Washington Sample Letter for Trust Account Check

Description

How to fill out Sample Letter For Trust Account Check?

It is possible to commit hours on the Internet attempting to find the legal papers web template that fits the state and federal requirements you require. US Legal Forms supplies 1000s of legal kinds which are reviewed by experts. It is possible to down load or produce the Washington Sample Letter for Trust Account Check from our service.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Obtain switch. Next, it is possible to comprehensive, change, produce, or sign the Washington Sample Letter for Trust Account Check. Every single legal papers web template you purchase is your own property for a long time. To obtain one more backup of any purchased kind, go to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website for the first time, stick to the straightforward directions below:

- Initially, make sure that you have selected the right papers web template for the area/area that you pick. Browse the kind information to ensure you have picked out the appropriate kind. If accessible, make use of the Preview switch to search throughout the papers web template too.

- If you want to discover one more version of the kind, make use of the Research discipline to get the web template that meets your requirements and requirements.

- When you have located the web template you want, simply click Buy now to continue.

- Find the rates plan you want, enter your credentials, and sign up for your account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal bank account to purchase the legal kind.

- Find the structure of the papers and down load it in your device.

- Make alterations in your papers if necessary. It is possible to comprehensive, change and sign and produce Washington Sample Letter for Trust Account Check.

Obtain and produce 1000s of papers themes using the US Legal Forms Internet site, that provides the biggest collection of legal kinds. Use skilled and state-specific themes to deal with your company or personal requires.

Form popularity

FAQ

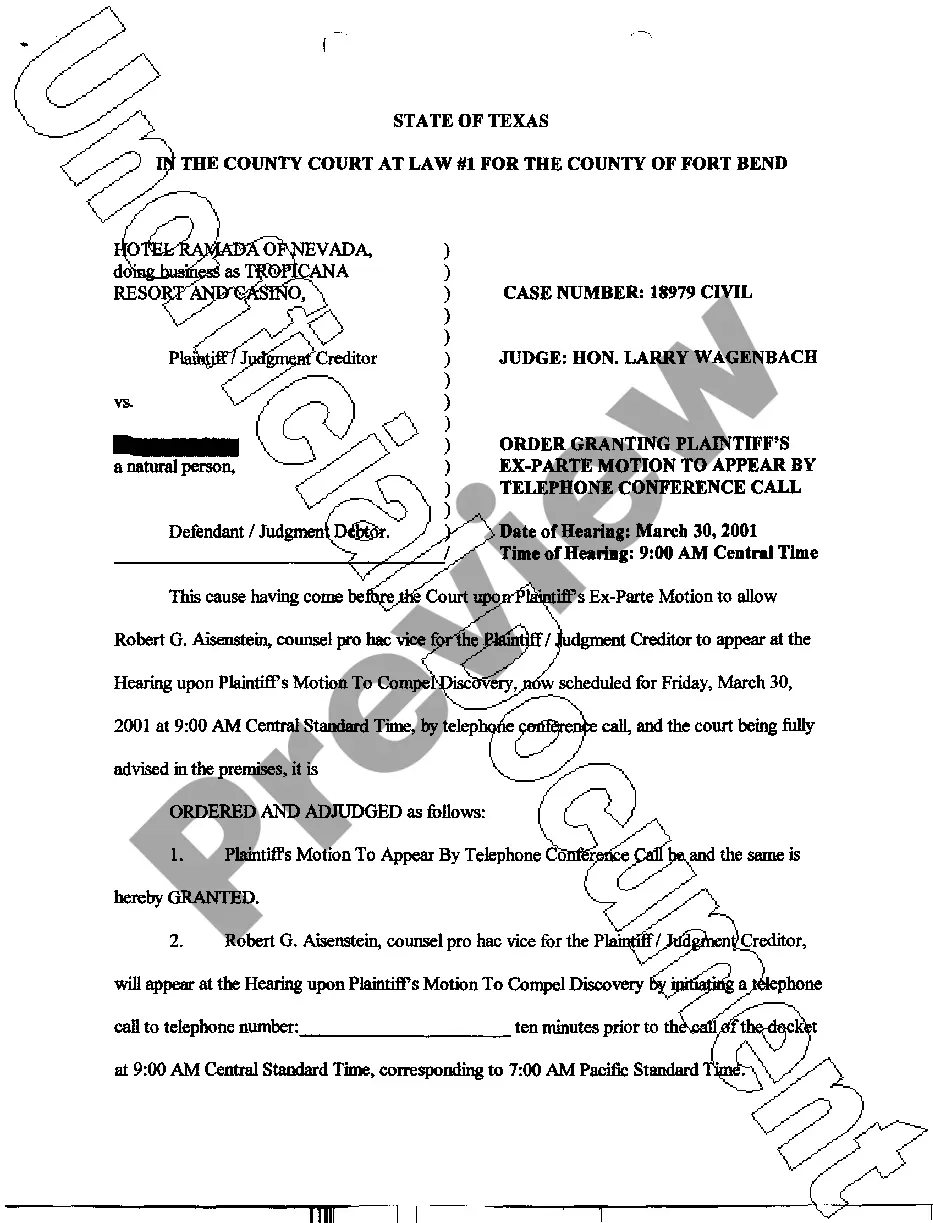

Trust Check means a negotiable instrument used to facilitate payment from the Trust Account.

The rule further specifies that the name and address of the lawyer or law firm and the name of the account must be printed in the upper left corner of the check.

Trust funds are all funds received from borrowers, or on behalf of borrowers, for payments to third-party providers. The funds are considered to be held in trust immediately upon receipt.

For trust accounts, the check can be payable to the custodian, the trustee, or the name of the trust account ? but it must appear exactly as it's registered on the account. Any deviation will cause the check to be returned.

What is a trust account? A trust account is a legal arrangement in which the grantor allows a third party, the trustee, to manage assets on behalf of the beneficiaries of the trust. A trust can provide legal protection for your assets and make sure those assets are distributed ing to your wishes.

It should show in chronological order: all receipts, all disbursements, and the account balance for that individual client. This is the sheet the attorney would consult if asked for a current record of an individual client's funds and/or activity.

An informal trust account typically means an account managed by one person, for the benefit of another. A formal trust account, in contrast, typically relates to a formal trust agreement and may have more than one beneficiary, broader powers and requires a formal trust deed.