Washington Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the website, you can access a multitude of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Washington Notice of Returned Check within moments.

If you already have a monthly subscription, Log In and download the Washington Notice of Returned Check from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make revisions. Fill out, modify, print, and sign the downloaded Washington Notice of Returned Check. Every document you added to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just go to the My documents section and click on the form you desire. Access the Washington Notice of Returned Check with US Legal Forms, one of the most extensive collections of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

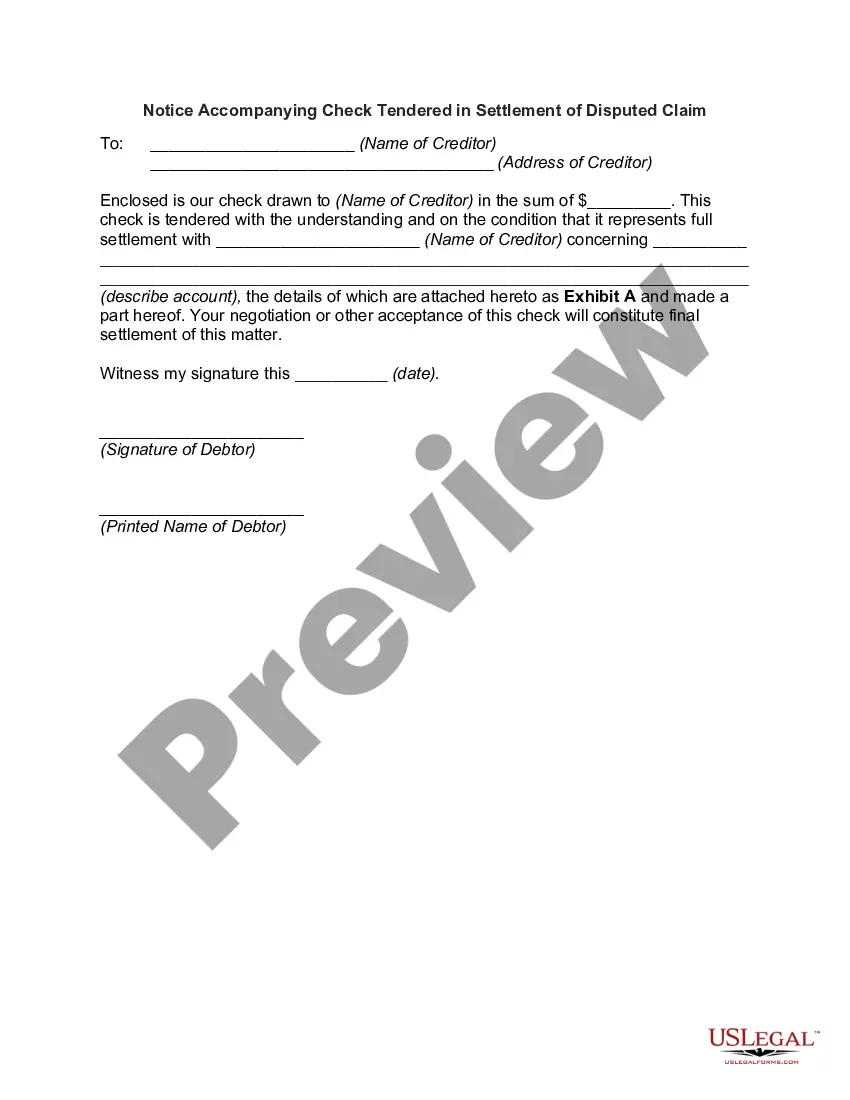

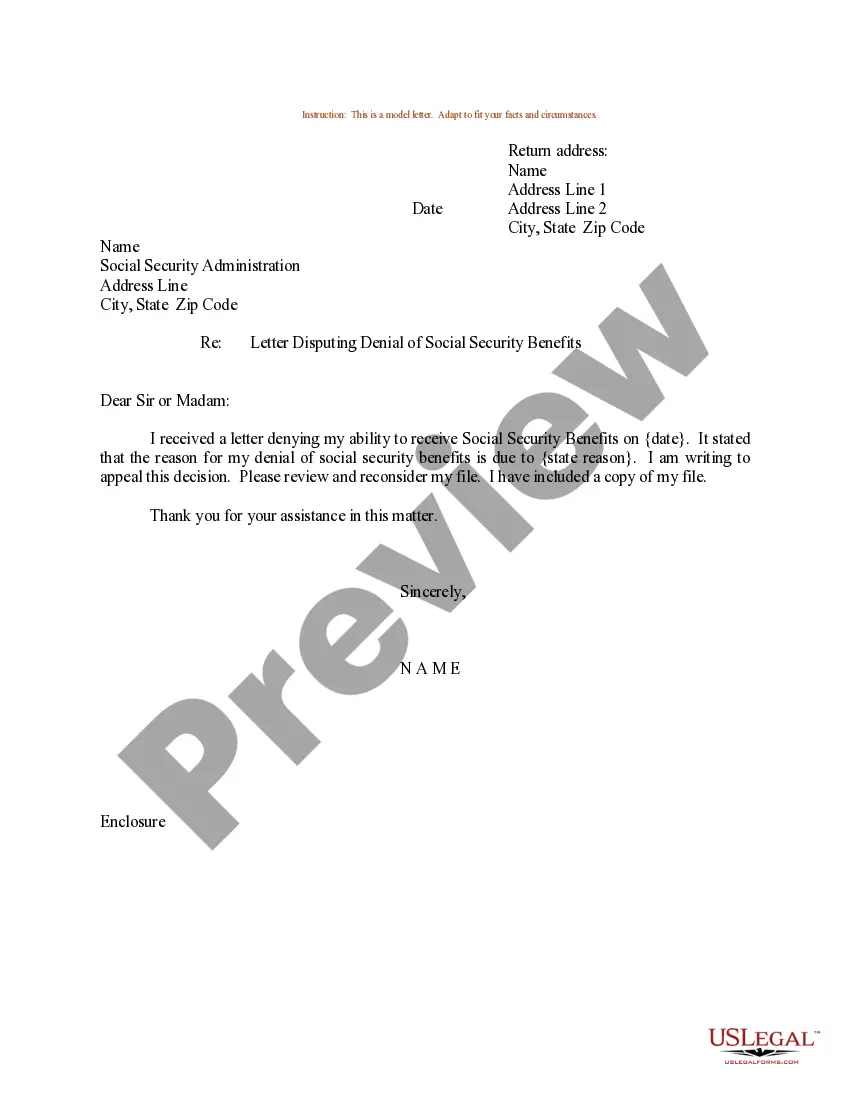

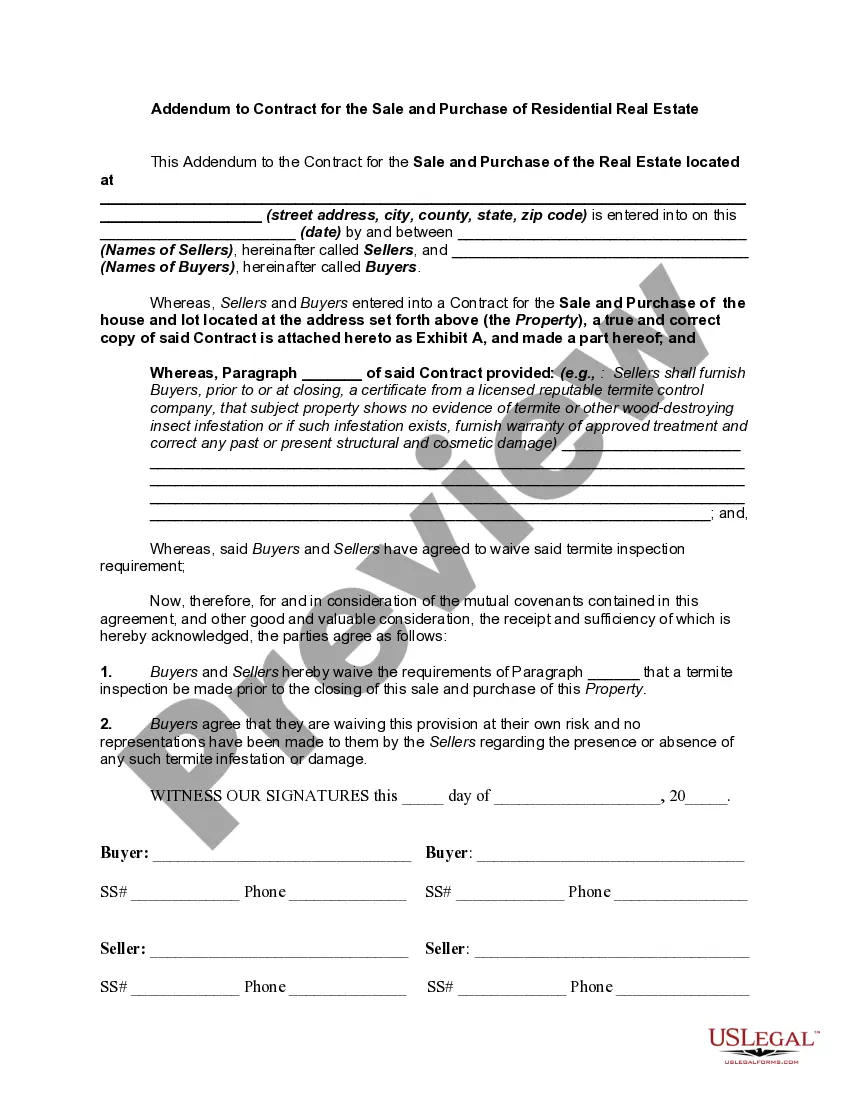

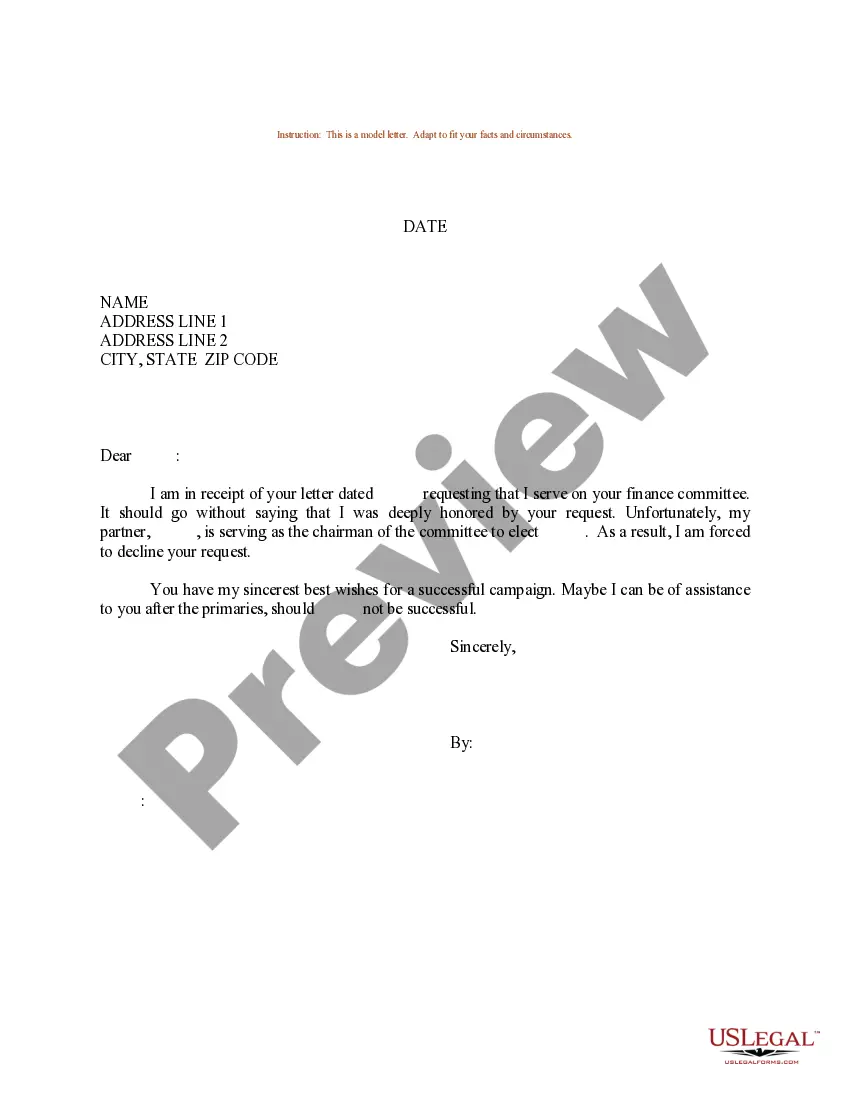

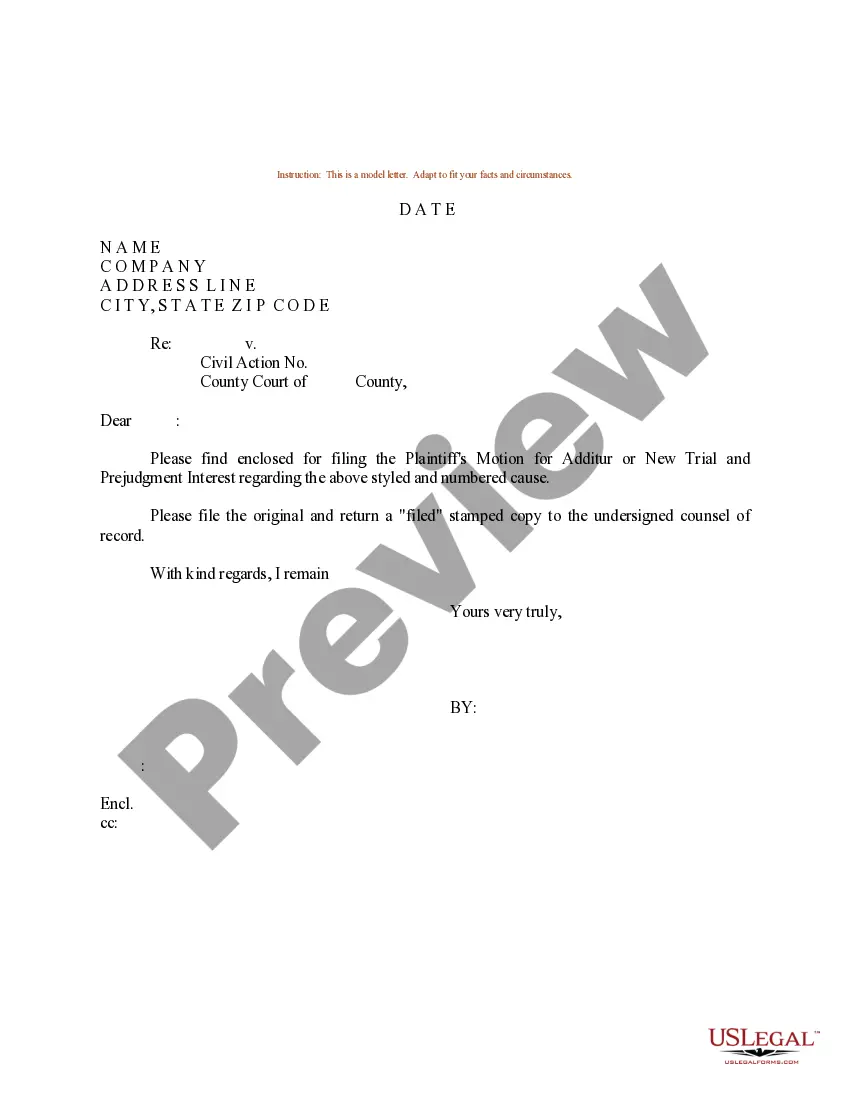

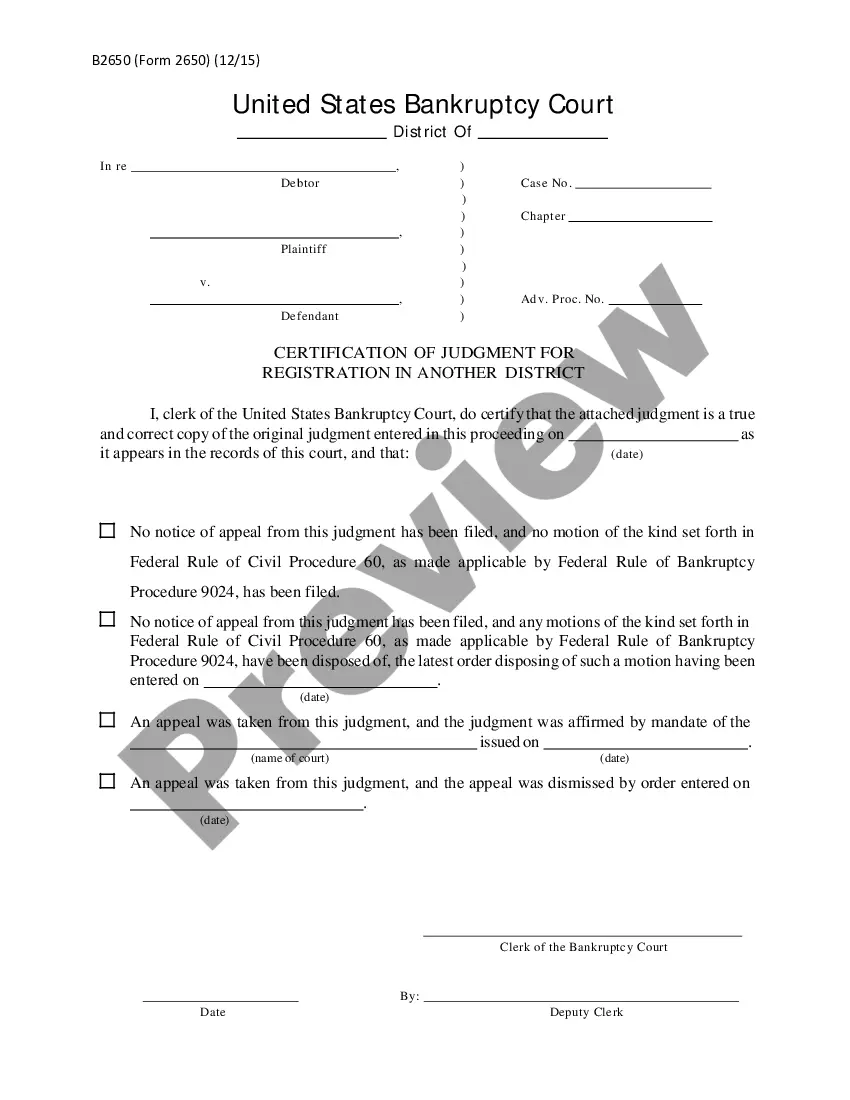

- Click the Preview button to review the form's content.

- Check the form description to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

If your check was returned, first review the details on the Washington Notice of Returned Check. This notice will provide important information about the reason for the return, such as insufficient funds. Act quickly to communicate with the recipient and make arrangements for payment. If you require additional assistance or legal advice, platforms like USLegalForms can provide valuable resources to help you navigate these challenges.

Yes, you can face jail time for depositing a bad check in Washington state, particularly if the amount exceeds $500. Legal consequences increase if there is intent to defraud. A Washington Notice of Returned Check will inform you of the returned transaction, yet ignoring it could put you at risk for criminal prosecution. It is essential to address this issue promptly to avoid severe penalties.

In Washington state, a felony generally involves crimes that carry a potential sentence of over one year in prison. Writing bad checks, especially amounts exceeding $500, can classify as a felony under certain conditions. Understanding these legal classifications is crucial, and resources like the Washington Notice of Returned Check can help clarify your situation. Should you find yourself facing such charges, consider consulting with a legal expert for guidance.

If you write a bad check exceeding $500, you may face serious consequences under Washington law. This situation can lead to criminal charges, often categorized as felony offenses. A Washington Notice of Returned Check will typically notify you of the insufficient funds, allowing you an opportunity to settle the debt. However, failing to resolve the issue can escalate into legal repercussions, including fines or even imprisonment.

You can deposit a returned cheque again, but be cautious about the reasons for its return. If the check bounced due to issues like insufficient funds or account closure, it’s advisable to contact the issuer. Ensure you have updated information to avoid future problems. Resources related to the Washington Notice of Returned Check can provide helpful tips and guidance in these scenarios.

Yes, you can redeposit a check that was returned, but ensure you understand why it was returned first. If the reason was due to insufficient funds, it might be prudent to confirm that the account has sufficient balance before redepositing. Keep in mind that repeated attempts may lead to further complications and additional fees. To navigate these situations effectively, utilize the Washington Notice of Returned Check information for better clarity.

To fill out the back of a check, start by signing your name on the designated line. Ensure your signature matches the one on the front of the check. Some checks may require you to add additional information, such as an account number or specific instructions. For a clear understanding, consider referring to a Washington Notice of Returned Check guide to avoid errors.

An example of a returned check would be a situation where a landlord receives a check for rent that cannot be processed due to insufficient funds in the tenant's account. In this case, the landlord will receive a Washington Notice of Returned Check, indicating the issue. This notice provides essential information that allows the landlord to take action, such as contacting the tenant for alternative payment arrangements. Knowing such examples can help you understand the implications of issuing checks without sufficient funds.

You may receive a return check notice for several reasons, including insufficient funds, a stop payment request, or an issue with the account linked to the check. A Washington Notice of Returned Check means that the bank alerts you about the failed transaction. Understanding why this happened can help you avoid similar situations in the future. Additionally, staying informed about your account balances and actions can assist in effective financial management.

A return check notice details the failure of a check to clear due to various reasons. It serves as a notification to the issuer about the problem with the check they wrote. If you find yourself with a Washington Notice of Returned Check, take it seriously, as it can help you rectify any outstanding obligations. Resolving such issues quickly can save you from additional fees and legal troubles.