Washington Sample Letter for Exemption of Ad Valorem Taxes

Description

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

US Legal Forms - one of many greatest libraries of authorized forms in America - gives a variety of authorized file templates you can down load or produce. Making use of the internet site, you can find 1000s of forms for enterprise and personal functions, categorized by groups, says, or keywords and phrases.You will discover the newest versions of forms like the Washington Sample Letter for Exemption of Ad Valorem Taxes within minutes.

If you have a membership, log in and down load Washington Sample Letter for Exemption of Ad Valorem Taxes in the US Legal Forms collection. The Acquire switch will show up on each and every type you view. You gain access to all in the past delivered electronically forms within the My Forms tab of your own account.

If you wish to use US Legal Forms initially, here are simple instructions to help you started:

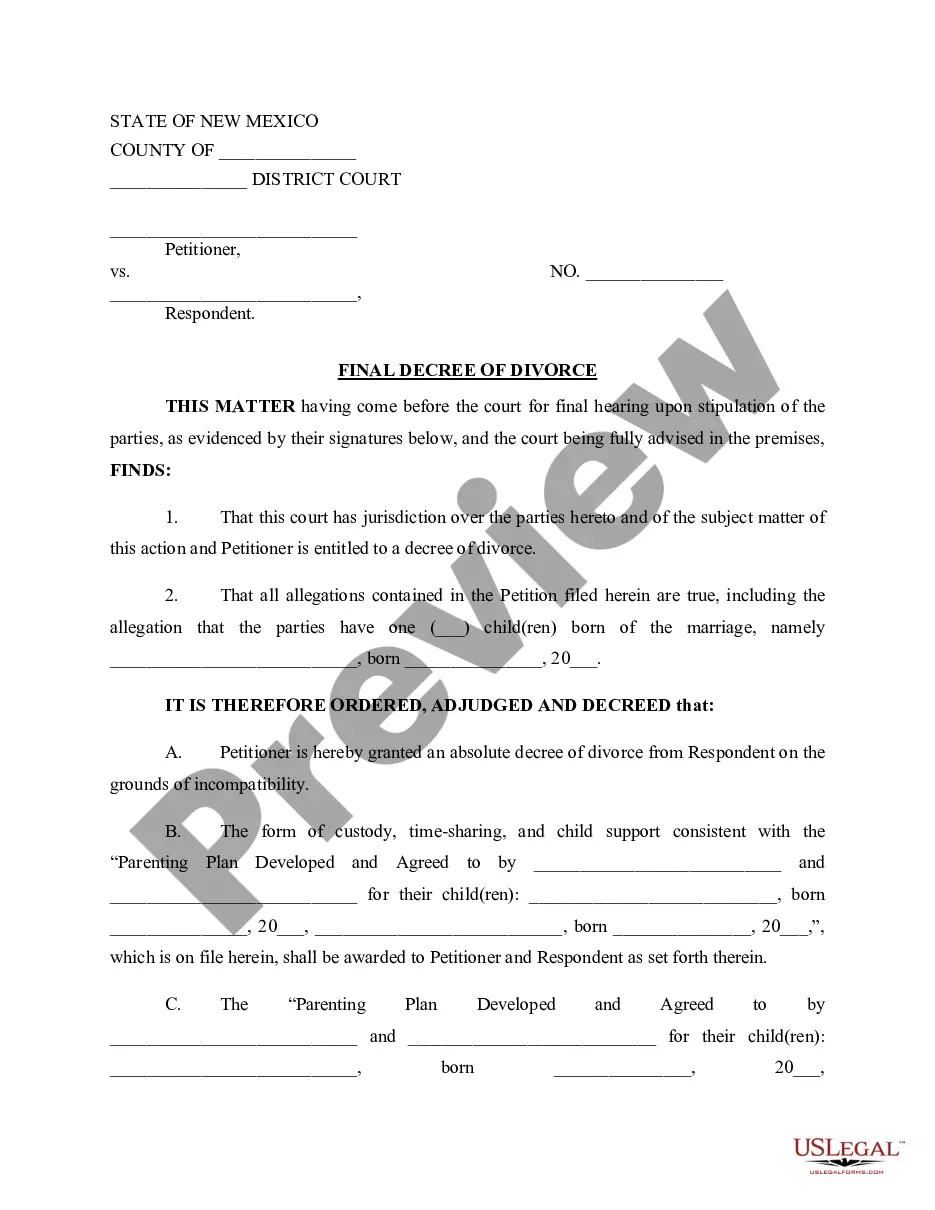

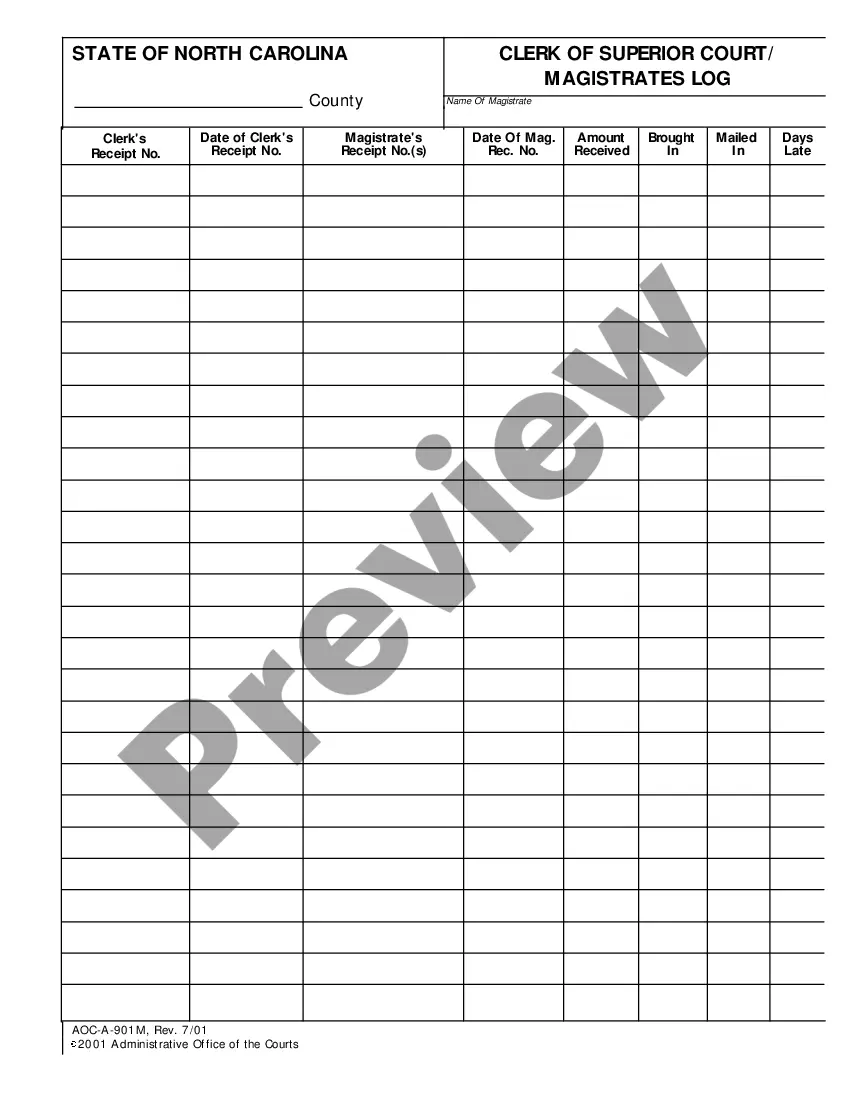

- Ensure you have picked the correct type for your personal town/region. Click the Preview switch to examine the form`s content material. Browse the type description to ensure that you have chosen the right type.

- In the event the type does not suit your requirements, take advantage of the Look for field at the top of the screen to obtain the one that does.

- In case you are content with the form, validate your decision by clicking on the Purchase now switch. Then, pick the prices prepare you like and give your accreditations to sign up for the account.

- Method the purchase. Utilize your credit card or PayPal account to complete the purchase.

- Find the structure and down load the form on your system.

- Make adjustments. Complete, revise and produce and indicator the delivered electronically Washington Sample Letter for Exemption of Ad Valorem Taxes.

Every single format you put into your bank account lacks an expiration date and is also your own for a long time. So, in order to down load or produce an additional copy, just check out the My Forms segment and then click around the type you require.

Gain access to the Washington Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms, by far the most comprehensive collection of authorized file templates. Use 1000s of skilled and express-particular templates that meet your organization or personal needs and requirements.

Form popularity

FAQ

Age or disability By December 31 of the assessment year, you must be any of the following: At least 61 years of age. At least 57 years of age and the surviving spouse or domestic partner of a person who was an exemption participant at the time of their death.

Transfers due to a court order or sale by a court in any mortgage, deed of trust, or lien foreclosure are exempt. This exemption does not apply to any other court ordered sale. Any type of negotiated sale is taxable unless another exemption applies.

Beginning January 1, 2022, Washington imposes a capital gains excise tax on the sale or exchange of long-term capital assets. The tax equals 7% multiplied by an individual's Washington capital gains.

The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property. REET also applies to transfers of controlling interest (50% or more) in entities that own real property in the state.

A Certificate of Exemption (CE) is a document issued by the Division of Building and Planning that indicates a division of land is exempt from the requirements of state and local subdivisions laws.

However, in some cases, the buyer may be required to pay a portion of the tax if it is not fully paid by the seller. The real estate excise tax rate in Washington State is between 1.1% and 3.0% of the sales price of the property. In 2021 the average home price in Washington State was $560,400.

Nonprofit organizations may be eligible for an exemption (pdf) from both the property tax and the leasehold excise tax. Typical organizations receiving the exemption are schools, churches, social service agencies, hospitals and child care organizations.

Qualifying Activity: Own home in Washington for five years; occupy as a primary residence; have combined disposable income of $57,000 or less; and have enough equity to secure the interest of the State of Washington in the property.