Washington Private Annuity Agreement with Payments to Last for Life of Annuity, also known as a Private Annuity or Single Premium Immediate Annuity, is a legal contract established between two parties, where an annuitant transfers their assets in exchange for a guaranteed income stream for their lifetime. This agreement primarily focuses on ensuring a secure and steady source of income during retirement. Under the Washington Private Annuity Agreement, the annuitant relinquishes ownership of certain assets, typically real estate or a business, to the counterparty known as the annuity issuer, in return for regular payments that last until their demise. The annuitant becomes the recipient of a predetermined sum of money, which can be paid out monthly, quarterly, annually, or in any other agreed-upon frequency. These payments are guaranteed and remain constant throughout the annuitant's lifetime, providing financial stability and peace of mind. One variant of the Washington Private Annuity Agreement allows for a joint annuitant. In this case, two individuals, often spouses, can establish an agreement together, ensuring the continuation of annuity payments until the last surviving individual's death. This type of joint annuity agreement provides an extra layer of security by extending the income stream even after the primary annuitant's passing. The Washington Private Annuity Agreement offers several key benefits for both parties involved. For the annuitant, it guarantees a fixed income throughout their lifetime, protecting them from potential financial uncertainties and market fluctuations. It also enables tax-deferred growth on the assets transferred, as the annuitant is not subject to immediate capital gains tax upon the agreement's execution. From the issuer's perspective, the Washington Private Annuity Agreement allows for future asset acquisition without immediate payment, as the issuer receives the assets in exchange for the promise of annuity payments. This arrangement can be advantageous for estate planning purposes, minimizing potential estate taxes and facilitating the transfer of assets to desired beneficiaries. It is essential to note that the Washington Private Annuity Agreement must adhere to state laws and regulations specific to Washington State. Therefore, it is crucial for both parties to consult with legal and financial professionals who are well-versed in Washington State laws, taxation, and annuity regulations to ensure compliance and make informed decisions regarding their financial future. In conclusion, the Washington Private Annuity Agreement with Payments to Last for Life of Annuity is a contractual arrangement aimed at providing a steady income stream throughout an individual's lifetime. This agreement offers a secure and reliable method for asset transfer while ensuring financial stability and peace of mind for the annuitant during their retirement years.

Washington Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

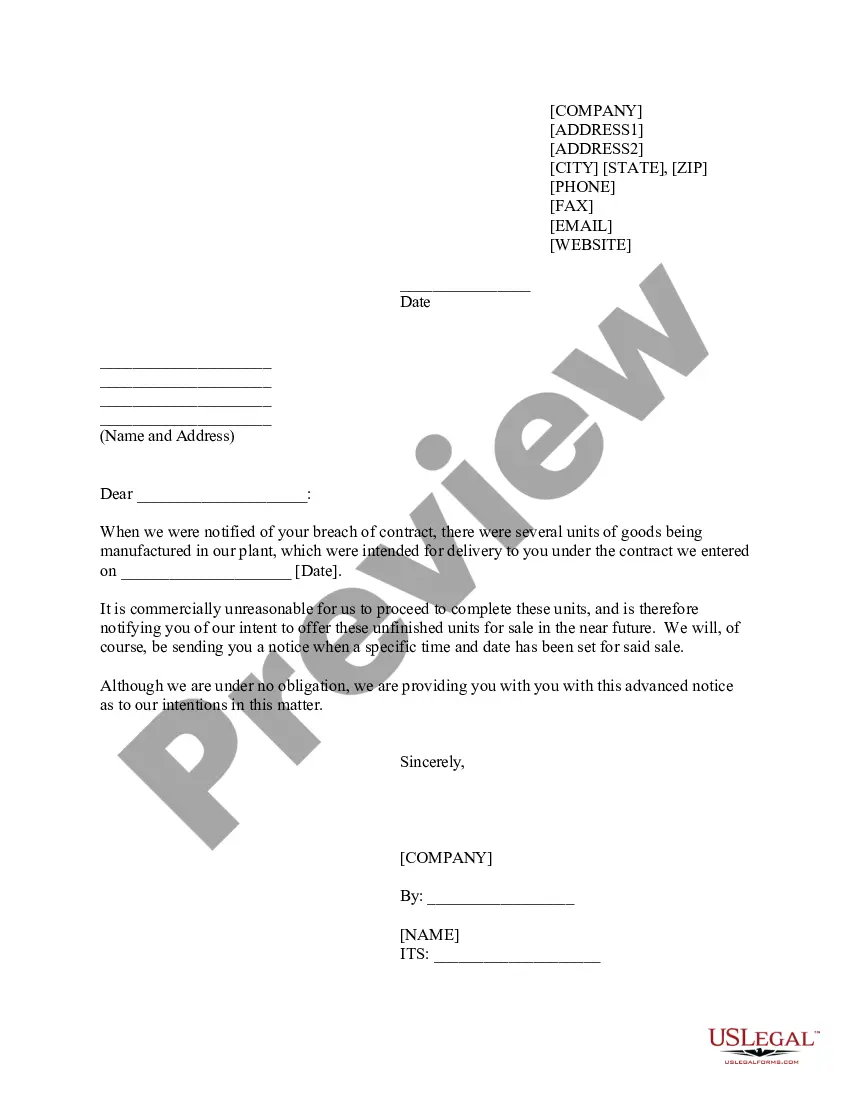

How to fill out Washington Private Annuity Agreement With Payments To Last For Life Of Annuitant?

If you wish to full, obtain, or printing authorized document web templates, use US Legal Forms, the greatest variety of authorized forms, which can be found on the web. Utilize the site`s simple and hassle-free research to find the documents you will need. Various web templates for company and personal uses are categorized by groups and claims, or key phrases. Use US Legal Forms to find the Washington Private Annuity Agreement with Payments to Last for Life of Annuitant with a couple of mouse clicks.

When you are currently a US Legal Forms buyer, log in for your account and then click the Down load switch to obtain the Washington Private Annuity Agreement with Payments to Last for Life of Annuitant. You may also access forms you previously saved within the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for that appropriate town/region.

- Step 2. Utilize the Review option to look over the form`s information. Never overlook to see the information.

- Step 3. When you are not satisfied together with the form, utilize the Lookup field towards the top of the screen to find other variations of the authorized form design.

- Step 4. Once you have found the form you will need, select the Acquire now switch. Select the rates plan you favor and add your qualifications to register on an account.

- Step 5. Approach the deal. You may use your charge card or PayPal account to perform the deal.

- Step 6. Pick the file format of the authorized form and obtain it on the product.

- Step 7. Complete, modify and printing or sign the Washington Private Annuity Agreement with Payments to Last for Life of Annuitant.

Every single authorized document design you get is your own property for a long time. You might have acces to each form you saved within your acccount. Click the My Forms portion and pick a form to printing or obtain again.

Be competitive and obtain, and printing the Washington Private Annuity Agreement with Payments to Last for Life of Annuitant with US Legal Forms. There are many expert and state-distinct forms you may use for your company or personal requires.