Washington Estoppel Affidavit of Mortgagor

Description

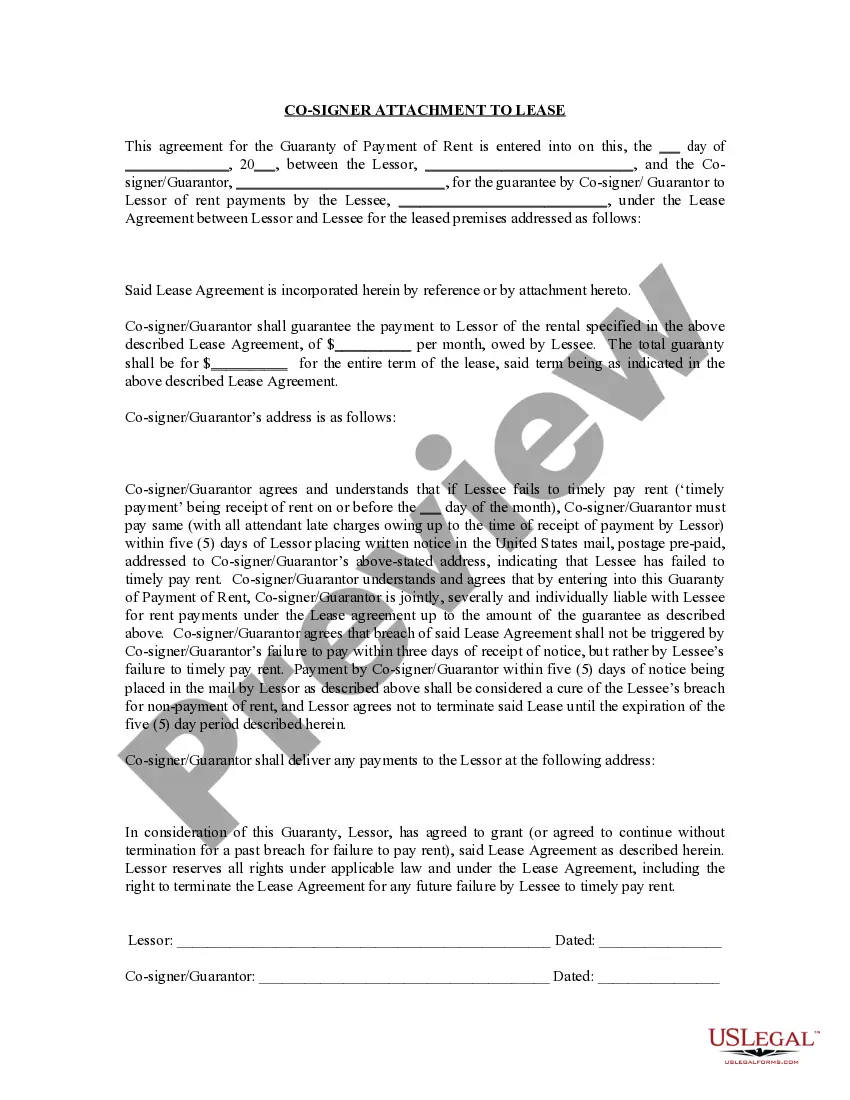

How to fill out Estoppel Affidavit Of Mortgagor?

If you need to aggregate, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you require.

Different templates for business and individual purposes are organized by categories and suggestions, or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your system.

- Utilize US Legal Forms to find the Washington Estoppel Affidavit of Mortgagor with just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and then select the Obtain option to get the Washington Estoppel Affidavit of Mortgagor.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions provided below.

- Step 1. Ensure you have selected the form for the appropriate city/country.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions in the legal form template.

- Step 4. Once you’ve located the form you require, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

The primary purpose of an estoppel certificate is to confirm the current status of a mortgage and outline the obligations of the borrowers. This document protects both lenders and buyers by ensuring everyone is on the same page regarding the mortgage conditions. When dealing with a Washington Estoppel Affidavit of Mortgagor, you can trust that it serves to reduce confusion and enhance transparency in real estate transactions.

Estoppel in a mortgage refers to a legal principle that prevents someone from arguing something contrary to an established fact. In the context of a Washington Estoppel Affidavit of Mortgagor, it ensures that mortgagors verify and confirm the existing terms of their mortgage. This can prevent disputes later on by confirming the parties involved agree on essential details. Understanding this can simplify any future transactions or conflicts.

To write a deed in lieu of foreclosure letter, start by addressing it to your lender and explain your situation succinctly. Request their acceptance of the deed while emphasizing your willingness to cooperate during the process. Including a Washington Estoppel Affidavit of Mortgagor can underscore your understanding of the implications and responsibilities associated with the deed.

A seller considering a deed in lieu of foreclosure should gather several essential documents. These include the mortgage agreement, a completed deed in lieu form, and possibly a Washington Estoppel Affidavit of Mortgagor to summarize any existing mortgage obligations. Doing so will create a clear record and help facilitate the lender’s acceptance of the deed.

When writing a foreclosure letter, start by detailing your situation and explaining why you are unable to keep the property. Clearly state your intention to pursue alternatives, such as a deed in lieu of foreclosure. It’s beneficial to include the specifics of your financial situation and any relevant information about the Washington Estoppel Affidavit of Mortgagor to ensure the lender understands your position.

To file a deed in lieu of foreclosure, gather all required documentation, including the signed deed and relevant disclosures. Submit these documents to your local county clerk or recorder’s office. Utilizing a Washington Estoppel Affidavit of Mortgagor can help clarify the terms of your transfer and protect both parties' interests during this process.

Executing a deed in lieu of foreclosure involves several steps. First, consult your lender to confirm their willingness to accept this arrangement. After that, complete the necessary paperwork, including a Washington Estoppel Affidavit of Mortgagor if required, and sign the deed in front of a notary. Finally, ensure the deed is recorded with the local county to finalize the transfer.

To transfer property to a family member in Washington, you typically use a quitclaim deed or a warranty deed. You must complete the appropriate deed form, sign it in the presence of a notary, and file it with your local county recorder. Additionally, consider using a Washington Estoppel Affidavit of Mortgagor if there are any liens or mortgages on the property to clarify the transfer's legal standing.

A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily gives the property back to the lender to avoid foreclosure. For example, if a homeowner in Washington faces financial struggles, they may choose to transfer the property to the lender through this deed. Importantly, a Washington Estoppel Affidavit of Mortgagor may be required during this process to confirm the borrower’s understanding and acceptance of the deed's implications.

Estoppel certificates do not always need to be notarized, but requirements can vary by jurisdiction or lender requirements. Notarization can add an extra layer of authenticity, which may be beneficial. For your Washington Estoppel Affidavit of Mortgagor, it is wise to confirm local regulations or lender preferences regarding notarization.