Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association is a legally binding document used in the state of Washington to announce a meeting where the board of directors or members of a non-profit association will discuss and vote on a resolution to incorporate the organization. The purpose of this notice is to inform all interested parties about the upcoming meeting and to provide them with the necessary information to participate in the decision-making process. The notice includes details such as the date, time, and location of the meeting, as well as the agenda for the discussion. Keywords: 1. Washington Notice of Meeting: This refers to the specific notice document required by the state of Washington when calling a meeting of a non-profit association. It highlights the state's specific legal requirements and regulations surrounding the incorporation process. 2. Pass on Resolution: This phrase indicates that the main objective of the meeting is to discuss and vote on a resolution. In this case, the resolution is related to the incorporation of the non-profit association. The resolution outlines the intent and purpose of incorporating as a non-profit entity. 3. Incorporation: Incorporation refers to the legal process of forming a separate legal entity, such as a non-profit association. It involves registering with the appropriate state agency and adhering to the state's laws and regulations concerning non-profit organizations. 4. Non-Profit Association: A non-profit association is an organization formed for purposes other than generating profit. It is dedicated to a specific mission, such as charitable, educational, or religious activities. The association relies on donations, grants, and membership fees to fund its operations. Types of Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association: 1. Public Notice of Meeting: This type of notice is used when the non-profit association wants to inform the public about the upcoming meeting. It may be published in local newspapers, on the association's website, and other appropriate channels to reach a broader audience. 2. Member Notice of Meeting: In this case, the notice is directed specifically to the members of the non-profit association. The notice is usually sent via email or regular mail to all active members of the organization. It ensures that members have the opportunity to attend the meeting, voice their opinions, and vote on the resolution. 3. Board of Directors Notice of Meeting: This type of notice is sent to the members of the non-profit board of directors. It is their responsibility to attend the meeting, discuss the resolution, and ultimately vote on whether to proceed with the incorporation. The notice is typically sent well in advance to allow board members to prepare and familiarize themselves with the resolution and supporting materials. In summary, the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association is a formal document issued to inform interested parties about an upcoming meeting where the incorporation of a non-profit association will be discussed. It serves as a legal announcement, ensuring transparency and giving participants the opportunity to voice their opinions and vote on the resolution.

Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

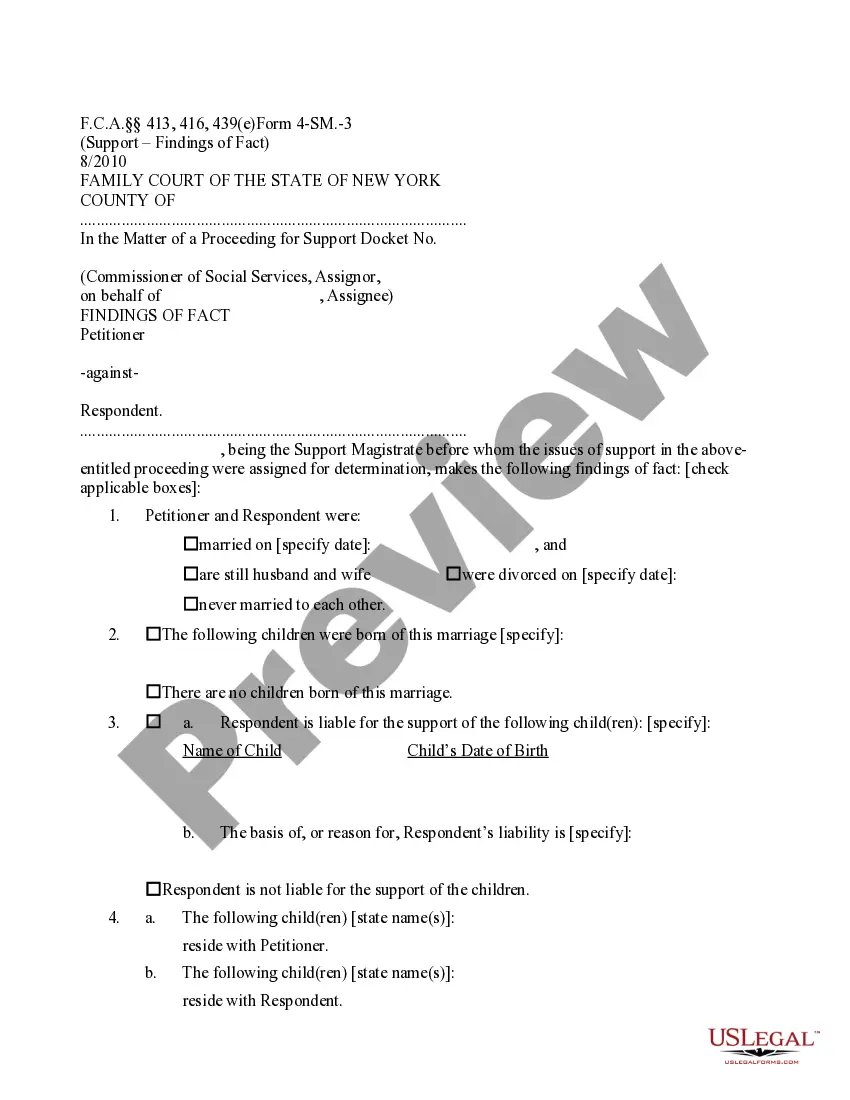

How to fill out Washington Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

If you have to total, acquire, or printing legal document web templates, use US Legal Forms, the greatest assortment of legal types, that can be found online. Use the site`s simple and easy convenient research to get the papers you want. Different web templates for organization and individual reasons are categorized by types and claims, or key phrases. Use US Legal Forms to get the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association with a few mouse clicks.

Should you be already a US Legal Forms customer, log in to your bank account and click the Obtain option to obtain the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Also you can access types you formerly saved in the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct town/country.

- Step 2. Take advantage of the Preview method to look through the form`s articles. Don`t forget to read through the explanation.

- Step 3. Should you be unsatisfied using the develop, take advantage of the Research field towards the top of the display to discover other types of your legal develop template.

- Step 4. Upon having found the form you want, click on the Buy now option. Select the prices strategy you prefer and add your qualifications to sign up to have an bank account.

- Step 5. Method the transaction. You should use your credit card or PayPal bank account to perform the transaction.

- Step 6. Select the structure of your legal develop and acquire it in your product.

- Step 7. Comprehensive, edit and printing or indicator the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association.

Every single legal document template you purchase is your own for a long time. You possess acces to every single develop you saved in your acccount. Click on the My Forms portion and select a develop to printing or acquire once again.

Be competitive and acquire, and printing the Washington Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association with US Legal Forms. There are thousands of expert and express-distinct types you can utilize for your organization or individual demands.

Form popularity

FAQ

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

How To Start A Nonprofit In WashingtonChoose your WA nonprofit filing option.File the WA nonprofit articles of incorporation.Get a Federal EIN from the IRS.Adopt your nonprofit's bylaws.Apply for federal and/or state tax exemptions.Apply for required state licenses.Open a bank account for your WA nonprofit.More items...

The Washington State Department of Commerce requires nonprofit organizations that conduct taxable business activities to apply for a business license before they can begin doing business within the state.

In Washington, nonprofit corporations must have at least one director. See RCW 24.03. 100. Many other states require a minimum of three directors.

How to Start a Nonprofit in WashingtonName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

To start a 501(c)(3) nonprofit corporation in Washington you must:Step 1: Name Your Washington Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization.

Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.