The Washington Loan Agreement between Stockholder and Corporation is a legally binding document that outlines the terms and conditions of a loan arrangement between a stockholder and a corporation based in Washington state. This agreement is crucial for establishing a clear understanding between both parties regarding the loan amount, repayment terms, and any additional provisions. In the Washington Loan Agreement, various keywords play a significant role in describing its features and types. Some essential terms and phrases related to this agreement include: 1. Loan Amount: This refers to the specific sum of money that the stockholder agrees to lend to the corporation. It is important to clearly indicate the loan amount to avoid any confusion or misunderstandings. 2. Interest Rate: The interest rate is the percentage at which the loan amount will accrue interest over time. It is crucial to define this rate to outline the financial obligations of the corporation and establish the total repayable amount. 3. Repayment Terms: The repayment terms outline how and when the loan will be repaid. This includes details such as the repayment schedule, frequency of payments (monthly, quarterly, annually), and the payment method. It is essential to define these terms clearly to ensure both parties are aware of their responsibilities. 4. Maturity Date: The maturity date is the date by which the loan must be fully repaid, including any accrued interest. This helps define the timeline for the repayment plan and creates a sense of urgency for the corporation. 5. Collateral: In some cases, the loan agreement may require the corporation to provide collateral as a form of security. This could be in the form of assets, property, or other valuable items that the stockholder can claim in case of default. Clarifying collateral requirements is crucial to protect the stockholder's investment. Different types of Washington Loan Agreements between Stockholders and Corporations may exist, depending on the specific circumstances and arrangements. Some variations could include: 1. Term Loan Agreement: This type of agreement establishes a fixed repayment schedule that must be adhered to over a specified period. It may include a lump sum repayment or installment-based repayments. 2. Convertible Loan Agreement: This agreement grants the stockholder the option to convert their loan into equity in the corporation at a predetermined conversion rate, typically during a future financing round or specific event. 3. Demand Loan Agreement: In this type of agreement, the stockholder can demand immediate repayment of the loan amount, regardless of the agreed-upon repayment schedule. This provides flexibility for the stockholder when requiring their funds. 4. Revolving Loan Agreement: This type of agreement allows the corporation to borrow funds multiple times up to a specified credit limit. As the loan is repaid, the corporation can access those funds again, similar to a credit line. It is important to consult legal professionals to ensure compliance with Washington state laws and tailor the Loan Agreement to the specific needs and requirements of both the stockholder and corporation involved.

Washington Loan Agreement between Stockholder and Corporation

Description

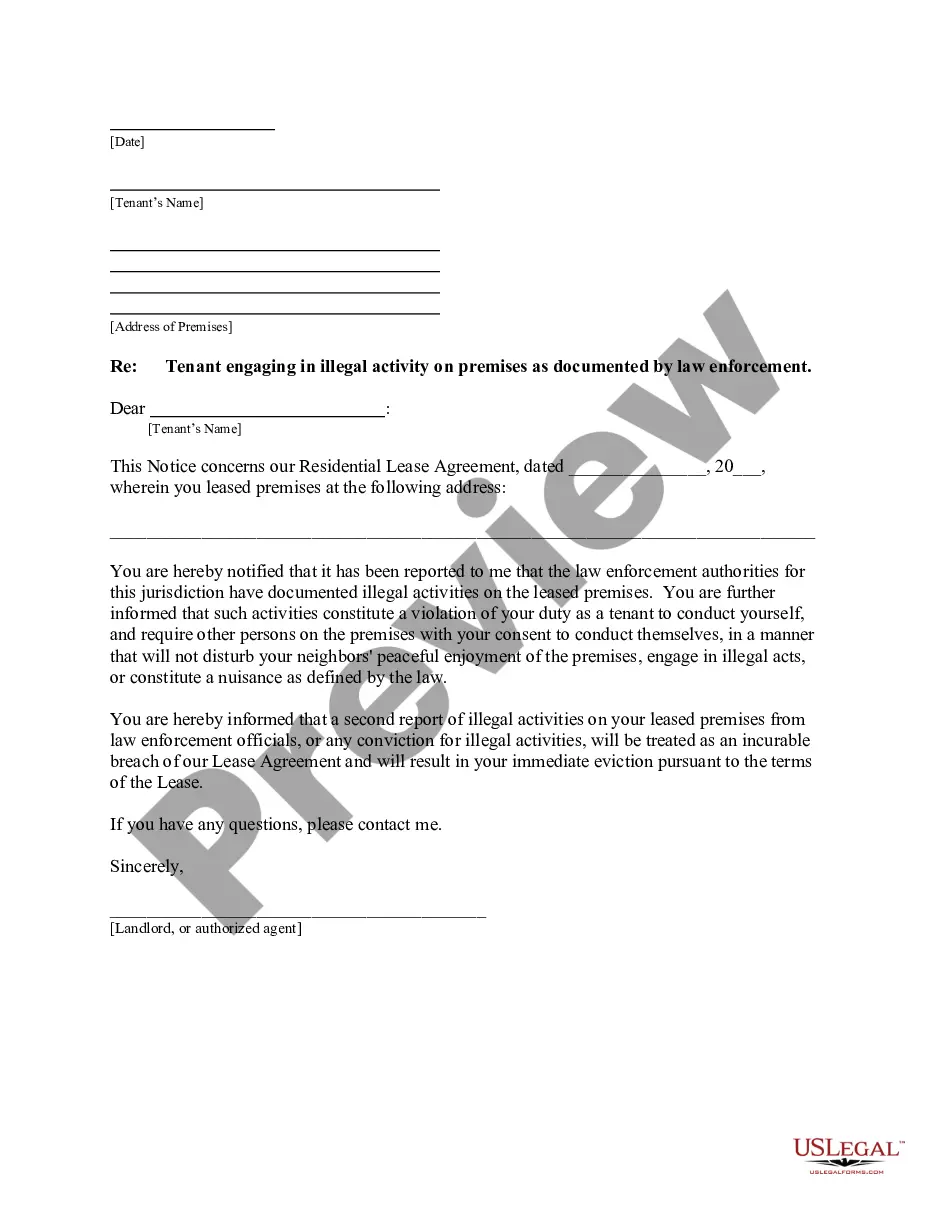

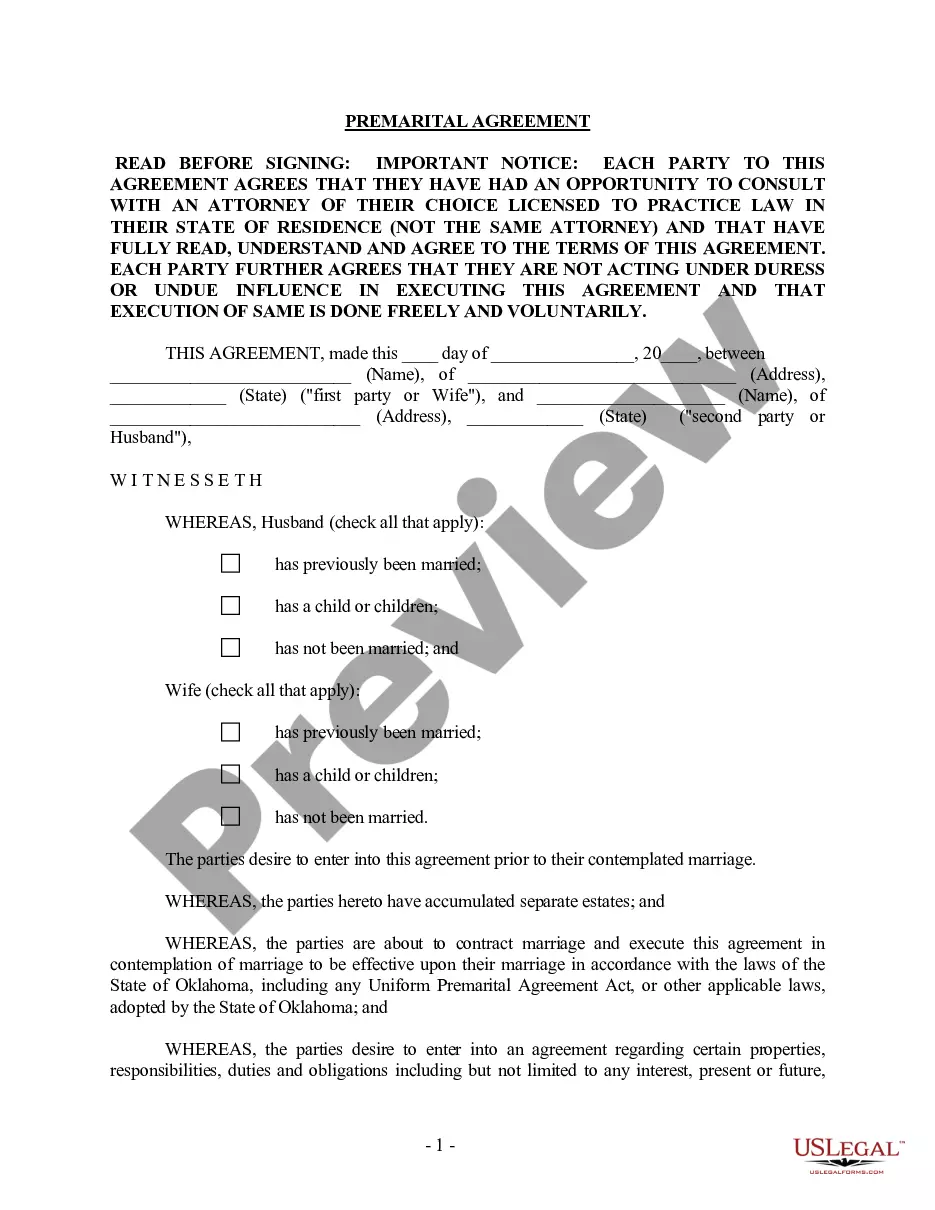

How to fill out Washington Loan Agreement Between Stockholder And Corporation?

If you need to full, download, or print out legitimate document themes, use US Legal Forms, the most important variety of legitimate varieties, which can be found online. Take advantage of the site`s simple and easy handy research to get the papers you will need. Different themes for enterprise and person reasons are sorted by categories and states, or keywords. Use US Legal Forms to get the Washington Loan Agreement between Stockholder and Corporation within a handful of mouse clicks.

In case you are previously a US Legal Forms buyer, log in to your profile and then click the Down load button to obtain the Washington Loan Agreement between Stockholder and Corporation. You can even entry varieties you in the past acquired within the My Forms tab of the profile.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that correct city/country.

- Step 2. Make use of the Preview method to check out the form`s information. Don`t neglect to see the outline.

- Step 3. In case you are unsatisfied with all the kind, use the Search field on top of the screen to discover other models of your legitimate kind web template.

- Step 4. Once you have found the shape you will need, click on the Acquire now button. Pick the pricing program you favor and add your qualifications to sign up on an profile.

- Step 5. Procedure the transaction. You should use your bank card or PayPal profile to accomplish the transaction.

- Step 6. Choose the formatting of your legitimate kind and download it on your device.

- Step 7. Total, revise and print out or indicator the Washington Loan Agreement between Stockholder and Corporation.

Every single legitimate document web template you get is your own eternally. You may have acces to every single kind you acquired inside your acccount. Select the My Forms segment and choose a kind to print out or download again.

Be competitive and download, and print out the Washington Loan Agreement between Stockholder and Corporation with US Legal Forms. There are thousands of specialist and condition-particular varieties you can utilize to your enterprise or person requirements.

Form popularity

FAQ

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

How do I create a Shareholder Loan Agreement?Determine how the corporation will make payments.State the term length.Specify the loan amount.Determine the payment details.Provide both parties' information.Address miscellaneous matters.Sign the document.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

Conclusion. Shareholder loans are a hybrid of debt and equity much like preferred stock. They are used by sponsors in transactions as a vehicle to carry the bulk of their investment as they carry a fixed rate of return.

Shareholders may take a loan from the corporation and are not required to report it as personal income on their personal tax return for that fiscal tax year. A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed.

Employers in the U.S. can provide loans to their employees, but may have to comply with different laws depending on your state. Some states allow employees to repay loans through payroll deductions, but only if it doesn't reduce their wages below the $7.25-per-hour federal minimum wage.

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

The answer is yes. One of the advantages of owning your own business is the option to borrow and lend money to your business. It is also possible to borrow from a 401K plan.

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.