Washington Annual Expense Report

Description

How to fill out Annual Expense Report?

If you need to finalize, obtain, or create legal document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Make use of the site's straightforward and convenient search feature to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Washington Annual Expense Report in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click the Download button to access the Washington Annual Expense Report.

- You can also reach forms you previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have chosen the form for your specific city/state.

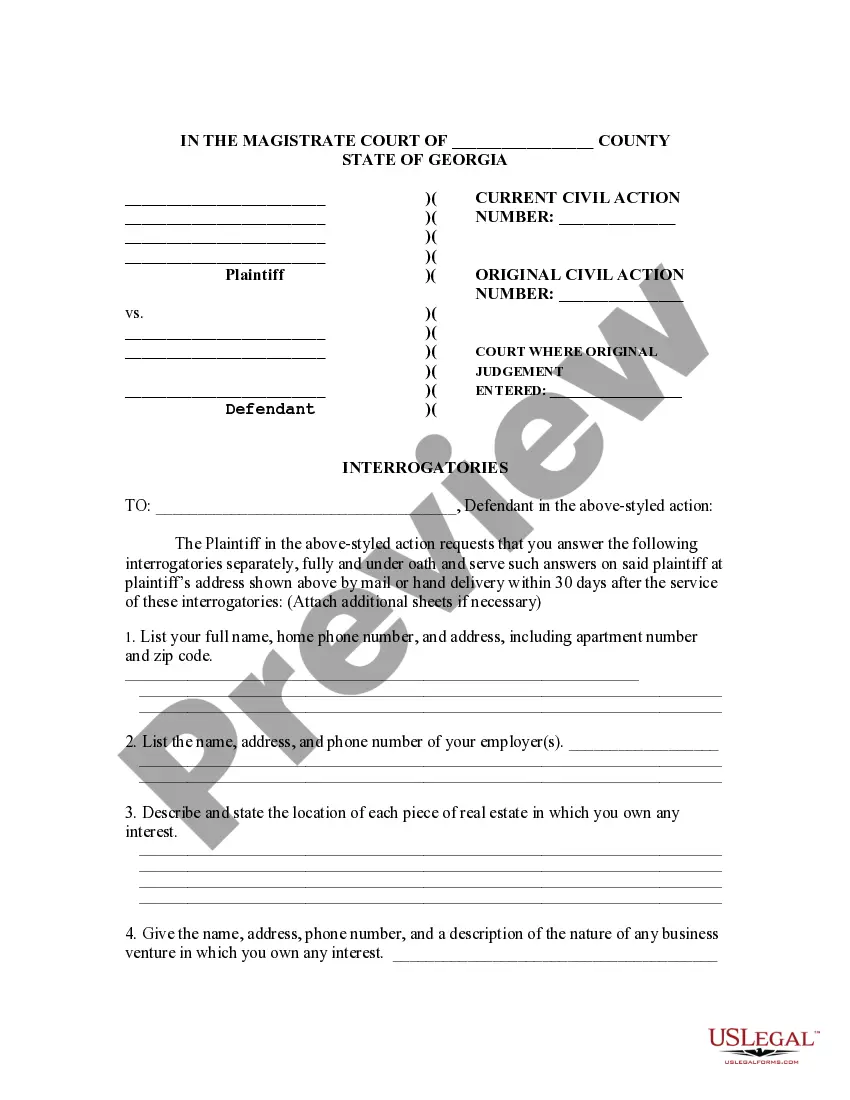

- Step 2. Use the Preview option to review the form's content. Be sure to read the explanation carefully.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To find a company's annual report, you can start by visiting the Washington Secretary of State's website. Many businesses publish their reports online for easy public access. Additionally, if you need assistance, platforms like US Legal Forms can guide you in obtaining the Washington Annual Expense Report from businesses you are interested in.

If you own a business entity in Washington, you are required to file an annual report. This requirement applies to various business structures, including LLCs and corporations. Filing the Washington Annual Expense Report is not just about keeping your business compliant; it also helps you remain informed about your company's financial standing.

Yes, you need to renew your LLC every year in Washington state by filing the annual report. This is part of maintaining your LLC's active status and compliance with state regulations. The Washington Annual Expense Report plays a crucial role in this renewal process.

Filing an annual report is mandatory for most businesses in Washington. This requirement helps the state maintain accurate business information and allows you to keep your licensure up to date. By submitting the Washington Annual Expense Report, you fulfill legal obligations while showcasing your business's commitment to transparency.

Yes, Washington requires businesses to file an annual report. This report is essential for maintaining your business's good standing in the state. By filing the Washington Annual Expense Report, you provide updated information about your business activities and ensure compliance with state laws.

Most states in the U.S. require some form of annual reporting, including Washington. The requirements vary by state, so it's important to check each state's regulations to understand their specific needs. For instance, Washington mandates the filing of the Washington Annual Expense Report for all registered businesses.

Failing to file your Washington Annual Expense Report can lead to significant consequences for your LLC. The state may impose fines and penalties, and your business could lose its good standing. In severe cases, your LLC may be administratively dissolved, which can complicate future operations. To avoid such outcomes, consider using U.S. Legal Forms to ensure you stay compliant with all filing obligations.

To file your Washington Annual Expense Report, gather your LLC's official name, the state of formation, and the principal office address. You will also need information on your registered agent and any relevant financial statements. If you're unsure, U.S. Legal Forms can simplify the preparation of the required documents and ensure you meet all filing requirements.

Filing your Washington Annual Expense Report is a straightforward process. Begin by visiting the Washington Secretary of State's website where you can submit your report online. You will need to provide your business information and follow the prompts to ensure all necessary details are included. For added convenience, consider using U.S. Legal Forms to guide you through the filing process.

To prepare an annual report, start by collecting your financial data and documenting your company's performance over the past year. Summarize operational highlights, financial metrics, and future goals for clarity. Organizing these elements into a coherent format will enhance readability and effectiveness. You can simplify this task with the assistance of US Legal Forms, offering easy-to-use templates specifically for crafting a Washington Annual Expense Report.