Washington Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a vast selection of legal template files that you can either download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms, including the Washington Bill of Sale by Corporation of all or nearly all of its Assets, within moments.

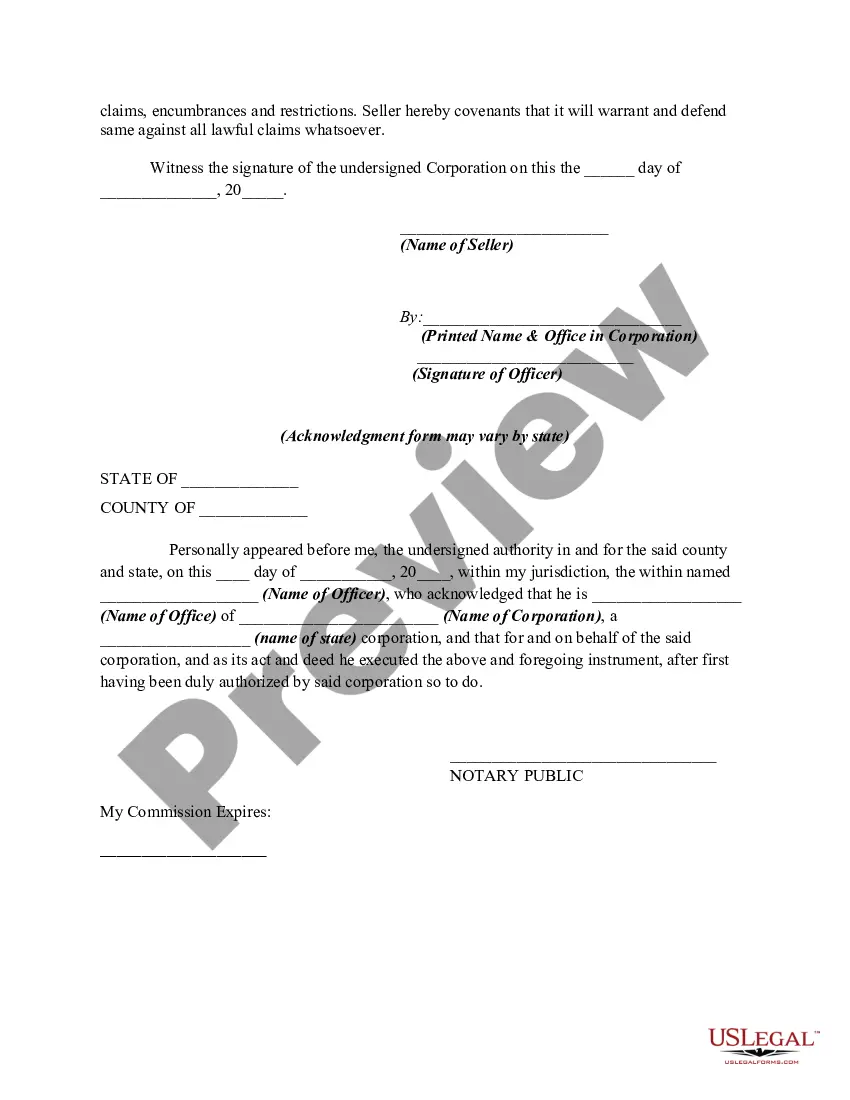

Click the Preview button to examine the content of the form. Check the form overview to confirm you have selected the right document.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you have an active monthly subscription, Log In and retrieve the Washington Bill of Sale by Corporation of all or nearly all of its Assets from the US Legal Forms library.

- The Obtain button will be visible on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are a first-time user of US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

Form popularity

FAQ

The sale of stock in a corporation is primarily regulated by state securities laws and federal laws. Each state has specific regulations that govern corporate stock sales, often requiring filings or disclosures to ensure transparency. When dealing with the transfer of assets, such as in the case of a Washington Bill of Sale by Corporation of all or Substantially all of its Assets, it is essential to comply with both state and federal requirements. Using legal resources like US Legal Forms can ensure you have the proper documents to navigate these regulations effectively.

No, Washington state does not impose a state income tax, making it unique among U.S. states. This absence of an income tax can lead to significant savings for residents. Instead, the state relies on other forms of taxation, such as sales tax and property tax. Individuals and corporations can benefit from this tax structure, particularly when conducting transactions like those involving a Washington Bill of Sale by Corporation of all or Substantially all of its Assets.

In Washington, residents can take advantage of charitable deductions for contributions to qualified organizations when filing federal taxes. However, while Washington does not impose a state income tax, individuals may need to adhere to federal regulations regarding deductions. Utilizing a charitable contribution can be an effective way to support causes while managing your tax liabilities. Incorporating a Washington Bill of Sale by Corporation of all or Substantially all of its Assets for asset donations can streamline this process.

To avoid capital gains tax on stocks in Washington, consider holding onto your assets for over a year to qualify for long-term capital gains treatment. Additionally, you might explore tax-loss harvesting to offset gains with losses. Planning your investment sales strategically can help minimize tax implications. Always consult a tax professional for specific advice, especially when dealing with the Washington Bill of Sale by Corporation of all or Substantially all of its Assets.

To dissolve a Washington state corporation, you must file a Certificate of Dissolution with the Secretary of State. Ensure you settle any remaining debts, obligations, and taxes before proceeding. Doing this properly can help protect you from future liabilities. In addition, consider executing a Washington Bill of Sale by Corporation of all or Substantially all of its Assets for any transfers of property during the dissolution process.

In Washington, a corporation is considered principally directed or managed when its main business activities occur within the state. This includes key decision-making processes and operational leadership. Understanding the management structure helps ensure compliance with state laws, including the use of a Washington Bill of Sale by Corporation of all or Substantially all of its Assets for asset transfers.

To avoid paying capital gains tax on inherited property in Washington, utilize the step-up basis feature. This adjusts the property's value to its fair market value at the time of inheritance. If you sell the property, your capital gains tax liability may be minimized. Consider using a Washington Bill of Sale by Corporation of all or Substantially all of its Assets to facilitate the transfer of ownership efficiently.

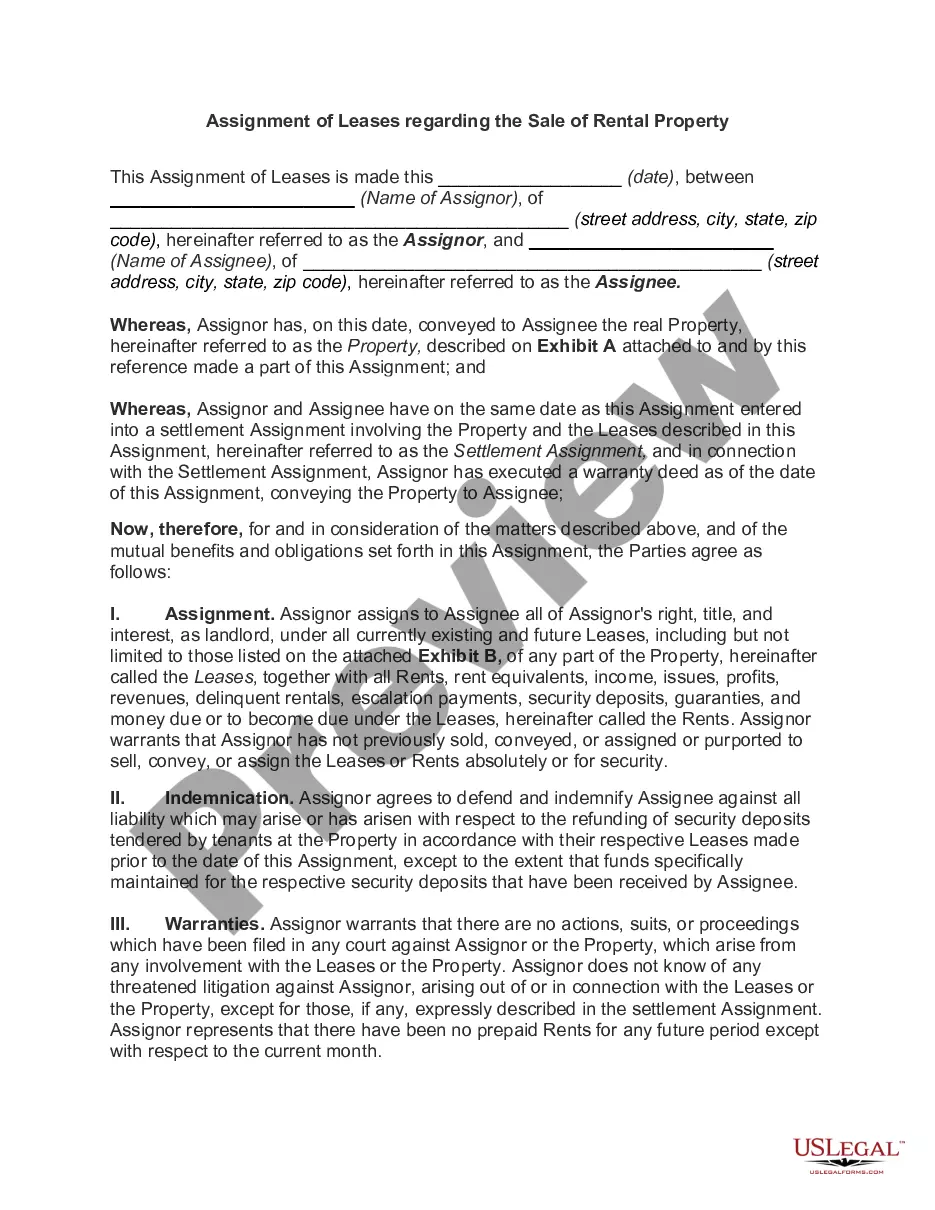

The sale of all or substantially all of the assets refers to a transaction where a corporation transfers the majority of its assets to another entity. This can be a strategic decision influenced by various factors, such as market conditions or business realignment. Utilizing the Washington Bill of Sale by Corporation of all or Substantially all of its Assets helps establish a clear and legally sound process for this significant change.

The sale of a company generally requires approval from both the board of directors and the shareholders. The board evaluates the sale's terms and potential benefits, then presents it to the shareholders for a vote. This process is essential for the transactions outlined by the Washington Bill of Sale by Corporation of all or Substantially all of its Assets, ensuring that all parties' interests are honored.

A sale of substantially all assets typically involves transferring the majority of a corporation's tangible and intangible assets. This can include inventory, real estate, patents, and customer lists, creating a significant change in the corporation's structure or business operations. The Washington Bill of Sale by Corporation of all or Substantially all of its Assets defines this transfer, ensuring transparency and compliance with legal standards.