Title: Washington Sample Letter for Tax Receipt for Fundraiser Dinner — Request by Attendee Introduction: When attending a fundraising dinner in Washington, it is vital for attendees to request a tax receipt for their contributions. These documents serve as proof of payment and enable individuals to claim appropriate tax deductions. This article provides a comprehensive guide with a sample letter that can be customized and utilized by attendees, helping them request their tax receipts promptly and accurately. Key Points: 1. The Importance of a Tax Receipt: — Explains why obtaining a tax receipt is essential for attendees of a fundraising dinner. — Highlights the benefits of tax receipts for tax deductions and financial record-keeping. 2. Understanding Washington Tax Laws: — Provides an overview of the tax laws in Washington related to fundraising dinner contributions. — Includes information on the tareducibilityty of donations and the requirements for claiming deductions. 3. Sample Letter for Tax Receipt Request: — Presents a standardized letter format that attendees can use to request their tax receipts. — Includes key elements such as personal details, event information, donation amount, and additional contact information for seamless processing. 4. Personalizing the Letter: — Offers guidance on personalizing the sample letter to suit individual attendees' requirements. — Provides recommendations on adding any specific details or requests attendees may have regarding their tax receipt. Types of Washington Sample Letters for Tax Receipt for Fundraiser Dinner — Request by Attendee: 1. Standard Tax Receipt Request Letter: — A comprehensive sample letter suitable for most attendees who wish to request a tax receipt for their fundraiser dinner contribution in Washington. 2. Urgent Tax Receipt Request Letter: — A variant of the standard letter format intended for attendees who require their tax receipt urgently due to impending tax filings or other time-sensitive reasons. 3. Customized Tax Receipt Request Letter: — A flexible sample letter that can be easily customized to accommodate any unique circumstances or specific requests made by attendees regarding their tax receipts. Conclusion: Obtaining a tax receipt for a fundraiser dinner contribution in Washington is crucial for attendees to claim the necessary tax deductions and maintain accurate financial records. By utilizing the provided sample letter and personalizing it to their requirements, attendees can promptly request their tax receipts and ensure compliance with Washington's tax laws.

Washington Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

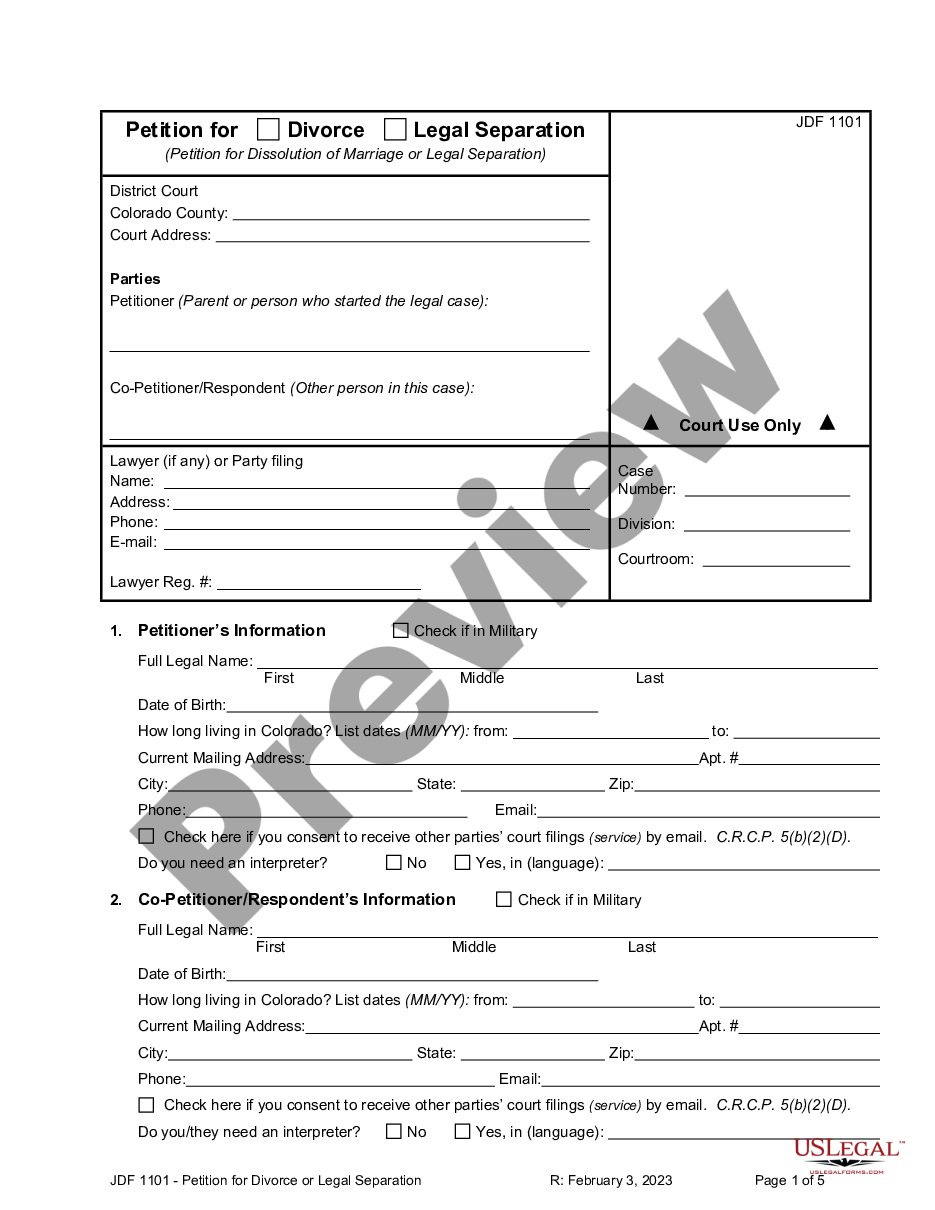

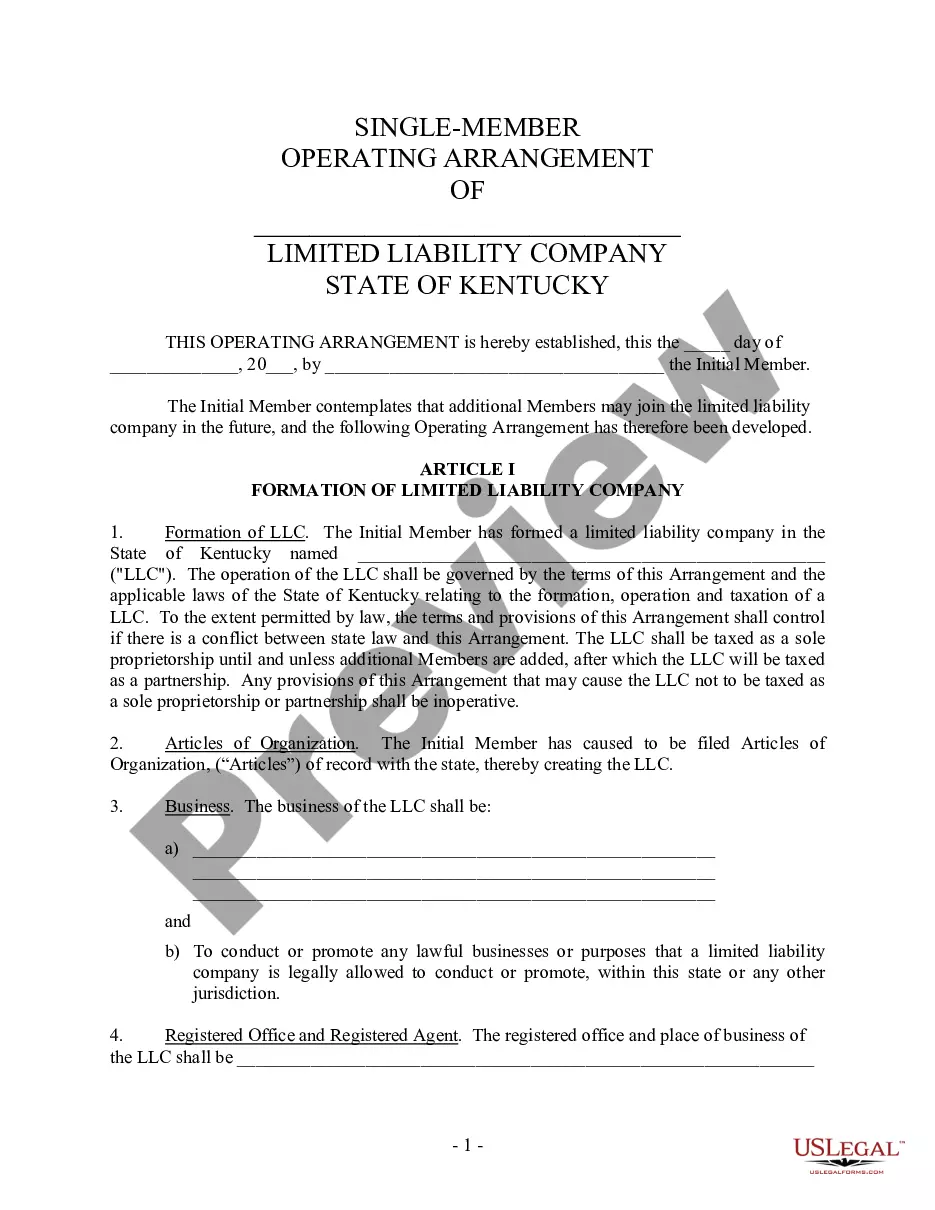

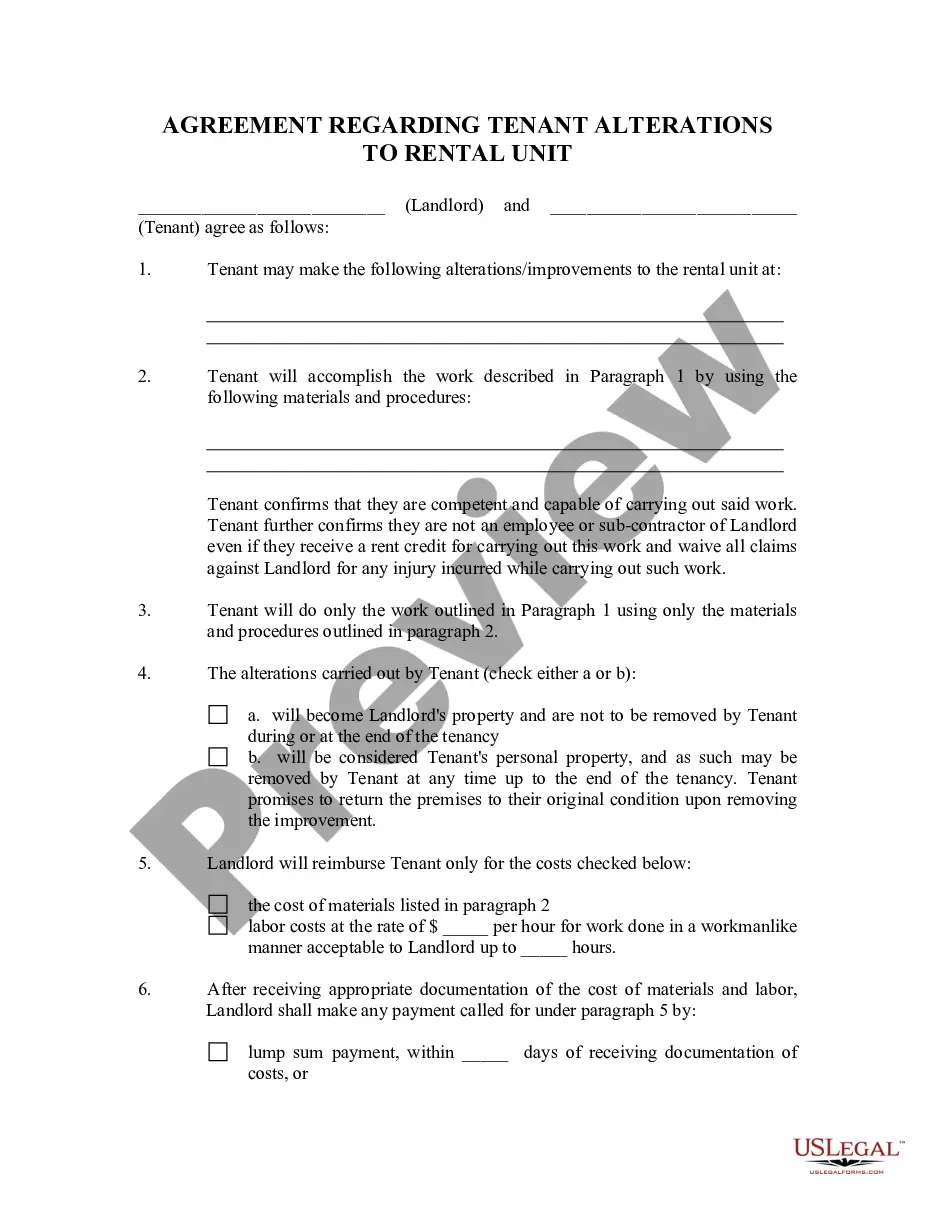

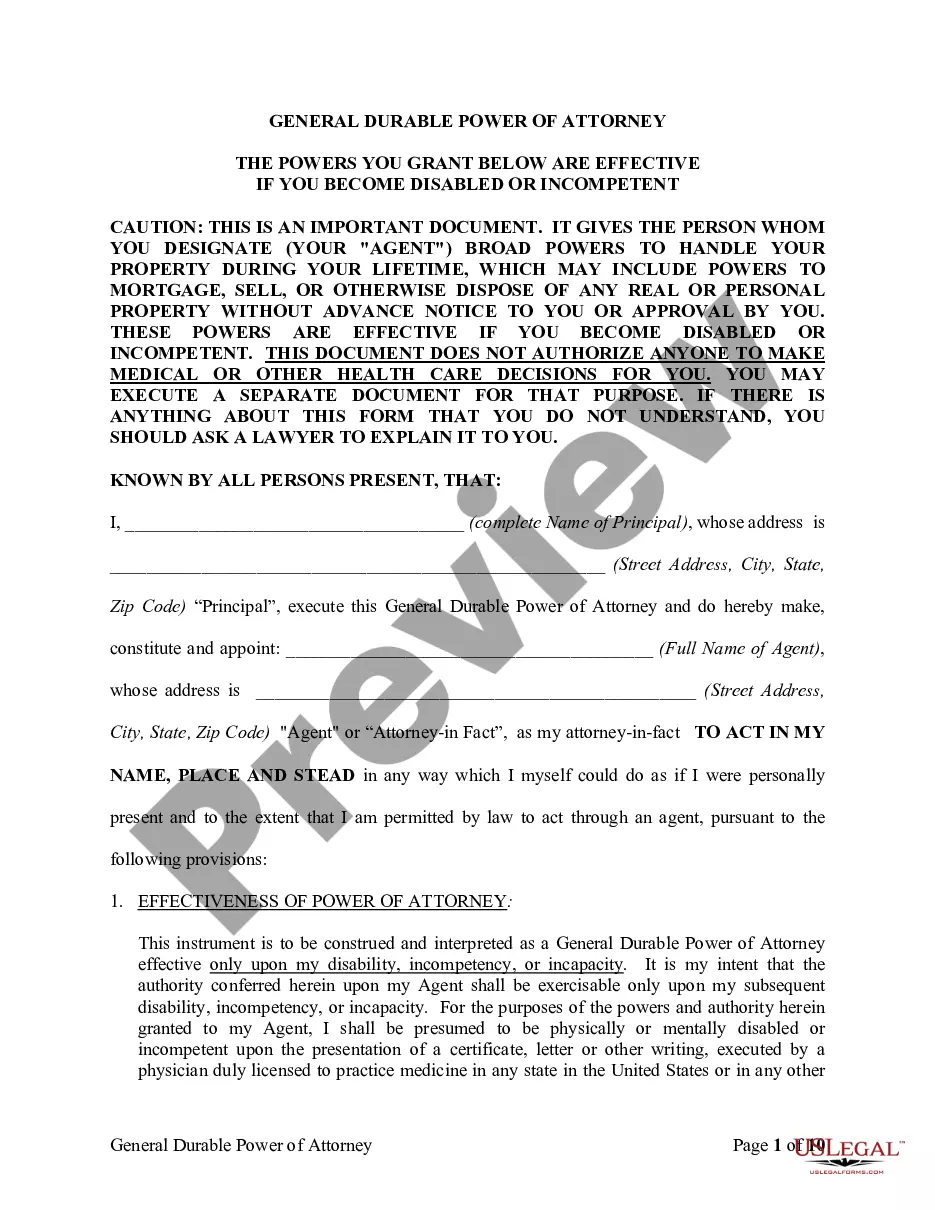

How to fill out Washington Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

Are you presently within a placement in which you need files for possibly enterprise or specific uses almost every time? There are a variety of legal record themes available online, but locating types you can rely is not simple. US Legal Forms offers thousands of kind themes, like the Washington Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee, which can be published to fulfill federal and state requirements.

Should you be currently knowledgeable about US Legal Forms web site and also have a merchant account, simply log in. Afterward, you are able to obtain the Washington Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee web template.

Should you not provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Discover the kind you require and ensure it is for that correct area/county.

- Take advantage of the Preview key to examine the shape.

- Browse the outline to ensure that you have chosen the proper kind.

- In case the kind is not what you are searching for, utilize the Research discipline to get the kind that meets your requirements and requirements.

- Once you get the correct kind, click on Purchase now.

- Pick the pricing strategy you want, complete the specified details to generate your bank account, and purchase the order utilizing your PayPal or bank card.

- Choose a hassle-free document file format and obtain your copy.

Discover all the record themes you may have bought in the My Forms menus. You may get a further copy of Washington Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee whenever, if needed. Just click the necessary kind to obtain or print the record web template.

Use US Legal Forms, one of the most substantial assortment of legal varieties, to conserve some time and stay away from mistakes. The service offers appropriately produced legal record themes which can be used for a range of uses. Make a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

How to Write(1) Date.(2) Non-Profit Organization.(3) Mailing Address.(4) EIN.(5) Donor's Name.(6) Donor's Address.(7) Donated Amount.(8) Donation Description.More items...?

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

Your title should include the first and last name of the individual or the name of the organisation receiving the funds. People seeking to donate money on GoFundMe often search for a particular person or cause. Similarly, if your cause is related to a known disaster, consider adding its name to your title.

How to Write a Fundraising LetterAddress your recipient personally.Tell a story.Define the problem.Explain your mission and outline your goal.Explain how your donor can make an impact.Call the reader to action.

The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.

Instead, choose words like partner, give, and support. "Donate" gives the impression that you only want (or need) their money. Words like "support" and "partner," followed by the name of your cause or campaign, can increase your donations significantly because they invite people into a relationship.

In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received. A cash donation receipt provides written documentation of a cash gift.