Washington Commission Buyout Agreement Insurance Agent plays a significant role in the insurance industry by offering specialized services related to buyout agreements. These agents assist businesses and individuals in Washington state in protecting their financial interests through the use of commission buyout agreements. By understanding and analyzing the unique needs of their clients, these agents ensure the smooth transfer of commission-based businesses in the event of unexpected circumstances. Commission buyout agreements provide a safety net for insurance agents who rely heavily on earned commissions for income. These agreements establish terms and conditions to protect agents against potential losses and ensure the continuation of their business in unforeseen situations such as disability, retirement, or death. Washington Commission Buyout Agreement Insurance Agents act as intermediaries, guiding clients through the complex process of formulating and executing these agreements. These agents possess in-depth knowledge of the insurance industry, the legal framework governing buyout agreements, and the specific regulations applicable in Washington state. By offering expert advice, they help clients navigate the intricacies of commission buyout agreements and make informed decisions that align with their long-term financial goals. The various types of Washington Commission Buyout Agreement Insurance Agents include: 1. Disability Buyout Agreement Agents: These agents specialize in helping insurance agents plan for replacement of their income in the event of a disability that prevents them from continuing their commission-based work. They draft comprehensive buyout agreements that outline the terms under which a disabled agent's interests would be bought out. 2. Retirement Buyout Agreement Agents: Retirement is a major concern for insurance agents heavily reliant on commissions. Retirement buyout agreement agents assist agents in planning for a smooth transition and ensuring the financial security of their post-retirement life. They draft customized buyout agreements that ensure agents receive fair compensation for their book of business. 3. Death Benefit Buyout Agreement Agents: In case of the sudden demise of an insurance agent, these agents specialize in handling commission buyout agreements that secure financial protection for the agent's family and facilitate the transfer of the book of business to another party. They ensure a seamless transition while safeguarding the agent's legacy. Washington Commission Buyout Agreement Insurance Agents are crucial partners for insurance professionals seeking financial security, stability, and protection against unexpected circumstances. With their expertise in Washington state insurance regulations, these agents offer peace of mind to agents and their families by managing the intricacies of buyout agreements, allowing them to focus on their core responsibilities.

Washington Commission Buyout Agreement Insurance Agent

Description

How to fill out Washington Commission Buyout Agreement Insurance Agent?

Are you currently within a situation the place you require files for both enterprise or individual purposes just about every working day? There are tons of lawful document web templates available on the Internet, but discovering types you can depend on is not easy. US Legal Forms delivers a large number of type web templates, such as the Washington Commission Buyout Agreement Insurance Agent, that are written to fulfill state and federal requirements.

In case you are currently informed about US Legal Forms website and have a free account, merely log in. After that, you are able to download the Washington Commission Buyout Agreement Insurance Agent web template.

Unless you offer an accounts and need to begin to use US Legal Forms, follow these steps:

- Get the type you will need and ensure it is for your appropriate city/county.

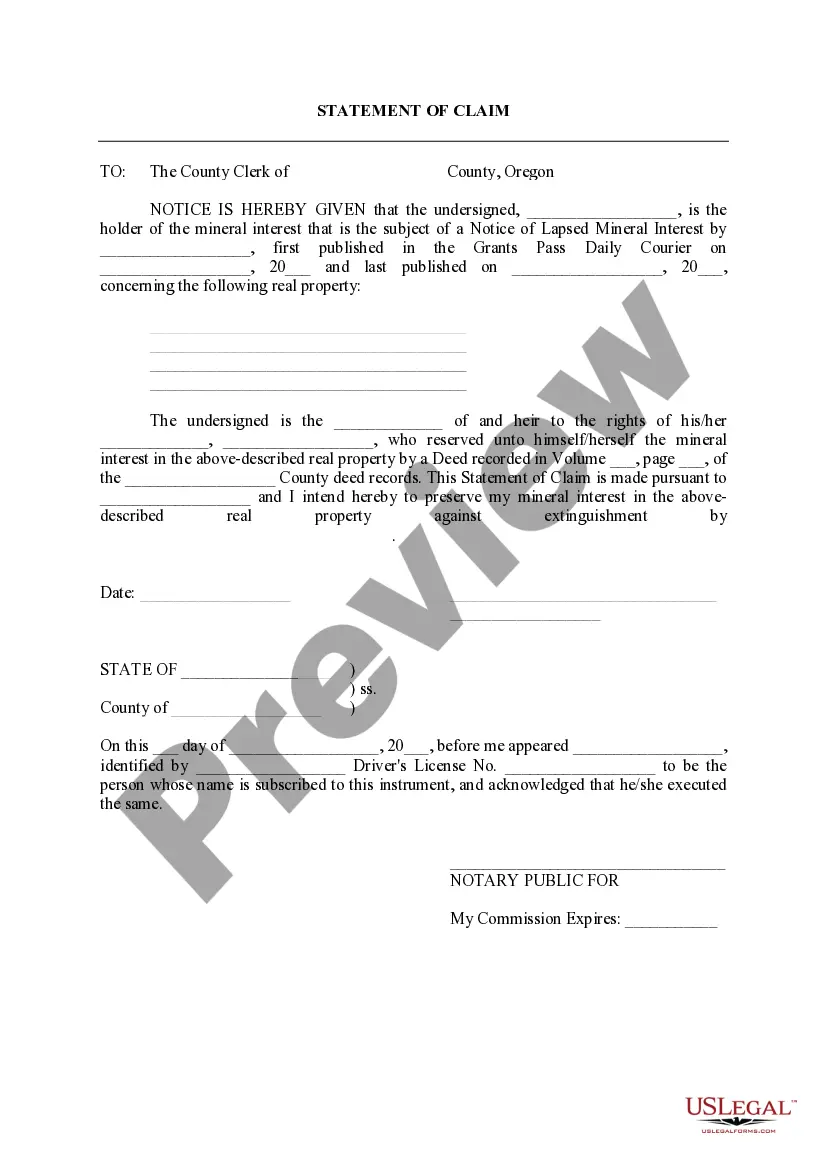

- Use the Review option to review the shape.

- See the description to ensure that you have chosen the right type.

- When the type is not what you`re looking for, use the Look for discipline to obtain the type that fits your needs and requirements.

- Once you discover the appropriate type, click on Buy now.

- Select the prices strategy you need, fill out the required info to produce your account, and buy the transaction using your PayPal or credit card.

- Choose a hassle-free data file structure and download your duplicate.

Find all the document web templates you possess purchased in the My Forms food list. You can aquire a extra duplicate of Washington Commission Buyout Agreement Insurance Agent whenever, if possible. Just click the needed type to download or print out the document web template.

Use US Legal Forms, the most extensive variety of lawful varieties, in order to save time and avoid blunders. The support delivers skillfully made lawful document web templates that you can use for an array of purposes. Generate a free account on US Legal Forms and begin creating your way of life easier.