Washington Bank Account Monthly Withdrawal Authorization

Description

How to fill out Bank Account Monthly Withdrawal Authorization?

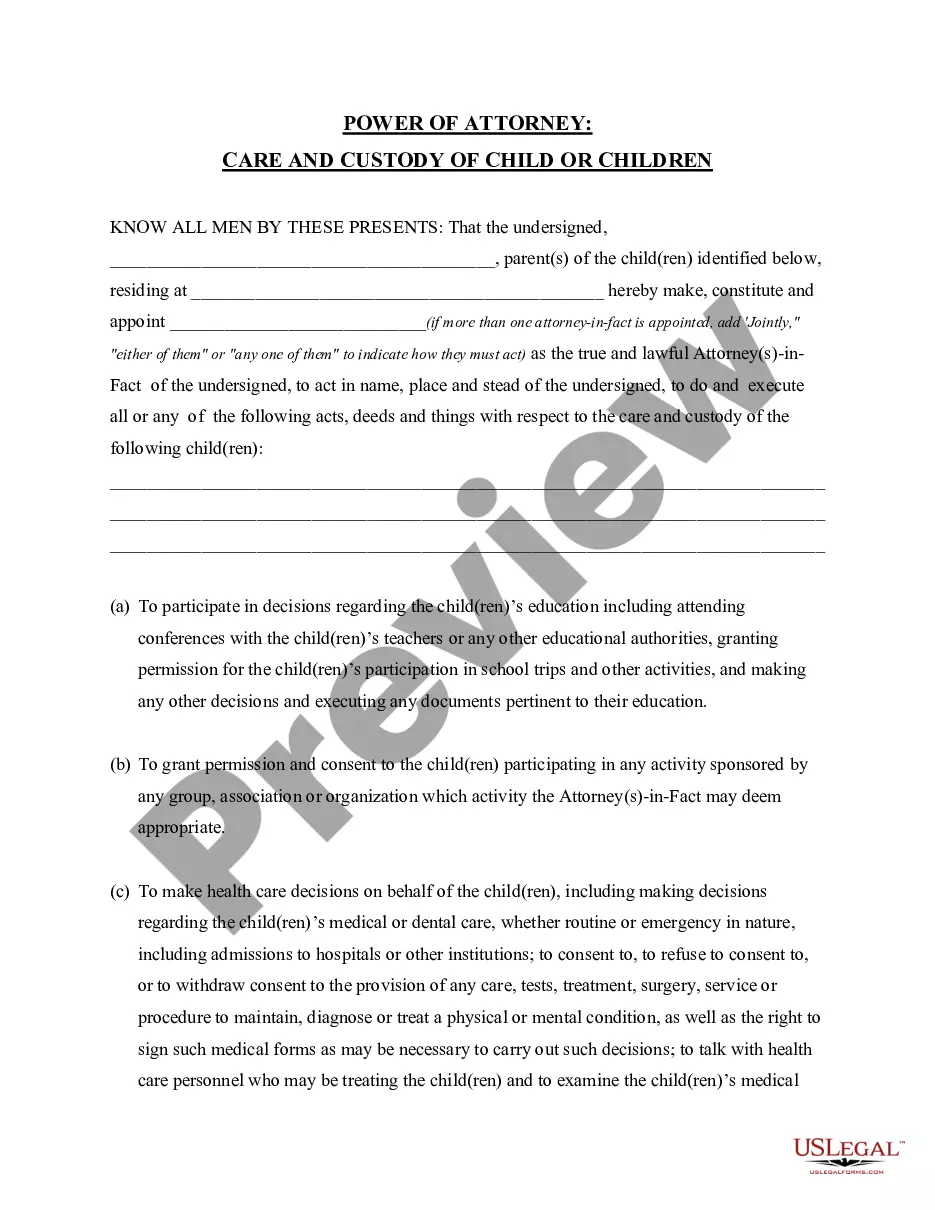

Discovering the right authorized file design might be a have a problem. Of course, there are plenty of layouts accessible on the Internet, but how will you discover the authorized form you require? Make use of the US Legal Forms site. The assistance delivers 1000s of layouts, for example the Washington Bank Account Monthly Withdrawal Authorization, that can be used for organization and personal requires. All of the types are checked out by professionals and meet federal and state demands.

Should you be currently listed, log in to your account and then click the Down load option to have the Washington Bank Account Monthly Withdrawal Authorization. Make use of your account to search through the authorized types you might have bought previously. Visit the My Forms tab of your own account and have one more copy of your file you require.

Should you be a fresh consumer of US Legal Forms, here are basic recommendations that you can stick to:

- Very first, ensure you have chosen the right form for the city/county. You can check out the shape making use of the Review option and study the shape explanation to guarantee it is the best for you.

- In case the form does not meet your preferences, use the Seach area to get the proper form.

- Once you are positive that the shape is proper, click on the Get now option to have the form.

- Opt for the prices plan you want and enter the required info. Design your account and pay for the order using your PayPal account or Visa or Mastercard.

- Pick the file structure and down load the authorized file design to your gadget.

- Total, edit and printing and sign the obtained Washington Bank Account Monthly Withdrawal Authorization.

US Legal Forms is the most significant collection of authorized types where you can find numerous file layouts. Make use of the company to down load professionally-created documents that stick to express demands.

Form popularity

FAQ

Excise taxes are taxes levied on specific goods or services like fuel, tobacco, and alcohol. They are primarily taxes that must be paid by businesses, usually increasing prices for consumers indirectly. Excise taxes can be ad valorem (paid by percentage) or specific (cost charged by unit).

Graduated REET Structure effective Jan. 1, 2023 for the state portion of REET Sale price thresholdsTax rate$525,000 or less1.10%$525,000.01 - $1,525,0001.28%$1,525,000.01 - $3,025,0002.75%$3,025,000.01 or more3%

If you receive a bill from the Department of Revenue for excise tax, you can make your payment over the phone using your credit card. The pay by phone option is only available to taxpayers who receive an invoice from the Department for outstanding excise tax. Call 1-800-2PAY-TAX (1-800-272-9829) (ACI).

Washington law exempts most grocery type food from retail sales tax. However, the law does not exempt ?prepared food,? ?soft drinks,? or ?dietary supplements.? Businesses that sell these ?foods? must collect sales tax. In addition, all alcoholic items are subject to retail sales tax.

Washington State has no income tax. That means income from Social Security, pensions and retirement accounts is all tax-free in Washington. Sales tax rates are quite high and property tax rates are about average. To find a financial advisor who serves your area, try our free online matching tool.

The IRS uses third party payment processors for payments by debit and credit card. It's safe and secure; your information is used solely to process your payment.

IMPORTANT: Please be aware that there is an additional 2.35% fee charged when paying your property tax by credit card. The Assessor-Treasurer's office is prohibited by law from absorbing the fees charged for credit card transactions for property taxes and must contract with an outside vendor to provide this service.