Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: A Comprehensive Guide Keywords: Washington deed, conveying condominium unit, charity, reservation of life tenancy, donor, donor's spouse, types. Description: The Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal document that allows individuals in Washington state to transfer ownership of a condominium unit to a charitable organization while retaining a life tenancy for themselves and their spouse. The deed ensures that the donor and their spouse can continue to reside in the condominium unit for the remainder of their lives, ensuring their security and wellbeing. This type of deed serves as a philanthropic tool for those who wish to make a significant charitable contribution while still maintaining a home during their lifetime. Different Types of Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: 1. General Washington Deed with Reservation of Life Tenancy: This type of deed allows the donor and their spouse to transfer ownership of their condominium unit to a charitable organization while reserving the right to live in the unit for the duration of their lives. It ensures they retain full control and use of the property until their passing. 2. Irrevocable Washington Deed with Reservation of Life Tenancy: This type of deed is similar to the general deed but comes with the additional provision of being irrevocable. Once the deed is executed, it cannot be reversed or altered, offering a more secure commitment to the charitable organization. 3. Conditional Washington Deed with Reservation of Life Tenancy: This deed is subject to specific conditions agreed upon by the donor and the charitable organization. These conditions might include the use of the property for specific purposes, maintenance responsibilities, or restrictions on alterations and modifications. Benefits of Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy: 1. Charitable Contribution: By transferring the ownership of a condominium unit to a charitable organization, the donor can make a significant contribution to a cause they believe in, often receiving tax benefits or deductions. 2. Retention of Residence: The donor and their spouse can continue to reside in the condominium unit for the rest of their lives. This provides security, stability, and the ability to age in a familiar and comfortable environment. 3. Philanthropic Legacy: A Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy allows individuals to leave a lasting impact and create a philanthropic legacy by supporting a charitable organization and its mission. In conclusion, the Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal tool that enables individuals to transfer ownership of a condominium unit to a charitable organization while reserving a life tenancy for themselves and their spouse. This arrangement allows donors to make a significant philanthropic contribution while still ensuring their lifetime housing needs are met.

Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Washington Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

Are you presently inside a situation the place you need documents for possibly enterprise or individual reasons virtually every day? There are tons of legitimate file web templates available online, but getting kinds you can rely isn`t simple. US Legal Forms offers a huge number of type web templates, like the Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, that happen to be composed to fulfill federal and state needs.

If you are currently familiar with US Legal Forms web site and also have an account, basically log in. Afterward, you may down load the Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse design.

If you do not offer an bank account and need to begin to use US Legal Forms, follow these steps:

- Find the type you want and ensure it is for the proper city/state.

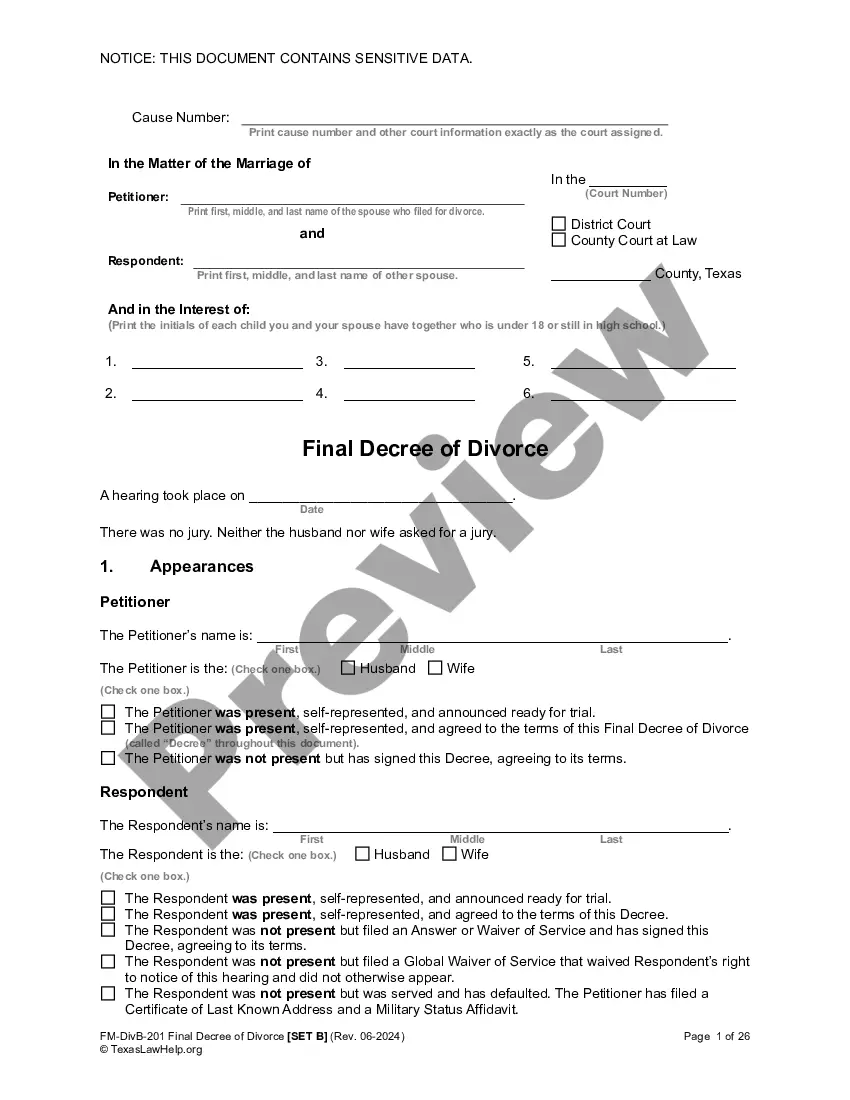

- Take advantage of the Preview button to examine the shape.

- See the explanation to actually have selected the appropriate type.

- In the event the type isn`t what you`re trying to find, utilize the Search industry to find the type that meets your needs and needs.

- When you get the proper type, click Get now.

- Opt for the rates program you would like, submit the required info to produce your money, and buy an order with your PayPal or charge card.

- Pick a practical data file formatting and down load your duplicate.

Find every one of the file web templates you have bought in the My Forms food selection. You may get a extra duplicate of Washington Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse anytime, if needed. Just select the required type to down load or printing the file design.

Use US Legal Forms, one of the most considerable collection of legitimate varieties, in order to save time and stay away from blunders. The assistance offers skillfully manufactured legitimate file web templates which you can use for a variety of reasons. Make an account on US Legal Forms and start creating your way of life a little easier.