A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Washington Check Disbursements Journal

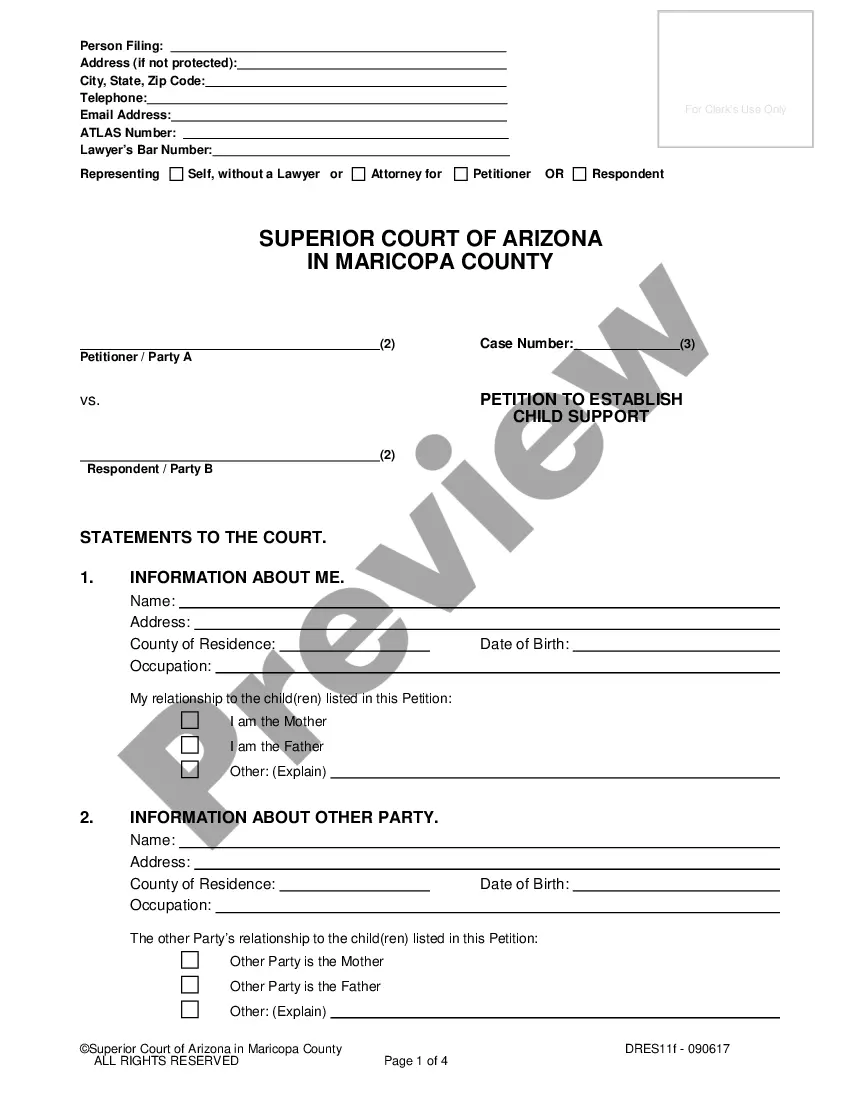

Description

How to fill out Check Disbursements Journal?

If you require extensive, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Take advantage of the site's straightforward and convenient search feature to locate the documents you need.

Various templates for business and personal uses are categorized by types and jurisdictions, or keywords.

Each legal document template you obtain belongs to you indefinitely. You can access every form you acquired within your account. Visit the My documents section and select a form to print or download again.

Acquire and download, and print the Washington Check Disbursements Journal with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the Washington Check Disbursements Journal in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Acquire button to obtain the Washington Check Disbursements Journal.

- You may also access forms you previously acquired in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the Washington Check Disbursements Journal.

Form popularity

FAQ

A check disbursement journal is a financial record used to document all payments made by checks. This journal captures vital information such as the date, amount, payee, and transaction purpose, thereby promoting efficient financial management. By implementing a Washington Check Disbursements Journal, businesses can maintain accurate records that help in reporting, budgeting, and auditing.

Filling out a disbursement journal begins with gathering all relevant information about each payment. Clearly document the date of the disbursement, the payee’s name, the check amount, and the reason for the payment. When utilizing a Washington Check Disbursements Journal, consistency in recording these details helps foster an accurate and useful financial record.

To use a disbursement journal effectively, begin by recording each check disbursement in chronological order. You should include essential details such as the date, amount, payee name, and purpose of the disbursement. Utilizing the Washington Check Disbursements Journal streamlines this process, allowing you to track payments effortlessly and maintain accurate financial records.

For recording disbursements by check, the Washington Check Disbursements Journal is the appropriate choice. This journal organizes your payment data, making it easier to review and report financial activities. By consistently using this journal, you enhance transparency in your financial reporting.

The Washington Check Disbursements Journal is the go-to resource for recording disbursements made by check. It captures essential details of each disbursement, providing clarity and helping you manage expenses effectively. Utilizing this journal simplifies your financial processes and prepares you for audits and reviews.

Payments made by check are typically recorded in a disbursement journal, such as the Washington Check Disbursements Journal. This journal provides a detailed account of each transaction, ensuring that businesses maintain accurate financial records. By using such a journal, you can streamline your payment tracking and enhance your financial management.

A disbursement journal is a record-keeping tool that tracks all payments made by a business. It specifically captures details such as the date, amount, and purpose of each payment. In the context of the Washington Check Disbursements Journal, it aids businesses in staying organized and compliant with financial reporting requirements.