Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

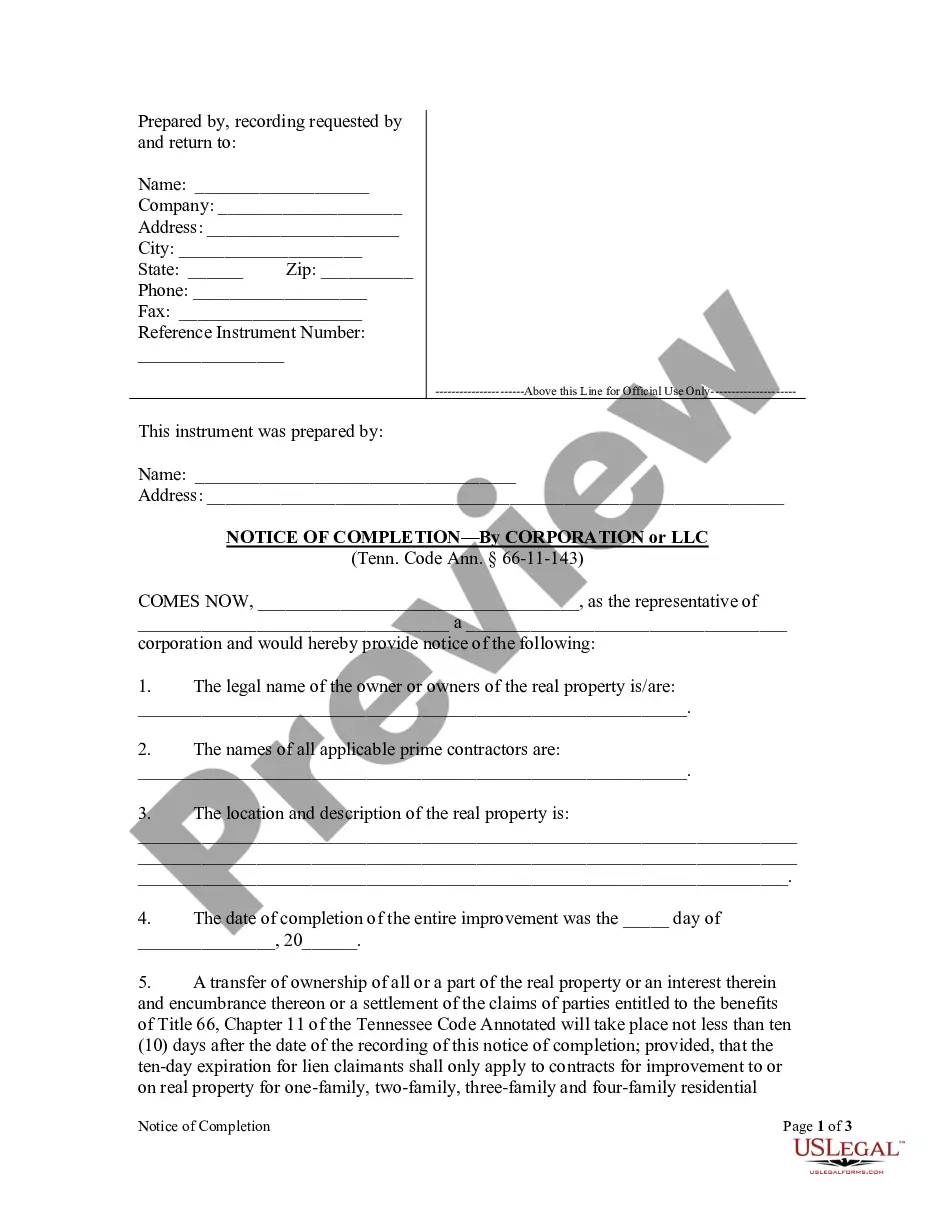

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Washington Objection to Allowed Claim in Accounting refers to a procedure available for disputing and challenging claims made in accounting within the state of Washington. This legal process allows individuals or organizations to reject or object to a claim that has been deemed allowable by the accounting department. The main purpose of the Washington Objection to Allowed Claim is to provide a mechanism for addressing inaccuracies, errors, or discrepancies in accounting records that may have led to an incorrect claim being accepted. This process ensures that claims are thoroughly reviewed and verified for their accuracy and legitimacy. Keywords: Washington objection, allowed claim, accounting, dispute, inaccuracies, errors, discrepancies, review, verification, legal process. Types of Washington Objection to Allowed Claim in Accounting: 1. Inaccuracy Objection: This type of objection arises when the accounting records contain incorrect or inaccurate information that led to the acceptance of the claim. The claimant asserts that the accounting department made a mistake in assessing the validity or accuracy of the claim and seeks a resolution through this objection process. 2. Fraudulent Claim Objection: Sometimes, a claim may be allowed based on fraudulent or deceptive information provided by the claimant. In such cases, individuals or organizations can file an objection, alleging that the claimant intentionally misrepresented facts or withheld important information. This objection aims to uncover fraudulent activities and prevent the disbursement of funds based on false claims. 3. Procedural Error Objection: This type of objection occurs when there are procedural irregularities in the handling of the claim. It could involve errors in processing, incorrect interpretation of regulations, or failure to follow proper accounting procedures. The claimant disputes the acceptance of the claim due to these procedural errors, seeking a fair reassessment and resolution. 4. Calculation Error Objection: In some instances, an objection may be raised concerning the calculation methods used by the accounting department. The claimant argues that the claim amount was incorrectly calculated, leading to an excessive or inadequate allowance. This type of objection focuses on the mathematical accuracy or methodology applied in assessing the claim. 5. Eligibility Objection: An objection relating to claim eligibility arises when the claimant believes they meet the criteria for claiming certain benefits or reimbursements, but the accounting department deems them ineligible. This objection disputes the determination made regarding the claimant's eligibility status, seeking a reconsideration of their case and a possible allowance of the claim. By understanding the various types of objections that can be raised in the Washington Objection to Allowed Claim in Accounting, individuals and organizations can ensure that their claims are thoroughly examined, mistakes are rectified, and fraudulent activities are identified and prevented. This process maintains the integrity of accounting practices while providing a fair avenue for dispute resolution.