Section 16(b) of Fair Labor Standards Act is found in 29 U.S.C. 201, et seq. The Fair Labor Standards Act (FLSA) is a federal act that is sometimes referred to as the minimum wage law. It also deals with child labor, overtime pay requirements, and equal pay provisions. to be shipped in interstate commerce. Coverage of the FLSA is very broad. Almost all businesses could be said to be involved in interstate commerce in some way. Exemptions to the Act are very specifically defined.

A corporate employer obviously can be liable under the Act, but individual officers can also be held liable. Anyone who actively participates in the running of the business can be liable. Payment of unpaid wages plus a penalty is the usual penalty for violation of the minimum wage or overtime provisions of the Act. However, fines of up to $10,000 and/or imprisonment for up to six months are possible for willful violations. A willful violation of the Act occurs when you know that you are clearly violating the Act but do it anyway.

Enforcement of the FLSA can result from an employee filing a complaint with the Wage and Hour Dept. of the Department of Labor or by the Dept. of Labor initiating its own investigation. Random audits are not uncommon, but audits generally result from a formal or informal complaint of an employee. Employers are prohibited by the FLSA from firing an employee for making a complaint or participating in a Dept. of Labor investigation.

The FLSA requires that nonexempt employees be paid 1.5 times their regular rate of pay for time work in excess of 40 hours. Salaried employees also are entitled to overtime payment unless they come under one of the white collar exemptions. To compute overtime payment due to a salaried employee, you divide their regular wage (figured as a weekly wage) by the number of hours they normally work in a week and then multiply it by 1.5 to get the amount they would receive for hours worked in excess of 40.

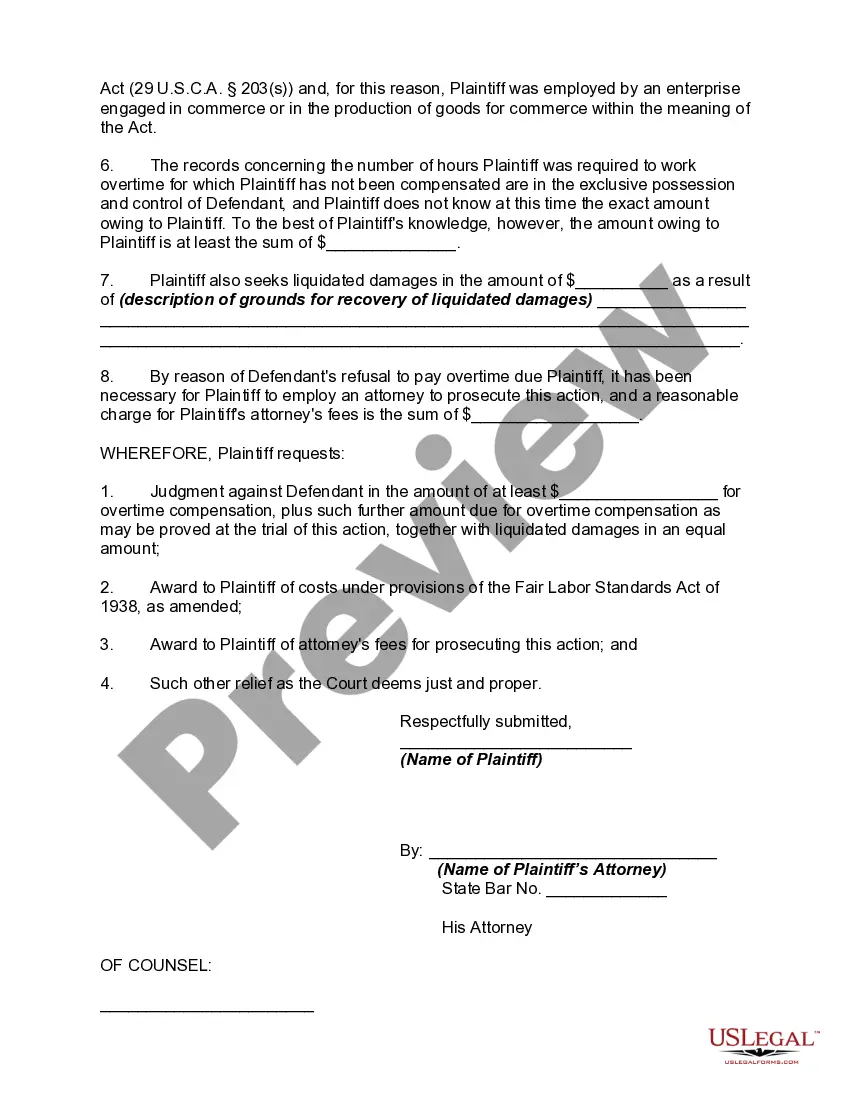

Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of Fair Labor Standards Act is a legal remedy available for employees in Washington state who have not been properly paid for overtime work or wages under federal law. This complaint is filed in state court and seeks to recover the unpaid compensation with additional liquidated damages and attorney fees as provided under the Fair Labor Standards Act (FLEA). Section 16(b) of the FLEA addresses the rights of employees to recover unpaid overtime compensation or wages. It allows employees to file a complaint against their employer in state court to seek redress for violations of federal overtime laws. The aim is to ensure that employees receive the wages they are entitled to when they work more than the standard 40 hours per workweek. There are different types of Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act. Some of these include: 1) Individual Complaint: An individual employee files a complaint against their employer alleging unpaid overtime compensation or wages. The complaint must include details of the employee's work hours, the amount of unpaid compensation, and any applicable evidence supporting their claim. 2) Collective Action: In certain cases, multiple employees who have similar complaints against the same employer may choose to join together in a collective action. This allows them to pool their resources and strengthen their case against the employer for non-compliance with federal overtime laws. 3) Class Action: In some situations, a class of employees that share common issues regarding unpaid overtime compensation or wages may file a class action complaint. This involves one or more representative employees (named plaintiffs) filing the complaint on behalf of the entire class. This approach can streamline the legal process and ensure consistent treatment for all affected employees. When filing a Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act, it is important to include relevant keywords to strengthen the complaint's legal standing. These may include terms such as "FLEA violations," "unpaid overtime," "minimum wage violations," "liquidated damages," "statute of limitations," "independent contractors' misclassification," "record-keeping violations," and "attorney fees." In conclusion, a Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act is a legal instrument used by employees to seek remuneration for unpaid overtime work or wages. By filing such a complaint, individuals or groups can pursue their rights under federal laws that protect workers' financial interests.Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of Fair Labor Standards Act is a legal remedy available for employees in Washington state who have not been properly paid for overtime work or wages under federal law. This complaint is filed in state court and seeks to recover the unpaid compensation with additional liquidated damages and attorney fees as provided under the Fair Labor Standards Act (FLEA). Section 16(b) of the FLEA addresses the rights of employees to recover unpaid overtime compensation or wages. It allows employees to file a complaint against their employer in state court to seek redress for violations of federal overtime laws. The aim is to ensure that employees receive the wages they are entitled to when they work more than the standard 40 hours per workweek. There are different types of Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act. Some of these include: 1) Individual Complaint: An individual employee files a complaint against their employer alleging unpaid overtime compensation or wages. The complaint must include details of the employee's work hours, the amount of unpaid compensation, and any applicable evidence supporting their claim. 2) Collective Action: In certain cases, multiple employees who have similar complaints against the same employer may choose to join together in a collective action. This allows them to pool their resources and strengthen their case against the employer for non-compliance with federal overtime laws. 3) Class Action: In some situations, a class of employees that share common issues regarding unpaid overtime compensation or wages may file a class action complaint. This involves one or more representative employees (named plaintiffs) filing the complaint on behalf of the entire class. This approach can streamline the legal process and ensure consistent treatment for all affected employees. When filing a Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act, it is important to include relevant keywords to strengthen the complaint's legal standing. These may include terms such as "FLEA violations," "unpaid overtime," "minimum wage violations," "liquidated damages," "statute of limitations," "independent contractors' misclassification," "record-keeping violations," and "attorney fees." In conclusion, a Washington Complaint to Recover Overtime Compensation or Wages in State Court under Section 16(b) of the Fair Labor Standards Act is a legal instrument used by employees to seek remuneration for unpaid overtime work or wages. By filing such a complaint, individuals or groups can pursue their rights under federal laws that protect workers' financial interests.