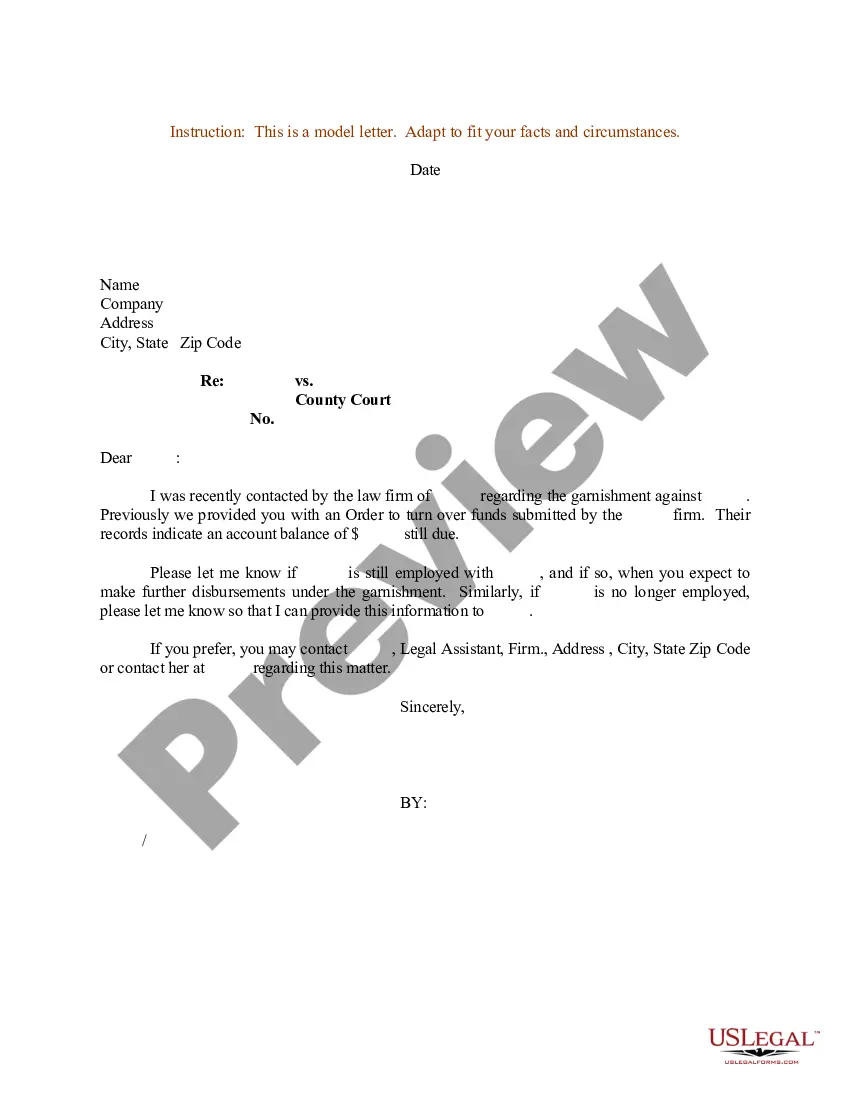

Washington Sample Letter for Garnishment

Description

How to fill out Sample Letter For Garnishment?

You can devote several hours on-line searching for the lawful record design that suits the federal and state demands you need. US Legal Forms gives 1000s of lawful kinds which can be evaluated by specialists. It is possible to download or print out the Washington Sample Letter for Garnishment from your support.

If you have a US Legal Forms account, it is possible to log in and then click the Down load button. After that, it is possible to complete, edit, print out, or signal the Washington Sample Letter for Garnishment. Every single lawful record design you acquire is your own for a long time. To get yet another backup of the purchased kind, go to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site the very first time, stick to the easy directions below:

- Very first, make sure that you have selected the proper record design for the area/metropolis that you pick. Look at the kind explanation to ensure you have picked out the correct kind. If readily available, take advantage of the Review button to search throughout the record design as well.

- If you want to find yet another variation of your kind, take advantage of the Look for industry to get the design that meets your needs and demands.

- Upon having found the design you need, click Get now to proceed.

- Pick the pricing strategy you need, type your references, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your Visa or Mastercard or PayPal account to fund the lawful kind.

- Pick the structure of your record and download it in your gadget.

- Make modifications in your record if needed. You can complete, edit and signal and print out Washington Sample Letter for Garnishment.

Down load and print out 1000s of record layouts using the US Legal Forms web site, which provides the biggest assortment of lawful kinds. Use specialist and condition-distinct layouts to deal with your business or individual requirements.

Form popularity

FAQ

Washington Wage Garnishment Process. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. This is true for wage and bank account garnishments. This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint.

In Washington, creditors can garnish 25% of your take-home pay. Even if you have a higher income and will need to file a Chapter 13 repayment plan, that is much better than being garnished. In most situations, a garnishment means things have really spun out of control. Only one creditor can garnish at a time.

Fees include union dues, and some retirement deductions. Wages of an independent contractor or employee include bonuses, commissions and draws against earnings. Tips and gratuities under an employer's control are subject to collection action.

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

Consumer debt exemptions are based on either 80% of disposable income or 35 times the state minimum wage which is now (2023) set at $15.74. Federal minimum wage remains unchanged and applies to general non-consumer, non-student loan, non child support, non spousal support type debts.

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments. See RCW 6.15. 010 for a list of other exemptions.

Stop Washington wage garnishment by filing a claim of exemption. Filing a claim of exemption in Washington State is a legal process that allows you to protect a portion of your income from wage garnishment. The reason for exemption could be that your income: Falls beneath the federal poverty line.