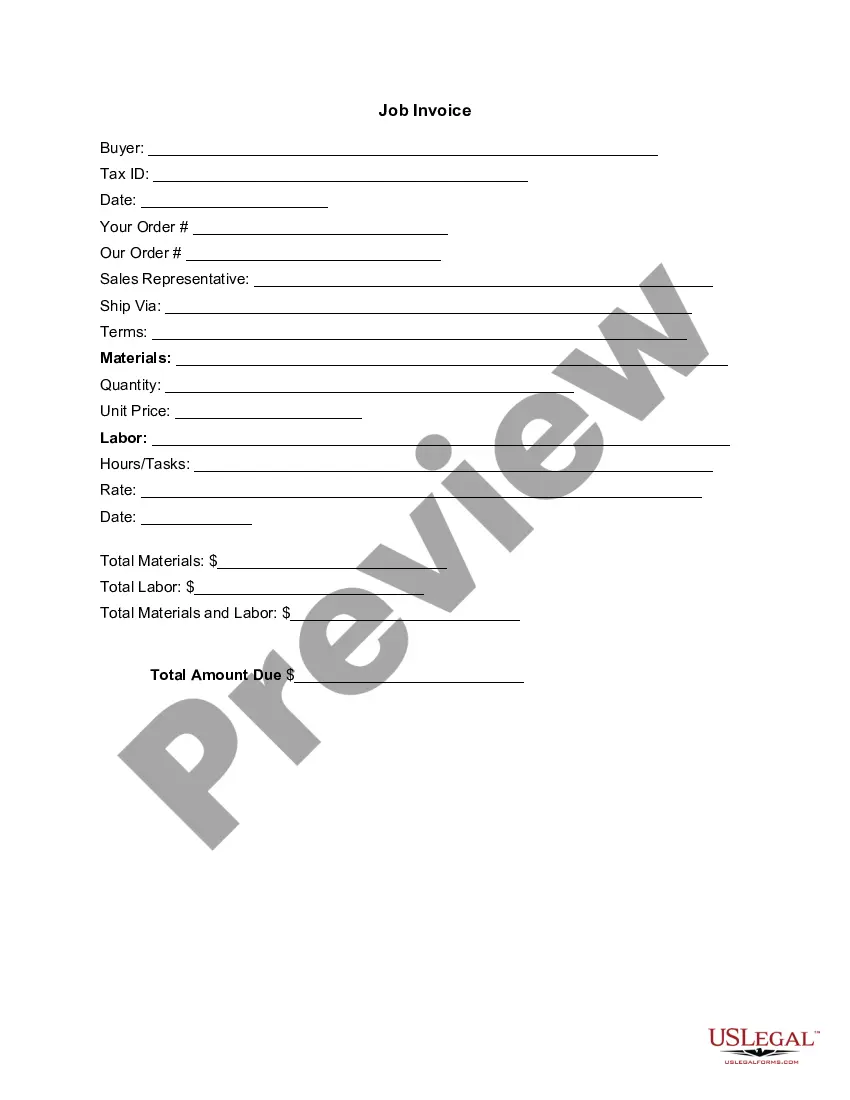

Washington Invoice Template for Independent Contractor: Simplify Your Billing Process If you're an independent contractor based in Washington, having a comprehensive and professional invoice template is crucial to ensuring seamless payment management and maintaining a strong business relationship with your clients. A Washington Invoice Template for Independent Contractors helps you streamline the invoicing process, allowing you to focus more on your core expertise while getting paid promptly and accurately. Let's delve into the specifics of this indispensable tool and explore the various types available to cater to different needs. The Washington Invoice Template for Independent Contractors is a pre-designed document that encapsulates all the vital elements required for creating an invoice. It saves you time and effort by providing a structured format, enabling you to easily list your services, expenses, rates, and any applicable taxes. By utilizing this template, you can effortlessly create professional and compliant invoices, leaving a positive impression on your clients. Key features of a Washington Invoice Template for Independent Contractors: 1. Essential fields: The template includes key fields such as your contact information, client's details, invoice number, issue date, payment terms, and due date. Ensuring all necessary information is included avoids misunderstandings and potential payment delays. 2. Service description: Clearly outline the services you provided for your client. Include detailed descriptions, hours worked, or items sold. This level of transparency helps your client understand the value of your work. 3. Hourly rates or flat fees: Depending on your agreement with the client, the template allows you to specify either hourly rates or flat fees for the services rendered. This ensures clarity regarding pricing and aids in the swift completion of payments. 4. Expense tracking: If you have any reimbursable expenses, such as travel costs or materials, you can include a section to itemize and calculate them. This allows you to provide a comprehensive overview of all billable expenses. 5. Tax compliance: Washington Invoice Templates for Independent Contractors adhere to state tax regulations, making it conspicuous where applicable sales taxes are due. This eliminates confusion regarding tax calculations and provides transparency for both parties. Now, let's explore the different types of Washington Invoice Templates for Independent Contractors: 1. Basic Invoice Template: Suitable for contractors offering straightforward services, it includes all essential invoice components and is easily customizable. 2. Time-based Invoice Template: Ideal for contractors charging hourly rates, this template emphasizes tracking billable hours accurately while allowing flexibility for multiple projects. 3. Project-based Invoice Template: Designed for independent contractors working on fixed-price contracts or projects, it focuses on outlining project milestones, deliverables, and associated costs. 4. Expenses Invoice Template: Specifically tailored for contractors incurring various reimbursable expenses, this template ensures easy tracking and reimbursement. 5. Recurring Invoice Template: For those providing ongoing services, this template automates the billing process by generating recurring invoices at specified intervals. By utilizing a Washington Invoice Template for Independent Contractors, you can enhance your professionalism, streamline your invoicing procedures, and maintain efficient cash flow management. This ultimately enables you to focus on delivering exceptional services while ensuring prompt payment for your hard work.

Washington Invoice Template for Independent Contractor

Description

How to fill out Invoice Template For Independent Contractor?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest forms, such as the Washington Invoice Template for Independent Contractor, in just seconds.

If you already have an account, sign in and download the Washington Invoice Template for Independent Contractor from the US Legal Forms library. The Download option will appear on each document you view. You can access all previously obtained forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make adjustments. Fill out, edit, print, and sign the downloaded Washington Invoice Template for Independent Contractor. Every template you add to your account has no expiration date and is yours forever. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require. Access the Washington Invoice Template for Independent Contractor with US Legal Forms, the largest library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have selected the correct form for your city/region. Choose the Review option to evaluate the form's details.

- Read the form description to confirm you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Invoicing yourself is legal in many cases, especially when you are a sole proprietor or independent contractor. However, ensure that you maintain accurate records and follow the usual tax obligations related to your income. Utilizing a Washington Invoice Template for Independent Contractor can help you create clear and legitimate invoices that meet legal standards. This practice not only keeps your records organized but also portrays professionalism to any potential clients.

To create an invoice as an independent contractor, start by gathering all your essential information, such as your name, address, and contact details. Next, include your client's information and specify the services you provided with clear descriptions and the respective costs. Using a Washington Invoice Template for Independent Contractor can simplify this process by providing a professional layout and ensuring you include all necessary legal components. Once complete, send the invoice promptly to your client for efficient payment.

In Washington state, certain groups are exempt from workers' comp requirements, including sole proprietors, partners in a partnership, and certain business owners. However, specific criteria must be met to qualify for these exemptions. If you’re an independent contractor, understanding these rules alongside using a Washington Invoice Template for Independent Contractor can help clarify your responsibilities.

When writing an invoice for an independent contractor, start with your name and contact details, and then list your client's information. Add a section that outlines the services rendered, including dates, descriptions, and costs. To ensure accuracy, you might find it helpful to use a Washington Invoice Template for Independent Contractor as it offers a professional layout for your billing needs.

Filling out a contractor's invoice involves detailing your business name, contact information, and the client's information. Next, specify the services offered with clear descriptions, quantities, and corresponding costs. Don’t forget to note the payment methods and terms. Using a Washington Invoice Template for Independent Contractor can provide the structure you need for a clear and effective invoice.

To fill out an invoice template, start by including your business information at the top, followed by the client's details. Clearly list the services provided, including descriptions and costs. Finally, include payment terms, due dates, and total amounts to create a professional invoice, especially when utilizing a Washington Invoice Template for Independent Contractor.

Independent contractors do not need workers' comp insurance in Washington state, as they are considered self-employed. However, if contractors hire other employees, they must obtain workers' comp coverage for those workers. By using a Washington Invoice Template for Independent Contractor, you can ensure your billing is clear and compliant with state requirements.

1099 employees, or independent contractors, generally do not require workers' comp insurance in Washington state. This is because they are not classified as employees and are responsible for their own work-related injuries. If you're working as an independent contractor, utilizing a Washington Invoice Template for Independent Contractor will streamline your billing process without needing to worry about workers' comp.

Yes, workers' comp insurance is generally required for most employers in Washington state. This insurance provides coverage for employees in case of work-related injuries. However, independent contractors typically do not need this insurance unless they have employees working under them. Therefore, using a Washington Invoice Template for Independent Contractor can help you manage your invoicing without the added complication of workers' comp.

In Washington state, the main difference between an employee and an independent contractor lies in the level of control and independence. Employees work under the direct supervision of an employer and typically receive benefits, while independent contractors operate their own businesses, providing services under a contract. It's crucial to understand these distinctions, especially when using a Washington Invoice Template for Independent Contractor to bill for your services.