A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partnership, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both.

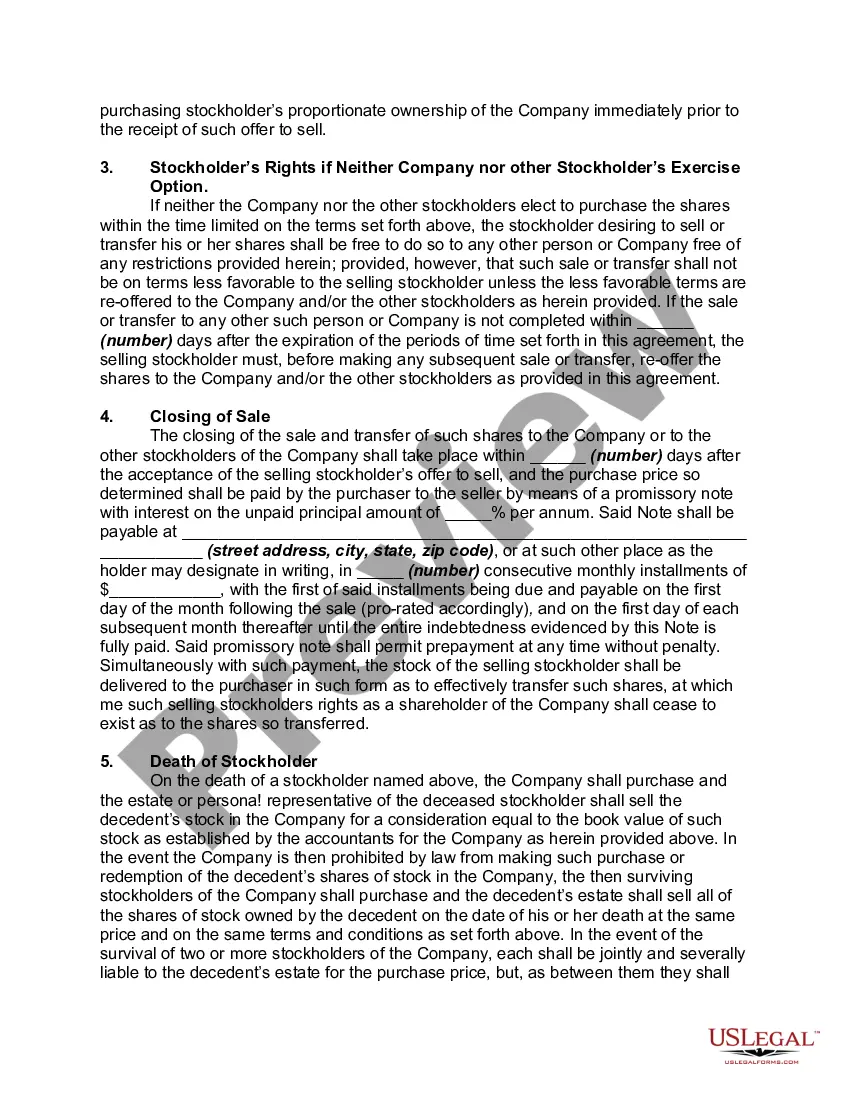

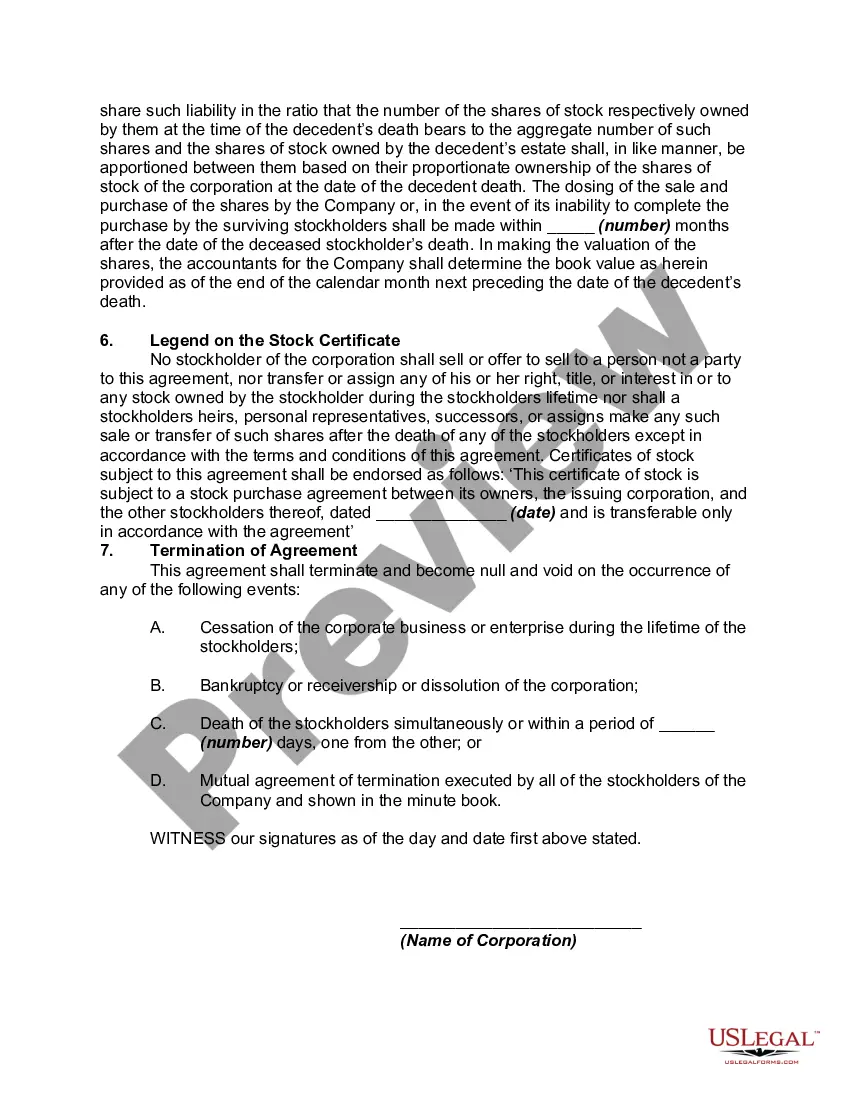

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Washington Stock Agreement, also known as a Buy-Sell Agreement between Shareholders and Corporation, is a legally binding contract that outlines the terms and conditions for the purchase and sale of shares between shareholders and the corporation they own. This agreement is specifically designed to address situations such as the death, disability, retirement, or voluntary departure of a shareholder, where the shares need to be sold or transferred. The primary purpose of a Washington Stock Agreement is to provide a mechanism for the smooth transition of ownership in a corporation and to protect the interests of both the shareholders and the corporation. By establishing clear guidelines and procedures for the sale or transfer of shares, it helps mitigate potential conflicts or disputes among shareholders and ensures stability within the corporation. There are different types of Washington Stock Agreements, each catering to specific scenarios and shareholder preferences. The most common types include: 1. Cross-Purchase Agreement: Under this agreement, each shareholder agrees to buy the shares of a departing shareholder in proportion to their ownership interest. Consequently, if a shareholder leaves or passes away, the remaining shareholders collectively purchase the departing shareholder's stock. 2. Stock Redemption Agreement: In this type of agreement, the corporation itself agrees to buy back the shares of a departing shareholder. The corporation usually uses the funds from its own assets or corporate policies to finance the buyback. 3. Hybrid Agreement: This type of agreement combines elements of both the cross-purchase and stock redemption agreements. It allows shareholders the flexibility to choose whether they prefer other shareholders or the corporation to buy their shares in the event of their departure. 4. Wait-and-See Agreement: With a wait-and-see agreement, the shareholders defer making a decision regarding the buyback until a specific triggering event occurs. This type of agreement is often used when there are uncertain circumstances, such as a potential acquirer showing interest in the company. By implementing a Washington Stock Agreement, shareholders and the corporation can ensure a seamless transition of ownership, prevent potential conflicts, and provide shareholders with an exit strategy. It is important for shareholders and the corporation to consult legal professionals well-versed in Washington State corporate law to draft an agreement that aligns with their specific needs and complies with the relevant legal requirements.A Washington Stock Agreement, also known as a Buy-Sell Agreement between Shareholders and Corporation, is a legally binding contract that outlines the terms and conditions for the purchase and sale of shares between shareholders and the corporation they own. This agreement is specifically designed to address situations such as the death, disability, retirement, or voluntary departure of a shareholder, where the shares need to be sold or transferred. The primary purpose of a Washington Stock Agreement is to provide a mechanism for the smooth transition of ownership in a corporation and to protect the interests of both the shareholders and the corporation. By establishing clear guidelines and procedures for the sale or transfer of shares, it helps mitigate potential conflicts or disputes among shareholders and ensures stability within the corporation. There are different types of Washington Stock Agreements, each catering to specific scenarios and shareholder preferences. The most common types include: 1. Cross-Purchase Agreement: Under this agreement, each shareholder agrees to buy the shares of a departing shareholder in proportion to their ownership interest. Consequently, if a shareholder leaves or passes away, the remaining shareholders collectively purchase the departing shareholder's stock. 2. Stock Redemption Agreement: In this type of agreement, the corporation itself agrees to buy back the shares of a departing shareholder. The corporation usually uses the funds from its own assets or corporate policies to finance the buyback. 3. Hybrid Agreement: This type of agreement combines elements of both the cross-purchase and stock redemption agreements. It allows shareholders the flexibility to choose whether they prefer other shareholders or the corporation to buy their shares in the event of their departure. 4. Wait-and-See Agreement: With a wait-and-see agreement, the shareholders defer making a decision regarding the buyback until a specific triggering event occurs. This type of agreement is often used when there are uncertain circumstances, such as a potential acquirer showing interest in the company. By implementing a Washington Stock Agreement, shareholders and the corporation can ensure a seamless transition of ownership, prevent potential conflicts, and provide shareholders with an exit strategy. It is important for shareholders and the corporation to consult legal professionals well-versed in Washington State corporate law to draft an agreement that aligns with their specific needs and complies with the relevant legal requirements.