Subject: Important: Dissolution of Legal Entity Officially Finalized — Washington Sample Letter to Client Dear [Client's Name], We hope this letter finds you well. We are writing to inform you that the dissolution process of your legal entity has been successfully completed as per the laws and regulations of the State of Washington. This letter aims to provide a detailed description of the finalization of the dissolution and its various aspects. I. Dissolution Process Overview: The dissolution process, which began on [Insert starting date of dissolution], involved several essential steps to legally terminate the existence of your entity. We would like to summarize the process for your understanding: 1. Compliance with State Laws: Throughout the dissolution process, we ensured strict adherence to the applicable laws and regulations of the State of Washington. This includes complying with all the necessary paperwork, legal requirements, and procedures specified by the state authorities. 2. Settlement of Obligations: To ensure a smooth dissolution process, all outstanding obligations, debts, tax liabilities, and pending legal matters were addressed meticulously. This includes finalizing outstanding payments, resolving any contractual obligations, and settling any claims or disputes related to the entity. 3. Asset Distribution: As part of the dissolution, the distribution of the entity's remaining assets was carried out in accordance with the applicable laws. This involved evaluating and allocating assets among the shareholders or partners, as stated in the agreements or articles of dissolution. II. Dissolution Finalization: We are pleased to announce that the dissolution has now been finalized, and your entity has officially ceased to exist as a separate legal entity as of [Insert dissolution completion date]. Consequently, the following key aspects have been completed: 1. Official Termination: Your entity's name has been removed from the Washington Secretary of State's records, signifying its official termination. This updates the state's official database, ensuring that your entity is no longer considered active. 2. Tax Filings: We have appropriately addressed all tax-related obligations during the dissolution process. For any remaining tax liabilities or required filings, we have provided the necessary guidance and assistance to ensure timely compliance. 3. Legal Documentation: To confirm the finalization of the dissolution, we have obtained the relevant documentation as proof of the entity's termination. These documents will help protect your interests and ensure future compliance with legal and financial requirements. Should you require any copies of the dissolution documents for your records, please do not hesitate to contact our office, and we will promptly provide them to you. Please note that the dissolution of your entity does not relieve you of potential legal or financial responsibilities arising from any past activities. It is essential to consult with your attorney and tax advisor for any further guidance or obligations that may require attention. At [Your Company Name], we understand that dynamics may change after the dissolution, and various implications may arise. Therefore, we remain committed to providing you with ongoing support and guidance during this transition period. If you have any questions or concerns regarding the dissolution process or require assistance moving forward, please feel free to reach out to us. We are here to help you navigate through any uncertainties that may arise. Thank you for entrusting us with your dissolution process. We value the opportunity to have assisted you, and we wish you success in your future endeavors. Kind regards, [Your Name] [Your Title/Position] [Your Company Name] [Contact Information: Phone, Email]

Washington Sample Letter to Client regarding Dissolution Finalized

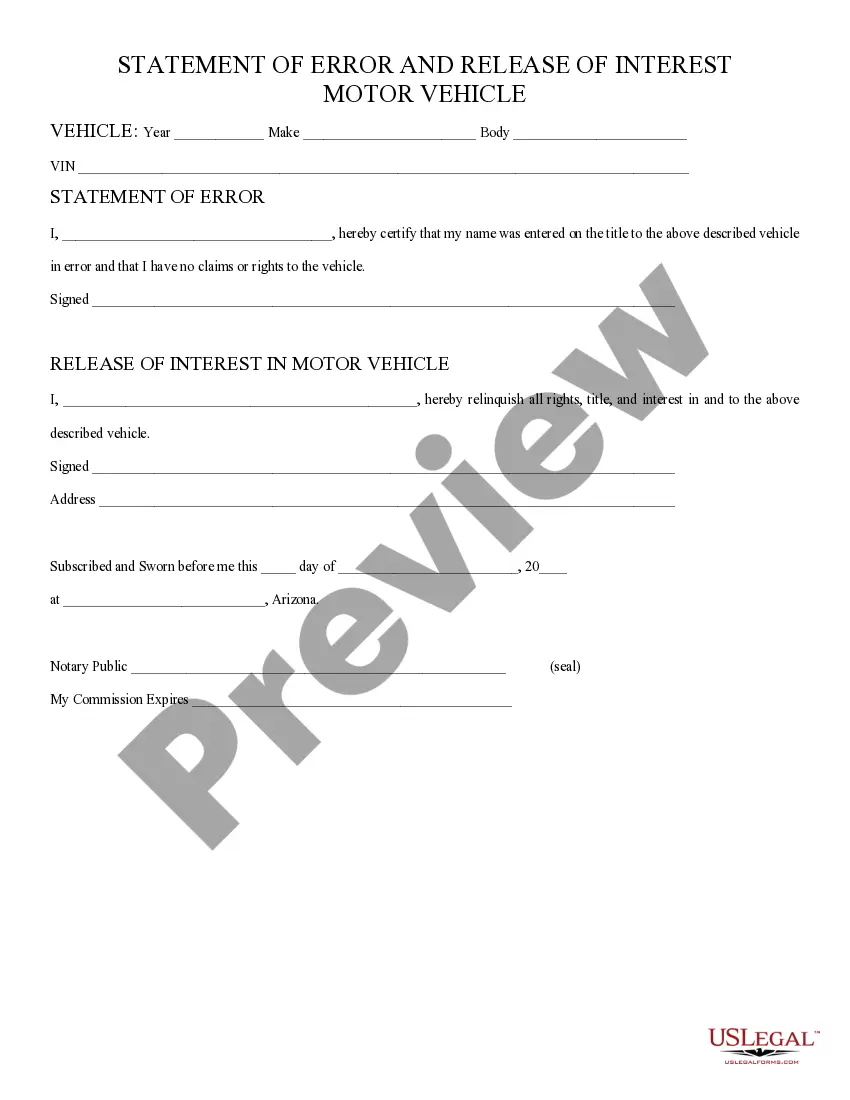

Description

How to fill out Sample Letter To Client Regarding Dissolution Finalized?

Are you currently in a position that you need to have documents for possibly enterprise or specific uses nearly every working day? There are a variety of lawful document themes available on the net, but finding kinds you can rely is not simple. US Legal Forms provides 1000s of form themes, just like the Washington Sample Letter to Client regarding Dissolution Finalized, which are written in order to meet federal and state demands.

If you are currently knowledgeable about US Legal Forms web site and also have your account, just log in. After that, you may acquire the Washington Sample Letter to Client regarding Dissolution Finalized web template.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Get the form you need and ensure it is for the correct metropolis/state.

- Take advantage of the Preview switch to examine the form.

- Look at the outline to ensure that you have chosen the proper form.

- In the event the form is not what you`re searching for, use the Search area to find the form that suits you and demands.

- Whenever you obtain the correct form, simply click Get now.

- Pick the pricing strategy you desire, fill in the necessary information to make your bank account, and purchase your order making use of your PayPal or charge card.

- Decide on a practical data file structure and acquire your version.

Locate all the document themes you have purchased in the My Forms food list. You can obtain a more version of Washington Sample Letter to Client regarding Dissolution Finalized anytime, if necessary. Just click the necessary form to acquire or printing the document web template.

Use US Legal Forms, probably the most extensive variety of lawful kinds, in order to save efforts and stay away from mistakes. The support provides skillfully produced lawful document themes that you can use for a range of uses. Make your account on US Legal Forms and initiate generating your daily life easier.