loan balance.

But what must the creditor provide by way of documentation? At a minimum, it must produce: A copy of the original written agreement between the parties, such as the loan note or credit card agreement, preferably signed by you.

If you're able to do so, pay the original creditor before your debt goes to collections. Having a debt sent to collections will damage your credit score and may limit your options for repayment. In most cases, the original creditor will offer better repayment options than a debt collector will.