A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

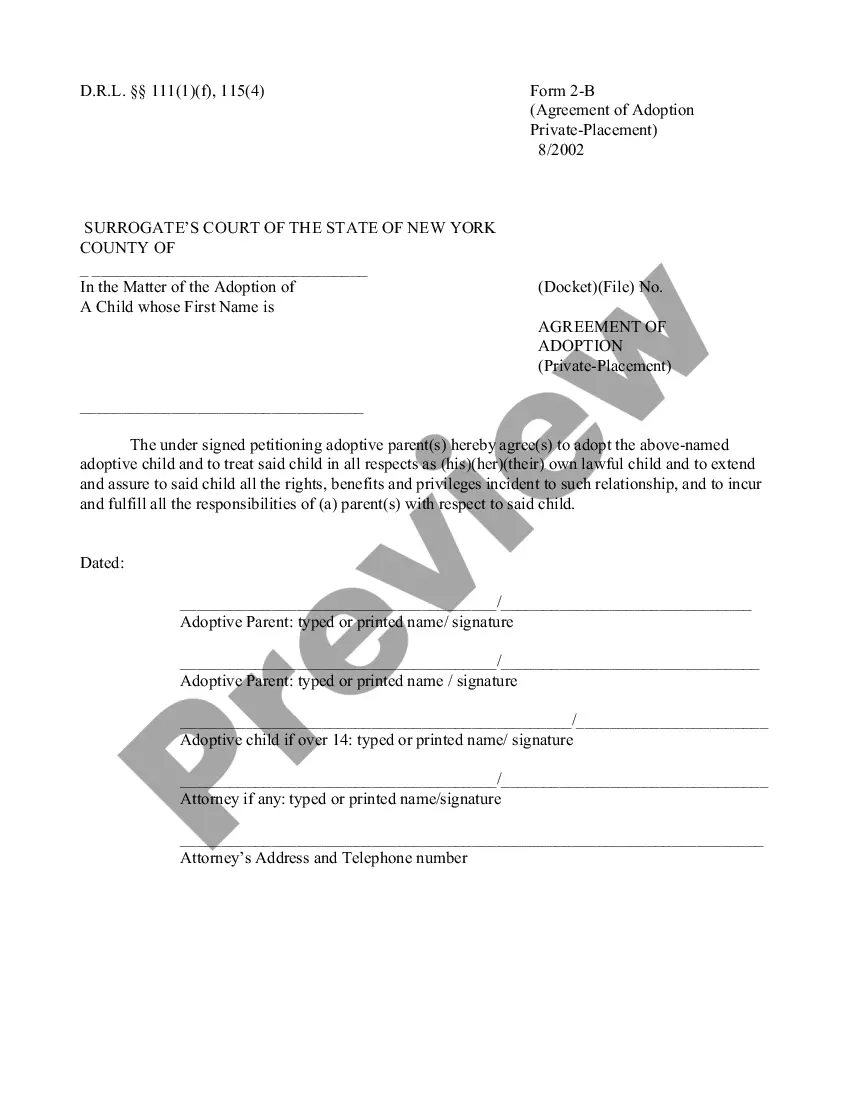

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Washington Agreement between Creditors and Debtors for Appointment of Receiver is a legal agreement that outlines the terms and conditions for the appointment of a receiver in situations where the debtor is unable to meet its financial obligations and the creditors seek to protect their interests. This agreement serves as a valuable tool for both parties involved, providing a clear framework for the appointment of a receiver and ensuring that the rights and responsibilities of all parties are respected. It aims to protect the creditor's interests by facilitating the recovery of outstanding debts and the orderly liquidation of assets, while also safeguarding the debtor's interests by ensuring a fair and transparent process. Keywords: Washington Agreement, creditors, debtors, appointment of receiver, legal agreement, financial obligations, protect interests, receiver, outstanding debts, orderly liquidation, assets, fair process, transparent process. There are different types of Washington Agreement between Creditors and Debtors for Appointment of Receiver, which may vary depending on the specific circumstances and requirements of the parties involved. Some common types include: 1. Voluntary Agreement: This type of agreement occurs when both the debtor and the creditors mutually agree to appoint a receiver to oversee the liquidation process. It is generally seen as a proactive measure taken by the debtor to prevent further financial distress and to ensure a fair distribution of assets among creditors. 2. Involuntary Agreement: In certain cases, creditors may initiate an involuntary agreement by petitioning the court to appoint a receiver. This typically occurs when the debtor exhibits substantial financial instability or fails to meet its obligations, thereby prompting the creditors to seek legal intervention for the recovery of their debts. 3. Emergency Agreement: This type of agreement is employed in urgent situations where immediate action is required to protect the interests of the creditors. It enables the appointment of a receiver to secure and manage the debtor's assets swiftly, ensuring their preservation until further actions can be taken to resolve the financial situation. 4. Interim Agreement: An interim agreement may be entered into when there is a need for a temporary receiver to be appointed. This could occur during a transition period, such as when the original receiver resigns or is unable to fulfill their duties. The interim receiver acts as a temporary replacement until a permanent solution can be arranged. 5. Post-Insolvency Agreement: In cases where the debtor has already become insolvent or bankrupt, a post-insolvency agreement may be established between the creditors and the debtor. This agreement aims to facilitate the appointment of a receiver specifically for the purpose of overseeing the liquidation of assets and distributing the proceeds to the creditors in accordance with the established priorities and legal requirements. These various types of agreements cater to different scenarios and provide flexibility to ensure that the appointment of a receiver is tailored to the specific circumstances of the debtor's financial distress.