Washington Receipt for loan Funds

Description

How to fill out Receipt For Loan Funds?

If you wish to complete, acquire, or produce legitimate file layouts, use US Legal Forms, the largest collection of legitimate types, which can be found on the web. Make use of the site`s simple and easy handy search to obtain the documents you require. Different layouts for company and individual uses are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Washington Receipt for loan Funds within a few click throughs.

If you are previously a US Legal Forms buyer, log in to the accounts and click the Download key to obtain the Washington Receipt for loan Funds. Also you can entry types you in the past acquired inside the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that right town/country.

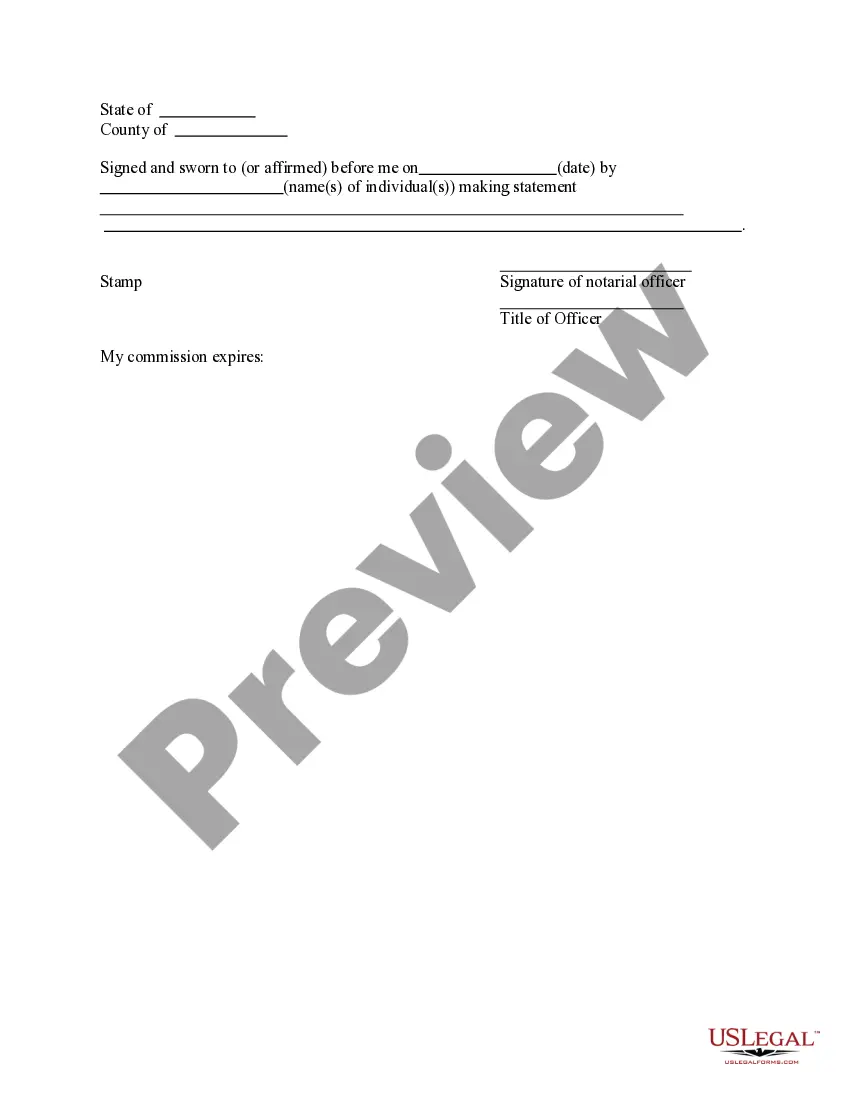

- Step 2. Make use of the Preview solution to look through the form`s content. Don`t neglect to read through the description.

- Step 3. If you are unhappy together with the kind, use the Lookup field on top of the monitor to locate other models from the legitimate kind web template.

- Step 4. When you have found the form you require, click on the Buy now key. Select the costs program you prefer and put your accreditations to register for the accounts.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Choose the file format from the legitimate kind and acquire it on the system.

- Step 7. Full, edit and produce or indication the Washington Receipt for loan Funds.

Each and every legitimate file web template you get is yours forever. You may have acces to every kind you acquired inside your acccount. Select the My Forms section and select a kind to produce or acquire once again.

Compete and acquire, and produce the Washington Receipt for loan Funds with US Legal Forms. There are thousands of expert and condition-certain types you can use to your company or individual demands.

Form popularity

FAQ

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

Washington State has a usury law (RCW 19.52 ) that sets limits on the maximum rate of interest a lender may charge a borrower. The usury law applies to consumer loans that are not related to a credit card debt, a retail installment contract or a consumer lease.

The Truth in Lending Act (and Regulation Z) explains which transactions are exempt from the disclosure requirements, including: loans primarily for business, commercial, agricultural, or organizational purposes. federal student loans.

The Truth in Lending Act, or TILA, also known as regulation Z, requires lenders to disclose information about all charges and fees associated with a loan. This 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit.

Criminal penalties ? Willful and knowing violations of TILA permit imposition of a fine of $5,000, imprisonment for up to one year, or both.