A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Washington Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

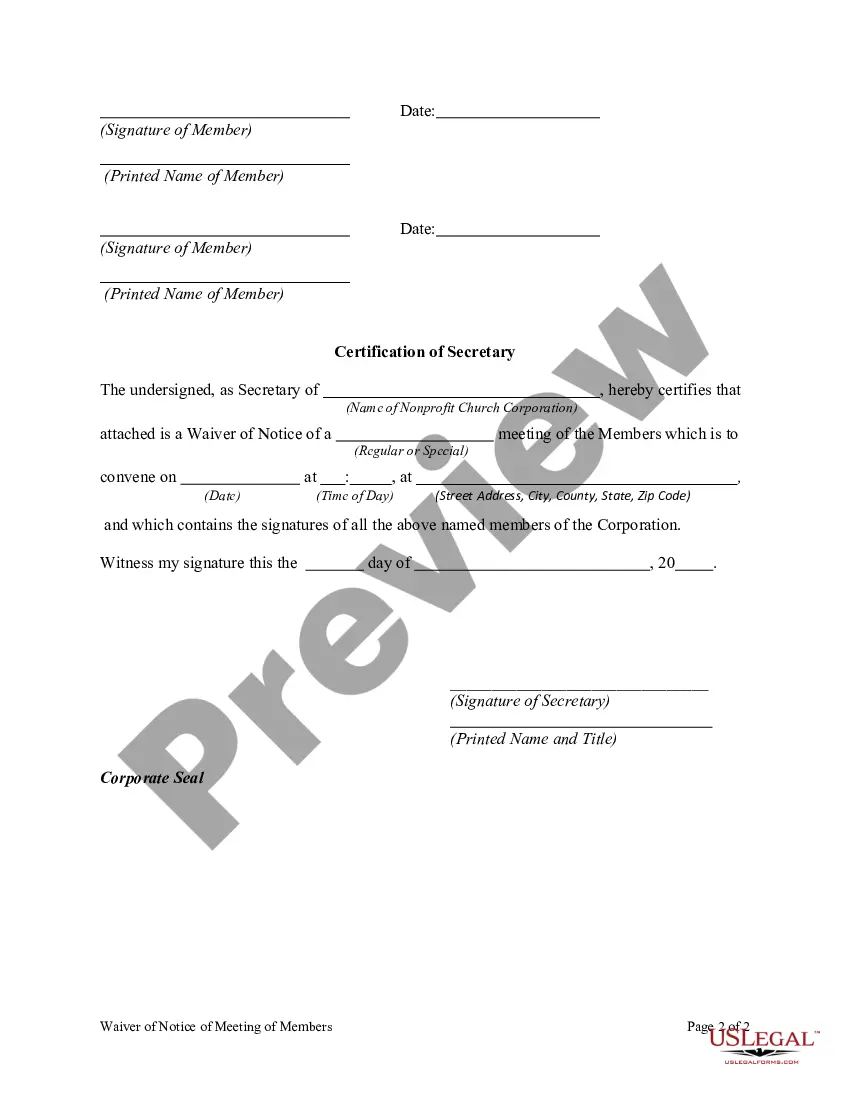

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can quickly obtain the latest versions of forms such as the Washington Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

If the form doesn’t meet your needs, use the Search box at the top of the page to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred payment method and provide your details to register for an account.

- If you already have an account, Log In to download the Washington Waiver of Notice of Meeting of members of a Nonprofit Church Corporation from the US Legal Forms library.

- The Download button appears on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some easy tips to get started.

- Make sure to select the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

When it is stated that 'notice of presentation waived', it means that individuals present at a meeting do not require advance notice regarding the details of the matters discussed. This waiver helps facilitate smoother discussions and quick decision-making, particularly in a nonprofit church corporation setting. With a properly executed Washington Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, members can focus on what really matters.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

profit small business operates with a view to enriching its owners or shareholders. In contrast, a nonprofit organization is organized and operated solely for social welfare, civic improvement, pleasure, recreation or generally any other purpose except profit.

Meeting minutes are typically taken by the organization's secretary. If the Secretary is not present, another officer or director should be chosen to record the minutes. Meeting minutes also need to be signed by the individual who took the minutes at the conclusion of the board meeting.

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

Since for-profit companies make profits for their own benefits, they have to pay taxes as required by the law. However, nonprofit organizations are exempted from paying taxes as they make profits to help society. In addition, individuals and businesses that donate to nonprofits can claim tax deductions.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

Nonprofits run like a business and try to earn a profit, which does not support any single member; not-for-profits are considered recreational organizations that do not operate with the business goal of earning revenue.

Board of Directors: Under state law, only one director is needed; however, you will need at least three directors if you are seeking tax-exempt status. Usually the number of directors is described as a range, with a minimum number and maximum number of directors given.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.