Washington Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

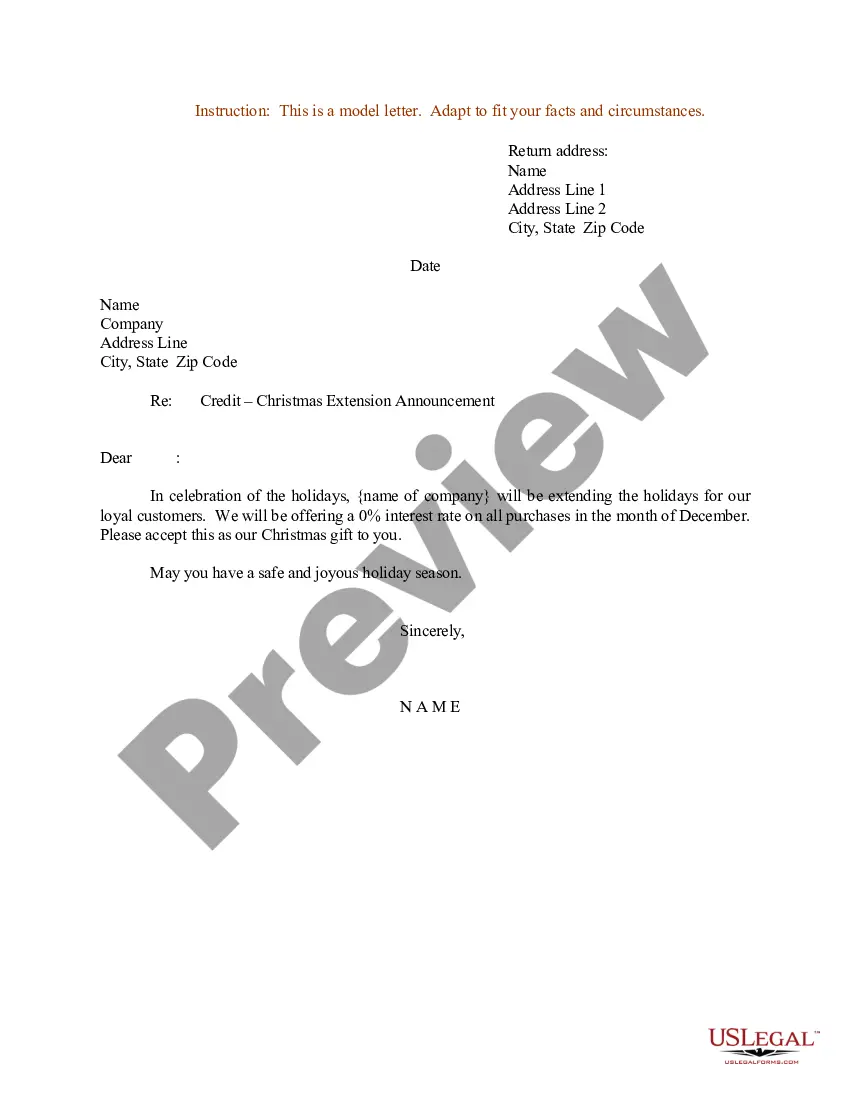

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

If you wish to complete, obtain, or produce authorized document layouts, use US Legal Forms, the most important collection of authorized kinds, which can be found on the web. Utilize the site`s simple and convenient lookup to find the documents you want. Numerous layouts for company and person purposes are categorized by groups and states, or keywords and phrases. Use US Legal Forms to find the Washington Sample Letter for Request of State Attorney's opinion concerning Taxes within a couple of clicks.

Should you be presently a US Legal Forms consumer, log in to the account and then click the Download switch to have the Washington Sample Letter for Request of State Attorney's opinion concerning Taxes. You may also gain access to kinds you formerly downloaded inside the My Forms tab of your respective account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate metropolis/region.

- Step 2. Use the Review solution to look over the form`s information. Don`t forget about to learn the outline.

- Step 3. Should you be not happy with the develop, utilize the Search industry on top of the monitor to locate other versions in the authorized develop design.

- Step 4. After you have identified the shape you want, click the Buy now switch. Pick the rates strategy you like and put your references to register to have an account.

- Step 5. Process the deal. You may use your bank card or PayPal account to accomplish the deal.

- Step 6. Select the format in the authorized develop and obtain it on your device.

- Step 7. Complete, modify and produce or indication the Washington Sample Letter for Request of State Attorney's opinion concerning Taxes.

Each authorized document design you purchase is your own property forever. You might have acces to each and every develop you downloaded in your acccount. Select the My Forms segment and select a develop to produce or obtain yet again.

Compete and obtain, and produce the Washington Sample Letter for Request of State Attorney's opinion concerning Taxes with US Legal Forms. There are thousands of specialist and express-distinct kinds you may use to your company or person requires.

Form popularity

FAQ

You are certainly within your rights to write directly to the prosecutor, but no good is likely to come of it. Either your letter will be ignored, or it will be used against you. In many cases, the prosecutor doesn't even care if you're innocent.

Address the letter appropriately. The salutation of the letter should be: Dear Attorney General (last name). For the Attorney General of a State address the envelop: The Honorable/(Full name)/Attorney General of (Name of State)/(Address). The salutation of the letter should read: Dear Attorney General (last name).

Like other members of a governor's cabinet, all state attorneys general are addressed in writing as 'the Honorable (Full Name)'. 80% are elected in a general election. 20% are appointed by their governor.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

The proper form of addressing a person holding the office is addressed Mister or Madam Attorney General, or just as Attorney General. The plural is "Attorneys General" or "Attorneys-General".