Washington General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Are you presently in the circumstance where you require documents for either business or personal reasons nearly every day.

There is a multitude of legal document templates accessible online, but locating forms you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable, which is designed to comply with state and federal regulations.

When you discover the correct form, simply click Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or credit card. Choose a convenient file format and download your copy. Retrieve all of the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable at any time, if necessary. Just click the required form to download or print the document template. Use US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for your appropriate city/county.

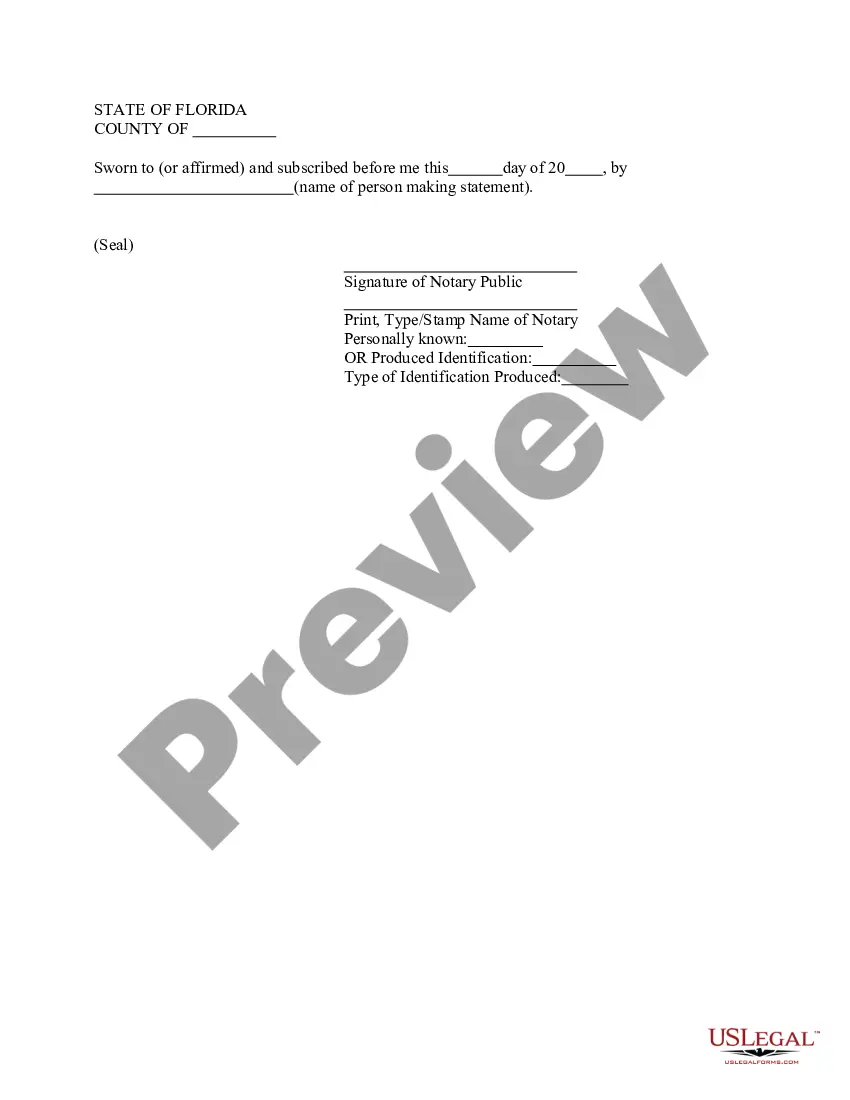

- Utilize the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

To get a notice of assignment, start by reviewing the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable. Typically, this document outlines the process for notification. You may need to contact your factor or financial institution that handles the factoring arrangement. They will guide you through the necessary steps to obtain your notice efficiently.

A Noa, or Notice of Assignment, in finance refers to a formal document that informs involved parties about the assignment of financial rights or debts. When you utilize the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable, the Noa communicates to your customers where to send their payments. This practice enhances clarity in financial transactions and prevents misunderstandings. For easy access to Noa templates, consider checking out US Legal Forms.

In accounting, Noa typically stands for 'Notice of Assignment.' This document serves as a formal notification regarding the transfer of rights to collect a debt or receive payment. In scenarios involving the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable, this notice is vital for informing your clients about the new payment arrangements. You can find templates for creating a Noa through resources like US Legal Forms.

You can obtain a notice of assignment from the factoring company once you enter into an agreement, such as the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable. This notice informs your customers that the invoices have been assigned to the factor. It is crucial for keeping your dealings transparent and ensuring that your customers send payments to the right entity. If you need assistance with this document, US Legal Forms offers templates to help streamline the process.

A Notice of Assignment (Noa) in factoring is a formal communication sent to account debtors, informing them that their receivables have been assigned to a third party. This document ensures that payments are directed to the factor and not the original creditor. Having the Washington General Form of Factoring Agreement - Assignment of Accounts Receivable can help facilitate this communication effectively. By including such notifications, you maintain transparency and uphold trust with your clients.

Note: $20,000 factor fee is considered interest expense because the company obtained cash flow earlier than it would have if it waited for the receivables to be collected.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

Follow these tips to ensure efficient and effective accounts receivable management.Use Electronic Billing & Payment.Outline Clear Billing Procedures.Set Credit & Collection Policies and Stick to Them.Be Proactive.Set up Automations.Make It Easy for Customers.Use the Right KPIs.Involve All Teams in the Process.

There are three accounts which need to be created to account for a factoring relationship based on With Recourse Conditions, including the following:FIZ Factored Invoices Sold: a contra asset account.FIR Factored Invoice Reserve: an asset account.FFE Factored Fees Expense: an expense account.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.