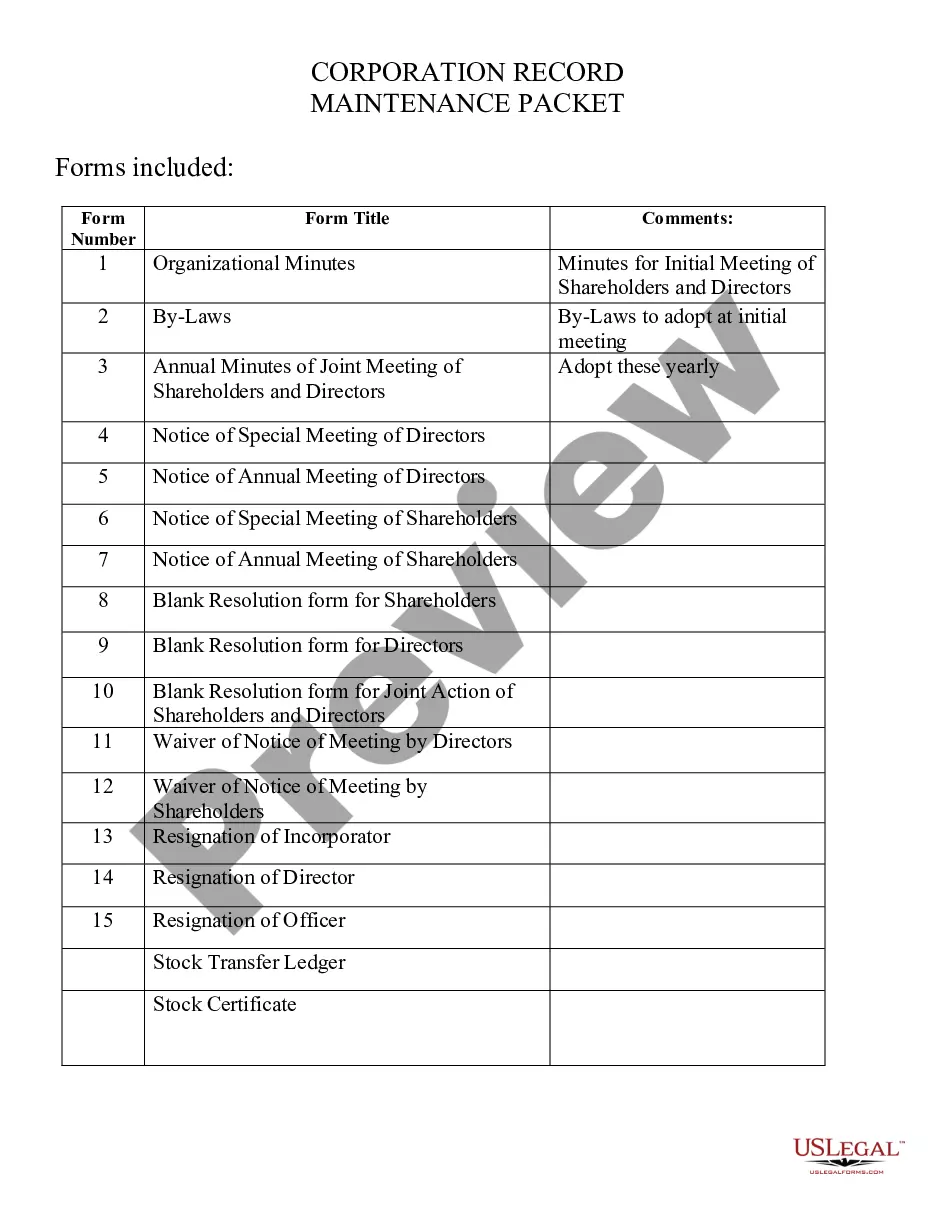

Bylaws may not be in conflict with a corporation's articles or certificate of incorporation or with the law regulating corporations, nor may they contravene the general law or public policy. The drafter should also bear in mind that bylaws are intended to be more or less permanent rules or principles of organization and conduct, as distinct from resolutions dealing with specific transactions and events.

Washington By-Laws of a Non-Profit Church Corporation are a set of rules and regulations that guide the governance and operations of a non-profit church corporation in the state of Washington. These by-laws ensure compliance with state laws and provide a framework for the church's internal management and decision-making processes. The Washington By-Laws of a Non-Profit Church Corporation cover various aspects including the church's purpose, membership, board of directors, meetings and voting procedures, financial management, and dissolution. By adhering to these by-laws, the church corporation can maintain transparency, accountability, and legal compliance. Key provisions of the Washington By-Laws of a Non-Profit Church Corporation may include: 1. Purpose: Clearly stating the mission, vision, and religious objectives of the church corporation. 2. Membership: Establishing criteria and procedures for becoming a member, rights and responsibilities of members, and process for termination of membership. 3. Board of Directors: Defining the composition, qualifications, and roles of the board members, including the election or appointment process, terms of office, and responsibilities such as overseeing the church's affairs and making key decisions. 4. Meetings: Outlining the frequency, notice requirements, and procedures for conducting board meetings, as well as requirements for establishing a quorum. 5. Voting: Describing voting rules, including the number of votes required for specific actions, procedures for proxy voting, and rules for resolving tie votes. 6. Committees: Establishing committees and their roles, responsibilities, and authorities, such as the finance committee or the worship committee. 7. Financial Management: Ensuring proper management of the church's financial affairs, including budgeting, accounting procedures, and oversight of financial transactions. 8. Conflict of Interest: Addressing conflicts of interest among board members or key individuals involved in the corporation, requiring disclosure and refusal when conflicts arise. 9. Amendments: Outlining the process for amending the by-laws, including the required majority for approval and any notice requirements. Different types of Washington By-Laws of a Non-Profit Church Corporation can vary depending on the size, structure, and specific needs of the church. Some churches may have additional provisions related to specific religious practices or beliefs, while others may adopt more general by-laws that comply with state regulations. It is essential for any non-profit church corporation in Washington to consult legal professionals or seek guidance from state authorities to ensure compliance with all applicable laws and to tailor their by-laws to their specific organizational needs.